Saving money is a fundamental aspect of financial well-being and a skill that everyone can benefit from, regardless of their age or current financial situation.

Whether you're just starting your career, raising a family, or approaching retirement, inculcating a habit of saving money can provide a sense of security and open doors to future opportunities.

In this article, we will discuss the best ways to save money and equip you with the knowledge and tools necessary to make saving a part of your everyday life.

We will start with discussing the psychology behind saving, examining how factors such as mindset, cultural norms, and family upbringing influence our saving habits.

By understanding these underlying dynamics, you'll be empowered to reshape your relationship with money and set yourself up for financial success.

Additionally, we will also guide you on how to set SMART financial goals that help you define how to start saving. Finally, we will explore 12 different strategies and money-saving tips that are guaranteed to set you on the right path to saving more effectively.

Are you ready to embark on your saving journey? Let's dive in and discover the path to financial success together!

1) Understanding the Science Behind Saving Money

The way we think about money and our saving habits are deeply rooted in our mindset and can be shaped by various factors such as cultural norms, family upbringing, and personal experiences.

By understanding the science behind saving, we can analyze our own behaviors and change the way we think about money.

For example, a child that grows up in an environment where savings are emphasized and financial responsibility is encouraged may naturally develop a proactive saving mindset.

At the same time, another who is exposed to a culture of immediate gratification and spending without much consideration for the future might find saving money harder and may require a more intentional shift.

We also saw an interesting shift in spending habits among Indians during the pandemic. In a study published on Statista, we see that during the first wave, consumer spending dropped to 15 trillion from 20 trillion, and again during the second wave it dropped to 17 trillion from 22 trillion. Post-pandemic it returned to the 22 trillion mark.

Recognizing the impact of these influences is the first step towards understanding our own saving mindset. It allows us to challenge any limiting beliefs or negative associations we may have with savings and investments.

Our mindset also plays a significant role in our ability to stay committed to our saving goals.

Developing a growth mindset, which emphasizes learning, adaptability, and the power of consistency, can help us navigate setbacks and challenges on our saving journey.

Viewing setbacks as learning opportunities and celebrating small milestones along the way will reinforce positive saving habits and keep us motivated to continue.

By cultivating a positive saving mindset, we can infuse a daily saving habit in our lifestyle that ensures long-term financial success and stability.

Now that you’ve strapped on your positive saving mindset, let’s begin our savings journey! But first, let’s create some savings goals.

2) Setting Your Financial Goals

Setting clear and specific financial goals is a vital step as it provides you with the direction you need to take.

One powerful framework for goal-setting is the concept of SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound.

When we set SMART goals, we provide ourselves with a roadmap that guides our saving efforts in a focused and purposeful manner.

Specificity is key; clearly define what you want to achieve with your savings, whether it's building an emergency fund, paying off debt, or saving for a down payment and this can be different, depending on where you are in your life.

Ensure your goals are measurable, enabling you to track your progress along the way. It's also essential to set goals that are achievable with realistic budgets that help save money as this will help maintain motivation and prevent discouragement.

Your goals should be relevant to your larger financial aspirations, aligning with your values and long-term objectives. Lastly, set a specific time frame for achieving each goal. This adds a sense of urgency and accountability, helping you stay on track and measure your success.

3) Budgeting and its Benefits

Managing your finances effectively starts with budgeting, tracking, and understanding your own money flow.

Budgeting helps you save more efficiently, gives you control over your finances, and helps make informed decisions about where your money goes.

If you are making a budget for the first time, then the first step is to analyze how you are currently spending your money.

Whether you choose to do this on a fancy personal finance app or just simple pen and paper, tracking your expenses is equally crucial as it provides insight into your spending patterns, helps identify areas where you may be overspending, and allows you to make adjustments accordingly.

Understanding your money flow means being aware of how much income you have coming in, how much is going out, and where it's being allocated. With this knowledge, you can make intentional choices to align your spending with your financial priorities.

4) Cutting Expenses and Reducing Debt

Once you’re done analyzing your spending habits and understand how to save money each month with budgeting, the next obvious step is to cut expenses and reduce debt.

By identifying and eliminating unnecessary or excessive expenses, you can free up more funds to put towards savings and debt repayment, ultimately accelerating your path to financial stability.

In addition to cutting expenses, tackling your debt is a crucial part of the equation. High-interest debts, such as credit card balances or personal loans, can drain your finances through interest payments.

Create a plan to aggressively pay down your debts, starting with those carrying the highest interest rates. Consider strategies like the debt avalanche method, where you prioritize paying off the highest-interest debt first while making minimum payments on others.

As you learn how to get out of debt, you'll free up more disposable income that can be redirected toward your money-saving plans.

