A savings plan is a financial strategy that helps you set aside money for future goals. It can be as simple as setting up a savings account and depositing a fixed amount of money each month, or it can be a complex investment plan that includes a variety of assets.

Primarily, there are two types of saving investments: short-term and long-term.

Long-term savings plans are generally referred to as those investments that you hold for more than 3 years.

They are particularly important because they give your money more time to grow. Over the long term, the power of compound interest can work wonders, helping your money to grow exponentially.

For example: if you invest INR 1000 per month in a savings plan that earns 7.1% interest per year, you will have over INR 5 lakhs after 20 years.

A well-structured long-term savings plan can offer a multitude of benefits, ranging from tax savings options to retirement savings and protection against unforeseen circumstances.

In this blog, we will discuss everything from types of savings plans to their features, and benefits.

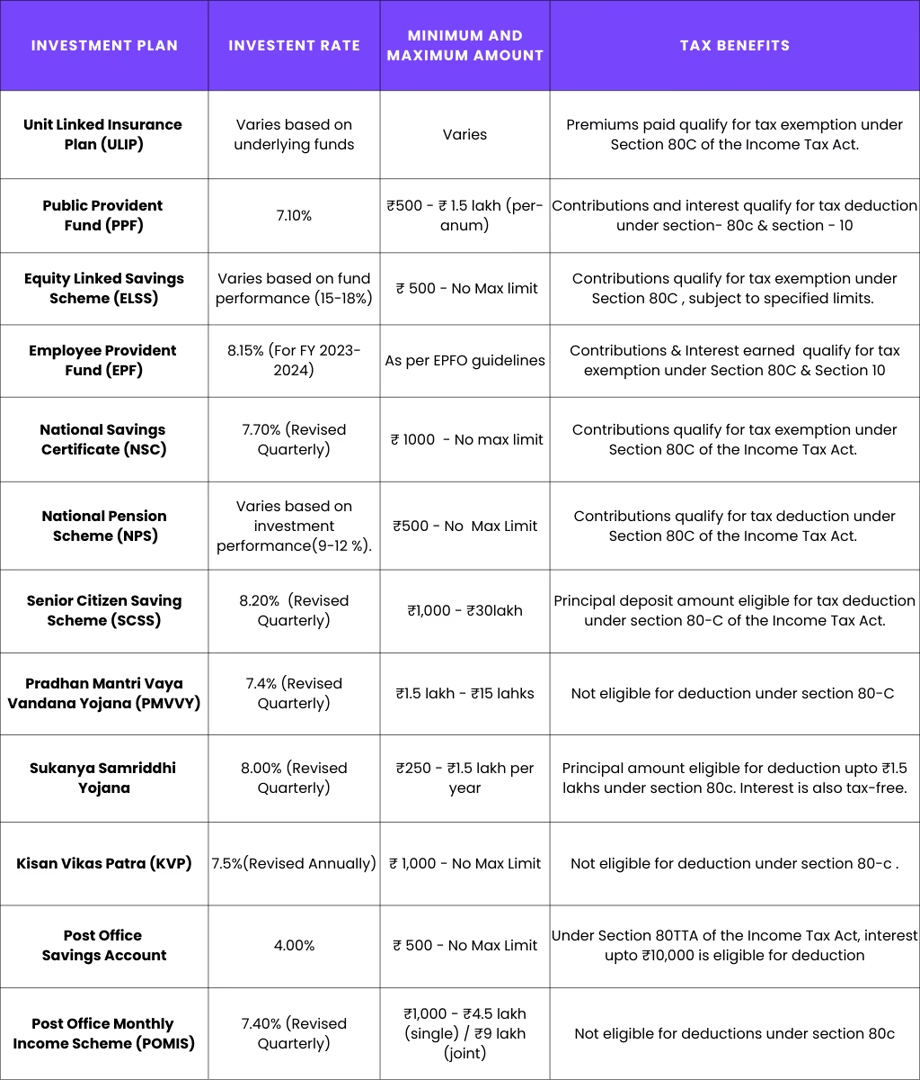

TYPES OF SAVINGS PLANS

Unit Linked Insurance Plan (ULIP)-

ULIPs serve dual purposes; they offer a unique combination of investment and insurance, providing individuals with an opportunity to grow their wealth while enjoying life coverage.

When you make investments in ULIPS, a portion of your investment is directed toward insurance. The other portion of these premiums is allocated toward investments in various funds. This can be anything from equity and debt to hybrid options, managed by experienced fund managers.

One of the key advantages of ULIPs is their flexibility, allowing you to switch between different funds based on your investment goals and risk appetite.

The returns from ULIPs depend on the performance of the underlying funds, offering the potential for higher returns compared to traditional insurance plans.

Additionally, ULIPs provide a life cover or death benefit, ensuring financial security for your loved ones in case of unfortunate events.

