When it comes to maximizing savings and minimizing tax liabilities, it's a smart approach to take full advantage of the deductions under various sections of the Income Tax Act.

In this article, we will focus on deductions offered under Section 80C of the Income Tax Act and its subsections Section 80CCD(1), Section 80CCC, Section 80CCD(1B), and Section 80CCD(2).

By exploring tax-saving investments under Section 80C, individuals can not only reduce their taxable income but also enjoy various benefits such as life insurance, premium investments, and robust retirement planning.

It’s very important to understand the impact of inflation on our finances and how can we beat the inflation rate by planning our investments smartly.

We’ll understand the diverse investment options that qualify for tax deductions under Section 80C and discover how they can lead to higher returns while securing a financially sound future.

What Does Section 80C of the IT Act Offer ?

Under the Income Tax Act of 1961, Section 80C offers tax deductions of up to ₹1.5 lakhs. Both individual taxpayers and Hindu Undivided Families (HUFs) following the old tax regime are eligible to leverage the deductions under section 80c.

By investing your money in the following investment options, you can claim the deduction:-

- ELSS (Equity Linked Saving Scheme)

- Bank Fixed Deposits

- Life Insurance plans

- Public Provident Fund

- National Savings Scheme

- Employee Provident Fund

- Voluntary Provident Fund

- Sukanya Samriddhi Yojana

- Five-year Post Office Fixed Deposits

- Senior Citizen Savings Scheme

- Unit-linked Insurance Plans

- Infrastructure Bonds

- Principal amount of a home loan

- Stamp Duty & Registration Cost

- Education fee for Children

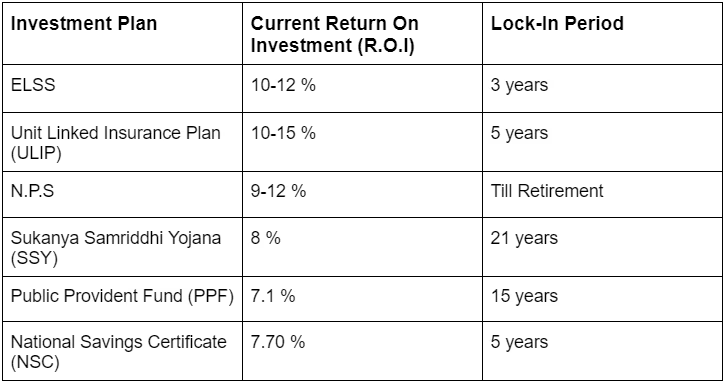

Choosing where to invest your money could be confusing. But most importantly, you need a proper understanding of their features. We have come up with the best tax-saving options under Sec 80C.

Best Tax-Saving Investments Eligible for Deductions Under Section 80C

You know what it's like to be on the hook for taxes. But starting investing from early quarters in a financial year allows you to avail maximum returns.

Let’s explore some investment options that allows you to claim deductions under Sec 80C and help you diversify your portfolio

ELSS - Equity Linked Savings Scheme

Equity Linked Savings Scheme (ELSS) allows you to invest your money in equity and equity-related instruments. Two key features of ELSS are -

- Investments up to ₹ 1.5 Lakhs are eligible for tax deductions

- It comes with a three-year lock-in period which is the shortest among other investments that qualify for deductions under Section 80C.

Long-term capital gains beyond Rs 1 lakh are taxed at 10%. Though it may offer high returns, the risk of investment in ELSS is high.

Unit-Linked Insurance Plans (ULIPs)

Unit Linked Insurance Plans (ULIPs) are financial products that combine life insurance with equity and debt investments (depending on your plan).

They offer the dual benefit of protection and investment growth.

ULIPS come with a minimum lock-in period of 5 years and investments are eligible up to ₹1,05,000 other than that the returns on ULIPS are tax-free as well.

It’s important to note that ULIPs may have high expenses, including various charges like premium allocation charges, policy administration charges, fund management fees, mortality charges, etc.

ULIPS invests in market-linked securities so it’s important to check the risk factors associated.

National Pension Scheme (NPS)

NPS is a government-backed pension scheme with tax benefits under Section 80C up to ₹1.5 lakhs and an additional ₹ 50,000 under Section 80CCD(1B). The minimum contribution is 1000 INR with no maximum limit.

The lock-in period is until the age of 60 (extendable till 70). Partial withdrawals are allowed after 3 years for specific purposes. 60% of the maturity amount can be withdrawn tax-free.

Employer’s contribution of up to 10% which comprises of basic salary and dearness towards NPS is also exempted under Section 80CCD(2). NPS comes under Exempt-Exempt-Exempt (EEE) – wherein investment, maturity, and interest benefits are exempted from tax.

Sukanya Samriddhi Yojana (SSY)

Every parent wants to create a better future for their children. SSY gives that freedom to parents, grandparents, or any legal guardian of a 10-year-old girl child. While any parent can open an SSY account only one parent can claim deductions under Section 80C.

Sukanya Samriddhi Yojana also comes under the EEE category and only one parent can claim deductions under Section 80C.

Also, you are free to withdraw 50% of the accumulated amount once the daughters reach 18 years. The remaining, you can withdraw once they are 21 years. You can open accounts only for two daughters. And the combined amount shouldn't exceed ₹1.5 Lakhs in a year.

