Ultimate Guide to gold investing

What’s the big deal about Gold?

Gold. A metal with glossy sheen. It can be easily melted into bars, coins, or jewelry. It does not rust or wear out easily. It has found an important place in human civilization.

Gold is valuable as a status symbol, a global store of value, and a medium of exchange. In this article, we will dive into why gold is so valued and how you can make hay while the sun shines.

Before thinking about gold as an investment asset, we should first discuss how gold became an investment in the first place.

As a metal abundant deep inside the earth, gold has many traits uncommon in metals and resources. Everything that is valuable is limited.

Limited supply and increased demand increase the value of a resource, but gold isn’t limited. As gold is mined, it is always around. Unlike other commodities like oil, gold can’t be consumed or destroyed. It is permanent.

So, we can safely say that even if the demand for gold dries up, the supply of gold will always increase; hence, the price of gold will stagnate after some point in time.

Wrong! Not about the supply problem but about the price.

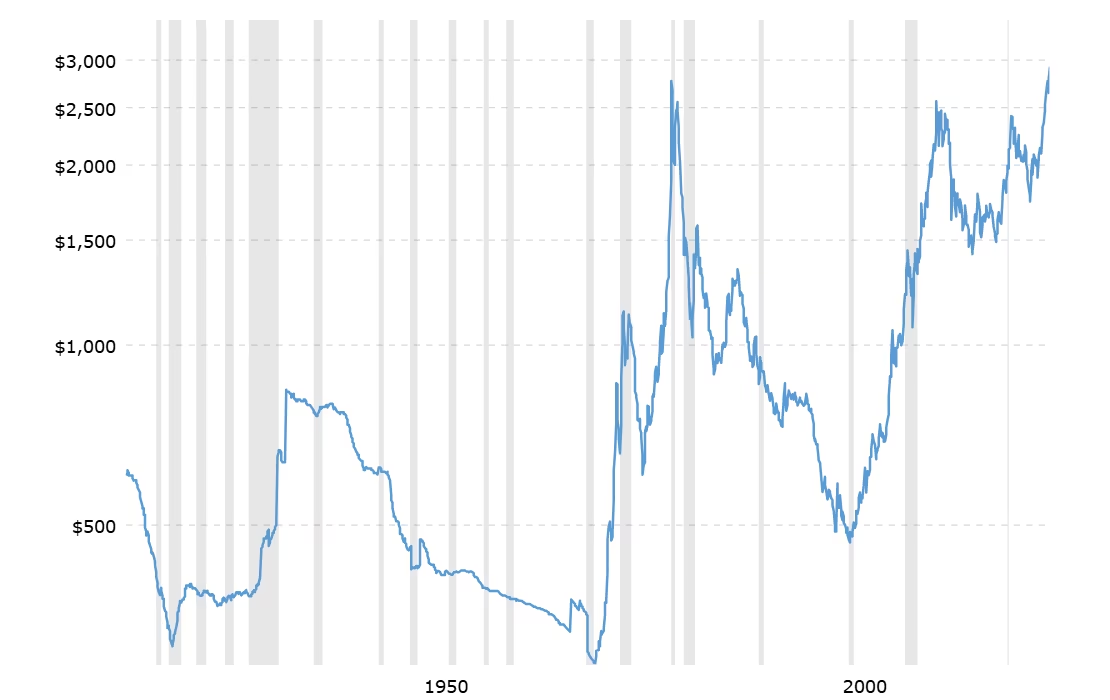

Here is the price of gold over the past 100 years. It has withstood political and economic turmoil and has increased significantly.

How did we overcome the supply problem?

Throughout the evolution of human civilisation, gold was chosen as an acceptable medium of exchange. In the 1970s, the US introduced the gold standard, linking the supply of money to the supply of gold.

It was done to control the expanding credit and stabilise and regulate the lending standards as the world figures out how to function as a global economy.

From this stemmed the idea of using gold as a comfortable hedge against economic and political turmoils. Not a bad idea if you think about it but it wasn’t without its flaws.