Premiums paid for ULIPS qualify for tax exemption under Section 80C of the Income Tax Act and are subject to specified limits. Tax benefits on maturity proceeds may vary.

PPF

The Public Provident Fund (PPF) is a very popular investment option as it comes with some unique features.

When opening a PPF account, the deposited money accumulates and earns compounded interest. It’s suitable for people looking for low-risk investments. As a government-mandated plan, it provides guaranteed returns of 7.1%.

PPF accounts offer stable annual returns. It comes with a lock-in period of 15 years and can be extended by 5 years.

PPF accounts offer tax benefits, with the principal amount eligible for tax exemption up to ₹1.5 lakhs under section 80C of the Income Tax Act. The total interest accrued on PPF investments is also exempt from taxation under Section 10.

E.L.S.S

ELSS Funds stands for Equity Linked Savings Scheme Funds. These funds invest a significant portion of their assets in equity and might also invest in some fixed-income securities. By investing in ELSS funds, individuals can avail of tax benefits under Section 80C of the Income Tax Act.

This allows for deductions on the invested amount, up to a maximum limit of ₹1,50,000

ELSS funds have a mandatory lock-in period of three years. ELSS funds offer both diversification and flexibility to investors. These funds allocate investments across various companies, sectors, and market caps and come with the flexibility to start as low as ₹ 500.

E.L.S.S has the potential to provide high, inflation-beating returns; due to the equity element, they are exposed to market volatility. Hence it is suggested to hold these investments for 5 years or more. You can also invest in E.L.S.S through a SIP, rather than investing a lump sum amount. Since it reduces risk and offers flexibility to invest your money based on market conditions.

Employee Provident Fund (EPF)

Employees' Provident Fund (EPF) is a savings scheme that is supervised by the EPFO (Employees' Provident Fund Organization) under the Government of India. Both employers and employees contribute 12% of the employee's basic salary and dearness allowance towards EPF.

The accrued interest is tax-free and can be withdrawn along with the lump-sum amount at retirement.

EPF offers benefits such as capital appreciation through interest, building a retirement fund, emergency funds availability, tax-saving opportunities, and partial withdrawal for specific purposes like education, housing, weddings, or medical treatment.

Contributions made to the EPF are eligible for a tax deduction under section 80c. Interest earned on EPF is also tax-free. You’ll be taxed in case you wish to withdraw your EPF before the completion of its 5 years. The Employees' Pension Scheme contribution does not earn interest, but it does offer a pension when reaching the age of 58.

Check out this link to understand taxation on E.P.F.

National Savings Certificate

The National Savings Certificate (NSC) is a fixed-income savings plan offered by the Government of India. It allows small to mid-income investors to save while enjoying tax benefits under Section 80C. The interest earned in the first four years is also eligible for tax exemption.

The interest on NSC is compounded annually and stands at 7.7%. It can be easily purchased from post offices with the submission of necessary KYC documents. It can also be transferred between post offices or individuals without affecting interest accrual or maturity.

Investors have the option to nominate a family member for inheritance in the event of their demise.

National Pension Scheme (NPS)

The National Pension Scheme (NPS) is a retirement investment plan in India under the supervision of the Pension Fund Regulatory and Development Authority (PFRDA) and the Central Government.

The NPS offers returns based on a portion of investments in equities and provides comparatively higher returns than other saving plans. It also provides tax advantages under Section 80C up to ₹ 1,50,00. For partial withdrawals, annuity purchases, and lump sum withdrawals. Employers can also enjoy tax breaks for contributing to their employees' NPS accounts.

Upon retirement, subscribers can withdraw up to 60% of the total fund as a lump sum, with the remaining 40% utilized for an annuity plan. If the fund is less than or equal to ₹5 lakhs, the entire amount can be withdrawn without the need for an annuity plan.

In the course of the death of an employee, the complete amount can be withdrawn by the nominee or the legal heir of the employee.

Senior Citizen Saving Scheme (SCSS)

Senior Citizens Savings Scheme (SCSS) is a savings plan in India that offers financial security and attractive returns for senior citizens. The principal amount deposited under this scheme is eligible for tax deductions however the interest earned on it is taxable as per the tax slabs.

TDS will also be deducted if the interest amount is more than ₹10,000 p.a.

Individuals who have attained the age of 60 years or above when opening the account are eligible. Those who are aged 55 to 60 years and have retired under Superannuation, VRS, or Special VRS are also eligible. Retired Defense Personnel can open an account at the age of fifty, subject to certain conditions.

The SCSS account has a maturity period of 5 years from the date of opening and can be extended for three years

In the event of the account holder's death, the account will be closed, and the deposit along with interest will be refunded to the nominee or legal heirs. It also allows for premature closure of the account under certain conditions.