To accelerate the process of cutting expenses and reducing debt, consider implementing additional everyday savings tips like negotiating bills, and insurance premiums and cutting monthly subscriptions. Shop around for competitive rates and consider switching providers if it makes financial sense.

Another effective strategy is to consolidate high-interest debts into a lower-interest loan or credit card. This consolidation can help simplify your repayments and potentially reduce your interest burden, enabling you to pay off debts more efficiently.

5) Developing Smart Shopping Habits

While you may not associate shopping with saving and investment, it is one of the most crucial aspects of saving money.

According to PhonePe, Indians tend to splurge 25% - 30% of their monthly salary on retail and shopping expenses, which is even more than their expenditure on grocery and daily needs (12%).

By incorporating smart shopping habits, you can make your money go further. Conducting thorough research before making a purchase, reading reviews, and evaluating value for money are all money-saving ideas that can help significantly.

Timing is crucial too - keep an eye out for sales, discounts, and promotional offers that can help you save money while shopping online.

Exploring alternative shopping options like buying pre-owned items or participating in online marketplaces is another clever way to save money.

Finally, always compare prices and don't hesitate to negotiate or ask for discounts, ensuring you get the best price possible.

6) Planning for Emergencies & Retirement

Even if you are in your early 20s, an essential money-saving rule is to plan for emergencies and retirement.

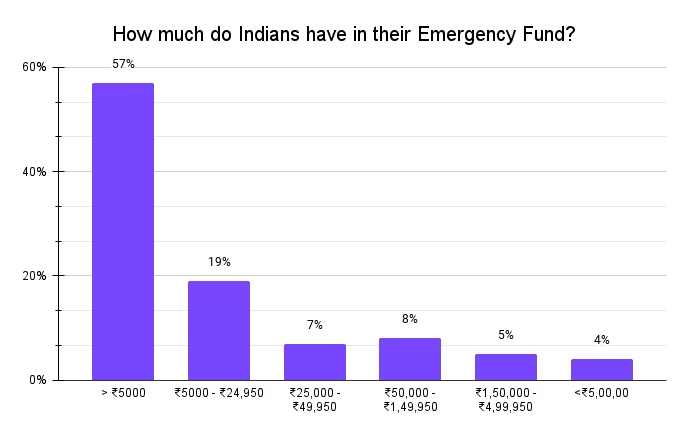

Firstly, establish a separate emergency fund to handle unexpected expenses like medical bills or job loss. Aim to save three to six months' worth of living expenses as this safety net.

Secondly, prioritize long-term savings for retirement by utilizing employer-sponsored retirement plans or individual retirement accounts.

Start early, contribute consistently, and take advantage of compound interest to grow your retirement savings. These strategies ensure financial security in the face of emergencies and provide a comfortable retirement lifestyle.

By accounting for unforeseen circumstances and maintaining retirement savings, you protect yourself from financial setbacks and build a secure future.

7) Avoiding Impulse Buying: Distinguishing between Needs and Wants

Once you’ve identified your shopping weak points, it’s time to stop impulsive buying and curb your spending on frivolous purchases.

It all starts with distinguishing between needs and wants. Before making a purchase, ask yourself if it is a necessary expense or simply a desire.

By understanding the difference and prioritizing needs over wants, you can avoid unnecessary spending and allocate your resources more effectively.

Another effective strategy is implementing a waiting period before making non-essential purchases. When you come across something you desire, rather than buying it immediately, give yourself a designated waiting period, such as 24 hours or a week.

This waiting period allows you to reconsider the purchase, evaluate its importance, and assess if it aligns with your financial goals and priorities.

Often, you'll find that the initial desire and financial FOMO diminishes over time, helping you make more deliberate financial saving decisions.

8) Being Mindful of Daily Expenses

It's important to recognize how seemingly small expenses in areas like transportation, groceries, and daily spending can add up significantly over time.

Some money tips on how you can save money monthly include making small adjustments in your day-to-day life.

Look for opportunities to reduce costs, such as carpooling or using public transportation instead of relying solely on personal vehicles, opting for more economical grocery choices for saving on food, and being conscious of impulse purchases or unnecessary expenditures.

Another method for saving on food is planning your meals and finding smart ways to eat healthy on a budget.

Look for discounts, coupons, or loyalty programs to maximize savings. Additionally, consider packing your own meals and snacks instead of relying on takeout or eating out, as this can save a significant amount of money over time.

Embrace cost-effective alternatives like brewing your own coffee instead of buying it from cafes or utilizing free or low-cost entertainment options like parks or community events.

By being mindful of daily spending and actively seeking ways to reduce expenses, you can make a significant impact on your overall financial well-being.

9) Maximizing Earning Potential

In this economy, sometimes having a single income stream is not always enough and it’s important to learn how to get more than limited income.