Most countries do not follow the gold standard any more but with immense importance bestowed onto gold, the world fell in love with owning it, using it, and flaunting it.

What drives the price of gold?

Gold is pegged to USD

As the value of gold is dollar-denominated, meaning it is priced in USD currency in the global markets, the value of gold is inversely related to the value of USD. If the dollar is expensive, people tend to buy less gold, and if the dollar is cheaper, people may buy more gold for the same price.

Central banks reserves

Many central banks in the world have large reserves of gold as a way to diversify their monetary reserves. As many central banks put their faith in gold, the price of gold rises.

Central banks have a huge influence on the mindset and outlook of people. A swing in any direction by central banks can influence the prices of commodities globally.

As of the fourth quarter of 2024, India's gold reserves were at an all-time high of 876.20 metric tons! That’s a lot of gold!

Demand for gold

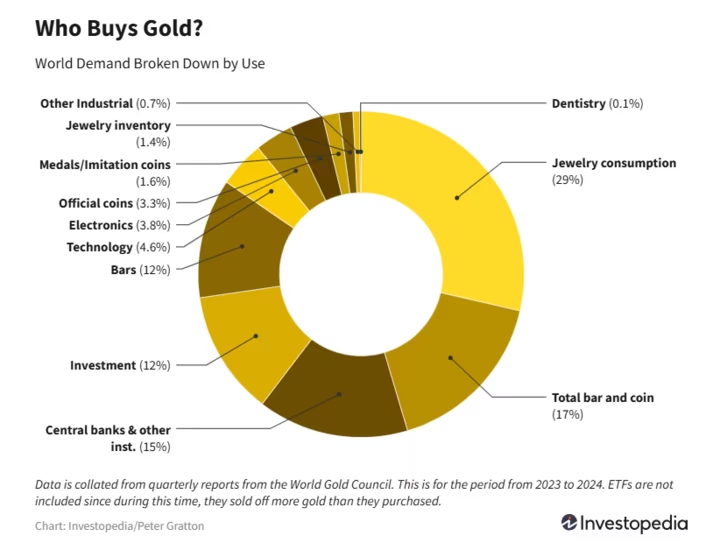

As a versatile metal, gold has many uses, from jewellery and bars to equipment in the NASA spacecrafts.

The demand for gold can be broadly split into 3 categories:

- Jewelry

- Investment

- Industrial

Jewelry makes up for most of the gold demand in the world, garnering huge influence on the prices globally. As gold becomes more and more in use for any of the abovementioned purposes, the price fluctuates.

A recent example is the rise of AI; the year-over-year demand for gold in technology has increased by 11%. As demand for consumer electronics increases, the prices of gold can also increase.

Gold Production:

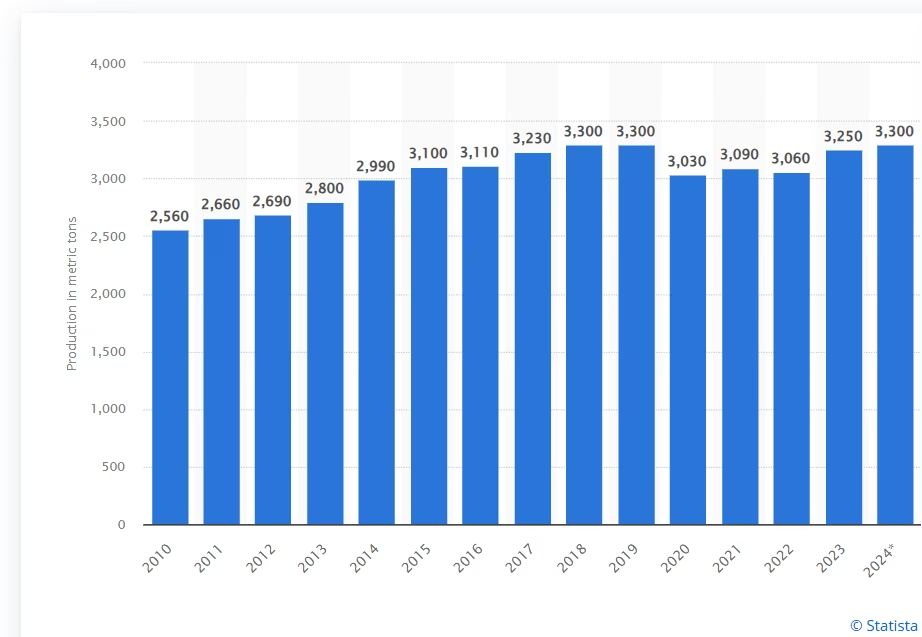

China, Australia, and Russia account for 31% of the world's gold production. In 2024, the global gold production was at 3300 metric tonnes.