Pradhan Mantri Vaya Vandana Yojana (PMVVY)

The Pradhan Mantri Vaya Vandana Yojana is a retirement investment plan in India operated by LIC of India under the supervision of the PFRDA and the Central Government. You should be of minimum 60 years of age to avail of its benefits.

The scheme can be purchased by paying a lump sum Purchase Price, and the pension payments can be received monthly, quarterly, half-yearly, or yearly through NEFT or Aadhaar Enabled Payment System

It offers benefits such as pension payments, death benefits, and maturity benefits. The scheme is available for individuals aged 60 years and above, with a policy term of 10 years.

Under certain circumstances, such as when the pensioner or their spouse requires funds for critical or terminal illness treatment. The scheme permits early withdrawal during the policy term. In such cases, the surrender value paid out will amount to 98% of the purchase price.

Minimum and maximum pension amounts range from ₹12,000 - ₹ 60,000 per year depending on the plan chosen.

Taxes are applicable as per Indian tax laws.

Sukanya Samriddhi Yojana

The Sukanya Samriddhi Account Scheme is a government initiative aimed at promoting savings for the future education expenses of girl children. It requires a minimum deposit of ₹250 and a maximum deposit of ₹1.5 lakhs per financial year.

The account can be opened in the name of a girl child until she reaches the age of 10, with only one account allowed per girl child. It is possible to open an account at post offices and authorized banks.

Withdrawals from the account are permitted for higher education expenses, while premature closure is allowed in case of marriage after the girl child turns 18.

The account can also be transferred between post offices and banks across India. It matures after 21 years from the date of opening, and deposits made into the account qualify for tax deduction under Section 80C of the Income Tax Act.

Furthermore, the interest earned on the account is tax-free under Section 10 of the Income Tax Act.

KVP (Kisan Vikas Patra)

Kisan Vikas Patra (KVP) is a savings plan available in India that offers attractive returns. While the minimum deposit amount is ₹ 1000, with subsequent deposits made in multiples of ₹100. There is no maximum limit on the deposit amount.

The scheme provides flexibility in account types. Adults can open a single-holder-type account for themselves or on behalf of a minor, while minors can open a single-holder-type account once they reach 10 years of age.

Joint accounts, either 'A' type or 'B' type, can be opened by up to three adults, with 'A' type accounts payable to both holders jointly or to the survivor, and 'B' type accounts payable to either of the survivors.

The account can be opened at post offices and authorized banks. Transfers of the KVP are allowed between individuals and post offices. After 2 and a half years from the date of investment, the KVP can be encashed.

It is advisable to thoroughly understand the terms and conditions. One of the key features is that the investment amount doubles upon maturity.

Post Office Savings Account

The Post Office Savings Account is a savings plan that provides individuals with a flexible and accessible way to save money.

To open an account, a minimum deposit of ₹500 is required, and there is no maximum limit on the deposit amount.

One of the advantages of the Post Office Savings Account is that it earns interest on the deposited amount. Additionally, the interest earned up to ₹10,000 in a financial year qualifies for deduction from income under section 80 TTA of the Income Tax Act, providing a tax benefit for account holders.

The current Interest rate offered by the post office savings account is 4%(compounded annually). Overall, the Post Office Savings Account is a reliable and accessible savings option for individuals seeking to save and grow their funds.

Post Office Monthly Income Scheme ( POMIS)

Post Office Monthly Income Scheme (POMIS) is a government-backed investment option offered by the post office in India. It is part of a range of schemes that provide fixed returns on investment, all backed by the sovereign guarantee.

POMIS is recognized and validated by the Ministry of Finance and stands out as one of the highest-earning schemes with an interest rate of 7.4%. As the name suggests, the interest in this scheme is disbursed monthly.

POMIS comes up with several features, including a lock-in period of 5 years, during which the deposited amount cannot be withdrawn.

POMIS accounts are transferable, allowing for a convenient transfer to another post office if you change your residential status. In the case of joint accounts, each investor has equal rights over the account.

The investment amount can be any multiple of ₹ 100, and while the interest amount does not incur Tax Deducted at Source (TDS), it also does not qualify for tax benefits under Section 80C.

