Understanding the difference between high risk investment and low risk investment is crucial to satisfy your goals.

In order to make successful investments, you need to know how you can maintain balance between high risk and low risk investments.

The reasoning behind this is simple: With a highly volatile investment, you need low risk options in order to maintain a backup and even out the overall portfolio risk.

Similarly, with a very low risky investment, you will need at least one highly risky option due to the high returns that it’ll potentially generate. This is one potential reason why you might choose an investment with high risk instead of one with low risk.

In short, with high risk comes high returns investments. Similarly, the more protected and less risky your investment will be, the lower will be the returns.

What is a low risk investment?

A low-risk investment refers to an investment option that is considered to have a lower probability of incurring significant losses. Low risk investments tend to generate more stable returns and have lower volatility. They prioritize capital preservation and provide a relatively predictable income stream over time.

What is a high risk investment?

An investment option that carries a higher probability of significant losses, but also has the potential for substantial returns is considered as a high-risk investment. These investments are typically characterized by greater price volatility and market fluctuations, making them more unpredictable compared to low-risk alternatives.

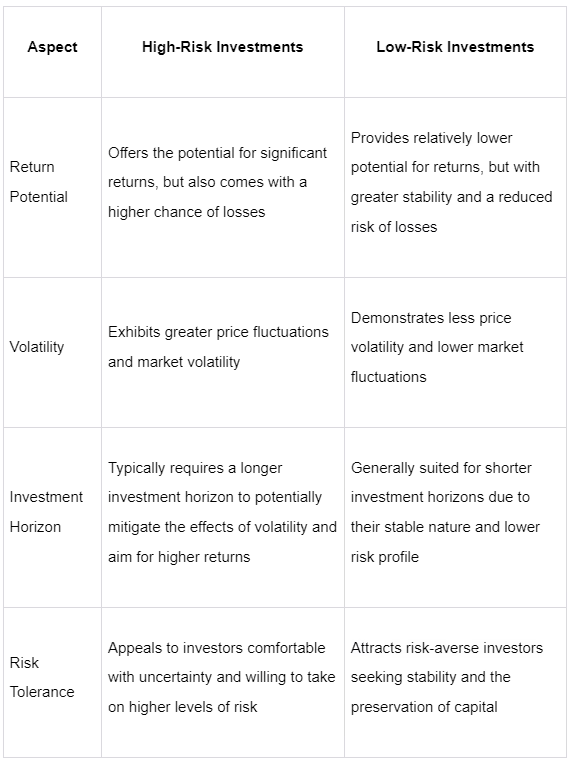

Difference between low risk and high risk investment

Understanding the difference between low-risk and high-risk investments is essential for investors looking to build a diversified portfolio and achieve their financial goals.

Here are the key differences between high risk and low risk investments

How do we measure risk?

Risk is measured by the possibility of underperformance or a fall down in value of the investment asset relative to what was initially expected of it.

People who are able to cope up with this fact and consistently aim for long-term high gains are usually classified as risk lovers.

On the other hand, people who have the constant fear of losing money, this possible fall in value would do nothing but discourage them from investing further. These people are known to be risk averse, and they generally prefer no to low risk options.

Examples of low risk investments

1. Fixed Deposits (FDs)

Fixed deposits is one of the low risk investment example and is definitely on the to-invest list of risk-averse people.

Since this investment option provides stable returns and has almost no risk, a lot of people invest in this. The time period in the case of fixed deposits can be as long as 15 years.

But the returns that are generated aren’t that high, though you will definitely get the assured sum. The only problem is that FDs do not really hedge you against inflation, and this makes FDs a low return investment instrument.

2. PPF (Public Provident Fund)

PPF is one of the best investment option in India is because it is generally backed by the government and, therefore, provides table returns at a very low risk.

For the purpose of just saving for retirement, PPF is one of the best options.

The returns are pretty reasonable in this case, and if you don’t have a formal retirement plan, this is the way to go.

3. Life Insurance Policies

You must never compromise with life insurance - be it a risk lover or hater, make sure you invest in a good life insurance policy.

To make sure that your family’s normal lifestyle is not threatened by your absence, you must set up an insurance plan.

Other must-have insurance policies are that of health insurance, and if you can digest some risk, then the high return paying term insurance plan.

4. Treasury bills, treasury notes, treasury bonds, and the treasury inflation protected securities (TIPS)

These low risk investment options are highly liquid - can be bought and sold easily either directly or in the mutual funds market.

Treasury bills generally mature within one year, treasury notes may stretch up to 10 years, the treasury bonds can go on up to 30 years, and TIPS’s value depends on the direction of the inflation.

If you are able to keep treasuries till they mature, you won’t lose any money. But you may lose a bit of the principal amount in case you sell them prior to maturity. Also, rising or falling interest rates do affect the returns here, and so if you can handle those kinds of fluctuations, then these are definitely a good low risk option.

Examples of high-risk investments

1. Direct equities

If you enjoy taking up risky investments, direct equities are one of the high risk investment examples for you.

Though every asset class will reap you some returns, stocks tend to outshine all of them, especially in the long run. So, if you want to make your money work for you, you should definitely invest in equities.

If you compare the returns, then stocks are able to outperform FDs.

Investing in stocks is considered a risky form of investment due to market volatility, uncertainty of returns, company-specific risks and lack of diversification but the returns are definitely worth it.

You should consider investing here only if you have proper knowledge about the stock market. External help might be useful, but in the end, no one can really predict the market conditions.

2. Equity funds

Well, if you find direct equities too risky, you can instead opt for mutual funds.

This definitely provides better returns than options like FDs and is comparatively more secure than the stocks.

Mutual funds are nothing but an alternative way to invest in stocks. Since you’ll share the risk in a mutual fund, it just makes them more attractive.

Plus, any experienced and professional fund manager would always pick the winning stocks.

3. Unit linked insurance plans (ULIPs)

This is a type of endowment plan that provides you with the dual benefit of insurance cover and investment. It is also one of the tax saving investment option you can explore, if you are looking to save tax under section 80C

When you invest in ULIPs, your investments are tied to the stock market along with a life cover.

You can yourself choose the type of stock you are interested in and adjust the risk in your portfolio accordingly. This flexibility makes ULIPs an attractive but risky investment option.

Conclusion

High and low investment instruments all have a basic aim- help you achieve your financial goals.

What, where, and how you invest depends on your risk tolerance. But in the end, it's always the proper diversification strategy that wins the game.

To succeed in your financial journey, we would recommend you to look for a blend of these high - and low risk investments and set up your own portfolio.

If confused, it's always a good idea to consult an expert.