Public Provident Fund (PPF)

Introduced in 1968, PPF is a long-term savings option with a lock-in period of 15 years, that can be extended for an additional 5 years. Minimum and maximum investment amount ranges from ₹. 500 - ₹. 1.5 lakhs.

PPF also comes under the EEE category. Contributions up to ₹ 1.5 lahks are eligible for tax deduction under Section 80C.

PPF accounts can be opened anywhere from a post office, public sector banks, and even private banks. The current interest rate on PPF is 7.1% and is compounded annually.

National Savings Certificate (NSC)

NSC is for all eligible Indian account holders - individuals, a group of 3 individuals, and guardians of a minor or a minor above ten years.

You can start investing by sparing only Rs 100, there is no maximum limit on the investments. Interest rates are revised quarterly and compounded annually, the current interest rate is 7.7 % from 1st July.

The amount invested comes with a lock-in period of 5 years investments made are eligible for deduction up to ₹1.5 lakhs and can be claimed under Section 80C.NSC’s are transferable and can be purchased from the nearest post office.

Senior Citizens Saving Scheme

The Senior Citizen Savings Scheme (SCSS) is designed especially for senior citizens who have attained 60 years of age. You can check age-related exceptions here.

It offers a secure and lucrative investment avenue for senior citizens, ensuring a stable income during their retirement years. Eligible individuals can open an SCSS account with a minimum deposit of ₹1,000, going up to a maximum limit of ₹ 30 lakhs.

The scheme comes with a fixed maturity period of 5 years, extendable for an additional three years if desired.

Investments in SCSS are eligible for tax deductions under Section 80C of the Income Tax Act, up to ₹1.5 lakhs per financial year. However, it's essential to note that NRIs and Hindu Undivided Families (HUFs) are not eligible to invest under this scheme.

Tax Saving Fixed Deposits

Tax Saving Fixed Deposits (FDs) are financial products available through banks and post offices, offering tax deductions under Section 80C of the Income Tax Act. These FDs have a mandatory lock-in period of 5 years and provide a maximum tax exemption of ₹1.5 lakh on the invested principal.

Nevertheless, it is important to note that the returns generated by these investments are subject to taxation as per your income tax slab.

Home Loan Repayment & Stamp Duty and Registration Charges

Owning a home is a cherished dream for many, to avail of a home loan you need to have a certain percentage of the value as a down-payment. But here's the good news - you can avail of tax benefits on the repayment of the principal amount of the home loan under Section 80C of the Income Tax Act, up to a maximum of ₹1.5 lakhs.

Additionally, when you purchase a property, you need to consider the stamp duty and registration charges. These charges can vary based on the location and various other factors.

While the costs may differ depending on the specific property transaction, the deduction under Section 80C remains the same - you can claim up to ₹1.5 lakhs on these expenses.

If you are wondering how to save money to buy a house, here are a few tips.

Education fee for children

Every parent desires to provide their child with the best education, but with the ever-increasing inflation and soaring education costs, it can be a little expensive.

Here is the good part you can claim a deduction of up to ₹ 1.5 lakhs under section 80 C. It can be claimed for a maximum of two children in the case of a single taxpayer and 4 children in the case of two taxpayers.

This deduction applies to full-time education within India and is not eligible for foreign universities. Only the actual payment of tuition fees qualifies for this deduction, and expenses such as donations, private tuition fees, development charges, etc are not eligible for exemption.

If you are concerned about your child’s future and finding it challenging to make savings for their future, check out our blog on how to save for your child’s future.

The Bottom Line: How Can You Benefit by Investing in These Options?

Keep in mind your financial goals before putting money in any of these schemes. Don't delay your tax plans until the last quarter to make the situation messy. Plan your investments at the beginning of a year, as your assets have much more potential to multiply over time. Here's what you can try:

Keep a check on your expenses towards loans, fees, and premiums. If the costs come within 1.5 Lakhs, you don't have to invest the entire amount. Then, as per your risk profile, choose one of the investing options that suit you best.

Making a financial investment under the above schemes is a serious commitment, most of which requires having the patience to see your money grow for years before making a fortune.

However, if you don’t want to stress yourself with complex investment options, fluctuating interest rates, lock-in periods, and the effort of going to banks and post offices. You can invest in digital gold by downloading the jar app.

Not only can you make seamless investments whenever and wherever, but you also have the freedom to withdraw your funds whenever needed. And that's not all – you have the exclusive opportunity to claim 24k gold, adding a touch of luxury to your investment journey.

FAQs

Q) What is section 80C of the IT Act, 1961?

Answer - The IT department offers benefits while investing in schemes like PPF, ELSS, ULIP, and others, under Sec 80C, up to Rs. 1.5 Lakhs.

Q) Can you claim benefits of more than Rs. 1.5 Lakhs?

Answer - No, Rs. 1.5 Lakhs is the maximum deduction combining all suitable options.

Q) Which investment plans are tax-free?

Answer - Tax-free investments include SSY, PPF, NPS, and EPF.

Q) How many tax-free investment options can I have?

Answer - There is no limit on the tax-free investment types, but there is a limit on the deductions.

Q) How can I pay less tax on higher incomes?

Answer - You can save taxes by choosing tax-free investments and paying less on high income.