Over the years, mining gold has become harder, as we can see with the stagnation at around 3000 metric tons. Mining difficulty can pose additional challenges as the product process gets more expensive, thus increasing prices in the global market.

Gold Investment Strategies

Gold Bullion

Bullion is shorthand for gold in its most common form, bars or ingots. A less expensive production method is pouring gold bars and pressing ingots.

Therefore, compared to ingots, bars are more expensive due to the premium they fetch over the daily spot price of gold.

Purchasing pure gold from trustworthy vendors or authorized organizations is the first step in investing in gold bullion.

Benefits

- Helps in portfolio diversification

- Hedge against inflation

- Safe haven against economic adversities

- High liquidity

Facts

Although most people associate Mitsubishi with cars made in Japan, you might be shocked to hear that they also produce gold bullion bars. Mitsubishi makes its own gold bars, you know?

The company's 2005 250-kg bar, marked as 999.9 fine gold, might be too expensive for most consumers. It is the largest gold bar produced in the world at the moment.

Gold Coins

Many countries around the world have minted huge amounts of gold coins for many years.

Typically, investors will pay a premium of around 1% to 5% over the gold's intrinsic worth when making gold coin investments from private dealers.

However, in some cases, the premium may exceed this amount.

Benefits

- Because gold coins come in smaller sizes, investing is more convenient.

- It is a universally recognised form of currency.

- Gold coins are tangible assets and have high liquidity.

Facts

The first gold currency ever produced by an Indian sovereign was supposedly the Kanishka 1 Gold Dinar, which was struck in 127 CE by the Kushan King Kanishka 1.

A variety of languages, including Greek, Persian (Bactrian), Uzbek, Afghan, and Tajik, began to appear on coins.

Later issues, however, used the Persian language, which was common in the Central Asian province of Bactria.

Gold ETFs / Mutual Funds

For those who choose a more cautious approach, there are exchange-traded funds (ETFs) and mutual funds that focus on gold.

The investing strategies of these funds differ: Mutual funds often favour equities in gold mining companies, but gold-backed exchange-traded funds (ETFs) buy real gold.

This is not the case for all funds. All of these options provide a liquid and inexpensive way to enter the gold market, making them a more diversified and, therefore, less risky alternative to purchasing stocks outright.

Benefits

- More liquid than physical gold

- Transparent pricing

- Less market risk

- No entry or exit load

Facts

As a subset of the overall exchange-traded fund (ETF) market, the Indian gold ETF is incredibly tiny.

Spider Gold ETF, the biggest gold ETF in the world, manages more than $35 billion in assets under management (AUM).

On the other hand, all of India's gold ETFs combined manage less than $1 billion.

Futures & Options

Gold futures are contracts to purchase or sell a specified quantity of gold at a future date.

People often invest in futures because the commissions are very low and the margin requirements are far below traditional equity investments.

A futures option is a substitute for purchasing a futures contract directly. Option holders can purchase the futures contract within a specified duration and at a predetermined price.

Benefits

- Future contracts have low commissions.

- Gold future contracts are standardised.

- Gold options leverage your original investment and limit losses.

Facts

In March 2024, India's F&O turnover hit a new monthly record of Rs 8,740 lakh crore, equivalent to $1.1 trillion.

This incredible increase is a marked departure from March 2019's total of just Rs 217 lakh crore, or almost $27 billion.

Mining Companies

Companies that mine and refine gold are likely to benefit from increased gold prices. Putting your money into these kinds of businesses can be a low-risk approach to making money off of gold.