Consider side hustles, freelance work, or part-time jobs that align with your skills and interests. This not only diversifies your income but also provides an opportunity to earn extra money that can be allocated towards savings and avoiding surplus debt.

Another important aspect of maximizing earning potential is advocating for yourself in the workplace. This includes learning how to negotiate salary for better pay and asking for raises.

Research salary ranges for your position and industry to ensure you are being fairly compensated. When the time is right, schedule a meeting with your employer to discuss your contributions, accomplishments, and the value you bring to the organization.

Articulate your case confidently and professionally, highlighting your skills, achievements, and increased responsibilities.

By proactively engaging in these discussions, you demonstrate your worth and increase the likelihood of securing a higher salary or a well-deserved raise.

10) Exploring Investments: Saving through Spending Smart

Savings and investments go hand-in-hand when it comes to securing your future. But which option should you choose?

Consider long-term savings plans like fixed deposits (FDs), which offer secure savings with fixed interest rates. Mutual funds provide professional management and the potential for higher returns through diversified portfolios.

Gold investments are some of the oldest and most trusted forms of investments, but if physical possession is not your cup of tea, then digital gold may be a better option.

Real estate investments offer rental income and potential appreciation and can help you achieve long-term financial wellness.

11) Strength in Numbers: Building a Support System to Save

Ask any successful investment mogul and they’ll tell you one of the best ways to save money and continue doing so is by building a strong support system.

Surrounding yourself with like-minded individuals who share similar financial goals can provide motivation, encouragement, and valuable insights.

Seeking help from financial experts is another valuable aspect of building a support system. Consult with professionals such as financial advisors or planners who can provide personalized guidance and strategies tailored to your specific financial situation.

Their expertise can help you make informed decisions, optimize your saving strategies, and navigate complex financial matters more effectively.

Furthermore, improving your financial literacy is essential for long-term financial success. Educate yourself about personal finance, budgeting, investing, and other relevant topics.

Read books, attend seminars, or take online financial literacy courses to enhance your knowledge. Additionally, consider joining online communities or forums dedicated to personal finance.

12. The Power of Motivation: Your Saving Grace

The final and most important strategy to save money is maintaining motivation. It’s a good idea to celebrate every milestone, no matter how small, to keep your spirits high.

Recognize your achievements and reward yourself when you reach savings targets or accomplish financial milestones.

By celebrating these moments, you reinforce positive habits and create a sense of accomplishment that fuels your motivation to continue saving.

Along your saving journey, anticipate and overcome setbacks. View setbacks as learning opportunities and adjust your plans accordingly.

Develop strategies such as creating an emergency fund to handle unexpected expenses and stay flexible with your budget.

Stay focused on your long-term vision and adapt as needed. By staying motivated and overcoming challenges, you can progress towards your saving goals and achieve financial success.

Conclusion

In conclusion, saving is a powerful tool that empowers individuals to achieve financial stability and reach their long-term goals.

By developing smart saving habits, setting financial goals, budgeting wisely, and making informed investment decisions, you can secure your future, overcome financial challenges, and enjoy the peace of mind that comes with financial security.

Remember, every dollar saved today brings you closer to a brighter tomorrow. Start saving now and embark on a journey toward a more prosperous future.

FAQs about Saving Money

1. How can I teach my children about the value of money?

Answer: You can teach your children about the value of money by involving them in age-appropriate financial discussions, setting savings goals, playing interactive financial literacy games, giving them an allowance or opportunities to earn money, and encouraging them to make spending decisions and save for the future.

2. How can I save money each month and how much should I save?

Answer: If you are wondering how to start saving, you can begin by creating a budget and tracking your expenses to identify areas where you can cut back. Aim to save a portion of your income, such as 20% or more, depending on your financial goals and circumstances. It's important to save an amount that aligns with your financial priorities and allows you to build an emergency fund, pay off debt, and work towards long-term goals like retirement or a major purchase.

3. How can I grow my money?

Answer: The best way to save money and grow it is through investments. You can consider investing in a diverse portfolio of stocks, bonds, and other financial instruments to potentially earn returns over time. Additionally, you can explore options like real estate investments, starting a business, or putting money into high-yield savings accounts or mutual funds that offer higher interest rates and returns. It's important to carefully research and assess the risks and potential rewards of each investment option before making any decisions.

4. What are some low-risk investment options for beginners?

Answer: Some low-risk investment options for beginners include investing in government bonds, certificates of deposit (CDs), or high-yield savings accounts. You can also consider investing in safe options like gold that allow you to save during inflation too. These options generally offer more stability and lower risk compared to higher-risk investments like stocks or cryptocurrencies. It's important to note that these options may not help you learn how to save money fast, but they come with a lower risk of losing your initial investment.