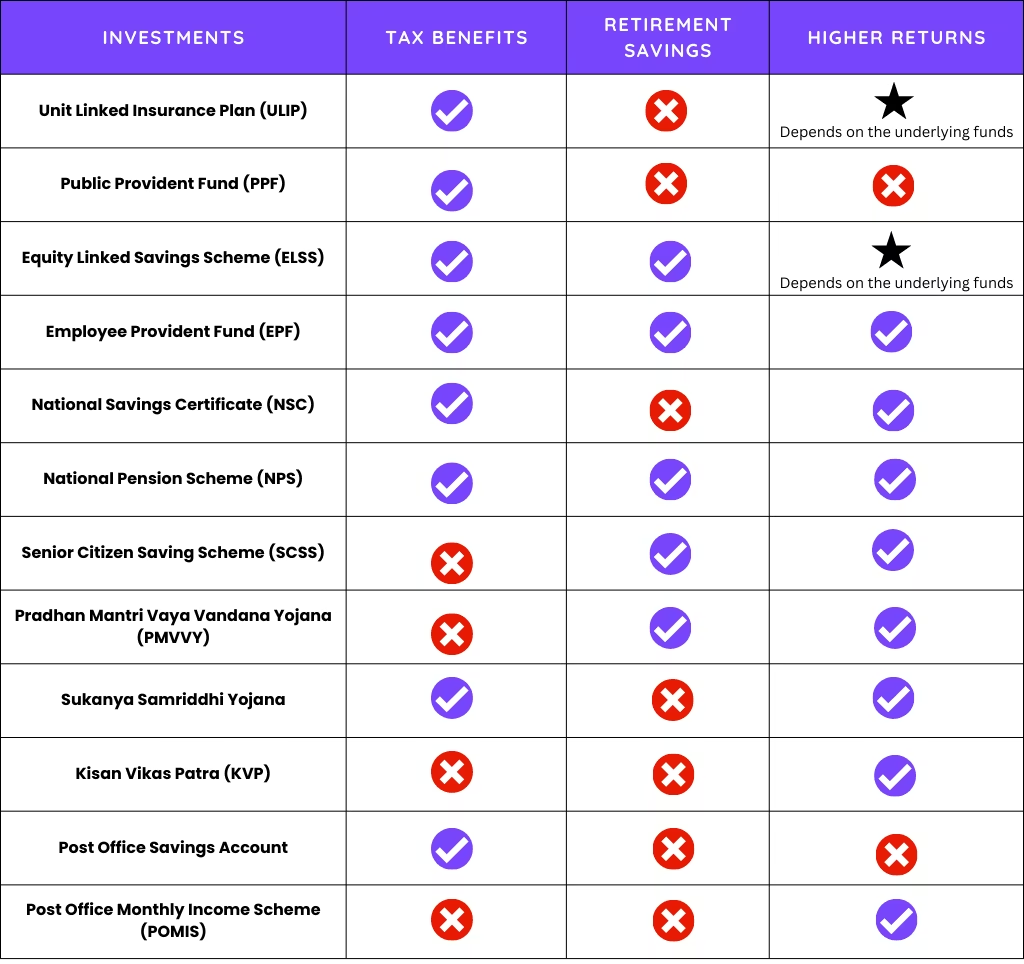

ANALYZING SAVINGS PLAN - TAX BENEFITS, RETIREMENT SAVINGS, HIGHER RETURNS

Benefits Long-Term Savings Plan Offer

The best savings plan offers many benefits to investors in the long term, depending on what type of plan you are investing in. However, overall, most long-term savings plans offer the following benefits.

Growth With Compounding

Several savings options, including popular choices like PPF and N.S.C, allow you to enjoy the raping benefits of compound interest on your investment.

Compound interest offers higher interest than normal simple interest rates. Compounding involves earning interest or returns on both the original amount of money you invest (the principal) and any interest or returns that accumulate over time

If you invest 12,000 in an account or investment that offers a 7% annual interest rate, at the end of the first year, you would earn ₹840 in interest. This brings your total to ₹12,840.

Now, in the second year, you not only earn interest on the initial ₹12,000 but also on the additional ₹840 that you earned in the first year. With a 7% interest rate, you would earn ₹ 898.80 in the second year, making your total ₹13,738.80.

Thus, a long-term savings plan helps you grow your wealth quickly.

Tax Benefits

Long-term savings plan offers tax deductions under various sections of the income tax act 1961

Depending on your investment plan, you can save a certain sum of money on the principal amount and on the interest offered. This way you can generate wealth over the long-term.

Security from Short-Term Volatility

The money market is hard to predict. So, investment becomes prone to risk, especially short-term investments.

A long-term savings plan eliminates the volatility of the stock market in the short-term and allows you to gain the maximum benefits.

Guaranteed Returns

When you invest in a long-term savings plan, in the majority of cases, you’ll get guaranteed returns on your savings. Therefore, you can plan for your significant milestones like retirement, house purchase, kids' education, marriage, etc.

Just give your bank a standing instruction to auto-debit your monthly contribution to make investing easier and more convenient.

Final Thoughts

Like small drops accumulate to make the sea, long-term investment over the years can help you save much money for your future.

Make sure you research well about the best investment options in India and align them with your financial goals to get the desired benefit during maturity.

You can begin your daily savings journey, with the Jar app by making investments in digital gold. By making investments in digital gold, you just don’t save money but you also get a hedge against inflation.

So what are you waiting for? Start making daily savings in Jar app and make your financial future secure.