Most of the major gold mining corporations have operations all over the world.

The success of such gold investment plans depends on business fundamentals that are common to many other significant organisations.

Benefits

- Mining companies can be profitable during economic uncertainty.

- Mining companies offer a safer way to invest in gold than purchasing gold bullion.

Facts

According to the Indian Bureau of Mines, there are currently over 550 operational gold mines in India. The states of Tamil Nadu, Jharkhand, Karnataka, Andhra Pradesh, Telangana, and Rajasthan are home to these.

Hutti Gold Mines is the largest gold mine in India, located in the Raichur district of Karnataka.

Jewellery

Jewellery accounts for most of the world's gold production. As the global population and wealth continue to rise at a steady rate, there will likely be a greater need for gold in the jewellery industry.

Gold jewellery buyers, on the other hand, have a reputation for being price-sensitive; they tend to buy less gold when prices rise quickly.

Benefits

- Tangible and aesthetically pleasing

- Holds sentimental value

Facts

With a demand that accounts for over 25% of the world's total, India is always among the top countries in terms of gold consumption.

The primary motivator here is a deep affection for gold jewellery, which plays a pivotal role in many Indian religious and festive celebrations.

Digital Gold

One substitute for purchasing the yellow metal in its physical form is digital gold. A customer can buy gold online and have the same quantity stored in a secure vault.

An individual can buy digital gold for as little as ₹10. At any moment, customers can sell all or part of their gold at the current market price.

The government has verified that all of these gold pieces are 24 karat. There will be no room for deception because it guarantees authenticity.

Benefits

- Ease of exchange

- Guaranteed purity

- Secured storage in bank-grade digital vaults

Facts

The World Gold Council estimates that 40 million Indians now own digital gold and that 120 million people have transacted in digital gold.

Comparison table

|

Types of Gold Investment |

Pros |

Cons |

|

Physical Gold |

|

|

|

Gold ETFs |

|

|

|

Gold Mutual Funds |

|

|

|

Sovereign Gold Bonds |

|

|

|

Digital Gold |

|

|

Benefits of Investing in Gold

Hedge against Inflation

Looking at historical data, gold investments have always been considered a hedge against inflation because their value tends to increase during times of high inflation.

As inflation is currently high, buying gold is a suitable option for investors looking to protect their wealth against inflationary pressures.

Gold’s Value Over The Years

Unlike paper currencies and other commodities, gold has held its value over the years. It is the second oldest asset to be traded in the world after land.

In international markets, gold’s value has been near the all-time high of 2956 USD per ounce, cementing the appreciating trend of gold.

Portfolio Diversification

To diversify your portfolio, you need to invest in assets that aren’t correlated with one another. Historically, gold has no correlation with stocks and financial instruments. Another reason is long-term stability.

Gold can be very volatile in the short term due to many factors but its price has been consistent over a long period of time.

No or low negative correlation with other assets coupled with long-term price stability makes gold a great portfolio diversification asset.

High Liquidity

With the advent of gold, exchange-traded funds and digital gold platforms, the age-old storage issue of gold is resolved, making it highly liquid.

Even today, owning physical gold can be more liquid than many financial instruments due to the abundance of jewellers across India and the world.

Risks in Gold

Gold does not provide any regular income, like rent from the house, interest on bonds, or dividends on stock. The profit of the investor is solely dependent on the price appreciation of the gold over time.

Gold has a good track record, but it can be volatile in the short term. For example, a common trend is that if equity stocks are not performing well, gold does. If equity stocks are on the rise, gold suffers.

That's all, folks!

How to invest in gold on the Jar App?

Jar App is India’s top-rated gold-saving app that offers a range of financial services.

Users can invest in digital gold, purchase gold coins, and shop gold jewellery for men and women.

Our mission is to make savings easier and help each Indian own gold.

Users can start their investment with as little as ₹10 with the Jar App. You can start investing by making a one-time payment or setting up an autopay system for daily, weekly, and monthly intervals.

Our app is powered by UPI and trusted by over 2 crore users across India.