In India, a small three-digit number can determine your ability to take loans or apply for credit cards for the rest of your life.

That's not all. This number decides whether you are eligible for EMIs and can avail of a low insurance premium. This is called a credit score.

Indian financial institutions and money lenders use a credit score called 'CIBIL Score' to measure a person's credit worthiness.

This score indicates whether you can pay back a loan and your financial stability. It demonstrates how likely the person will default on their loan repayment and bills.

So, it is crucial to properly understand the importance of credit score and how much it can impact your financial health.

What is a Good Credit Score in India?

A credit score is made of a three-digit number that ranges from 300 to 900.

Its state can impact your short-term and long-term fiscal goals and even your financial future.

The credit score is calculated by validating your credit history, credit score report, and rating. The closer your credit score is to 900, the better your chance of getting a debt.

Most companies consider 850 a perfect credit score. But today, the minimum requirement for availing a loan, EMI, hence a good credit score in India is 750 and above.

Anything below 750 gets automatically rejected.

Interesting Fact: Credit Information Bureau India Limited or CIBIL is India's primary credit information generation bureau. However, Equifax and Experian are two other leading players.

How is Credit Score Calculated in India?

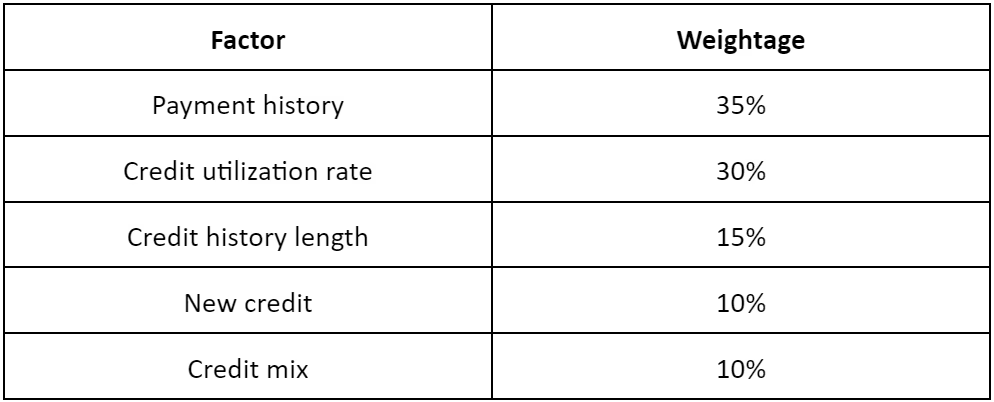

Every credit bureau has its own formula for calculating a credit score. But certain factors are common among all. These factors are:

Why Must You Maintain a Good Credit Score in India?

The current times that we live in, make it imperative for us to make financial health as important as physical and mental health.

Several studies have shown that financial burden triggers psychological strains like anxiety, sleep disorders, and depression in people. In some ways, mental well-being largely depends on one's financial health.

Therefore, you must ensure that you are financially prepared to face any uncertainties and have your family's future secured.

To do this, the first thing you must do is build and maintain a satisfactory credit score.

Not only will it help you easily get a loan, a credit card, or avail EMI facilities with favorable terms, with a high credit score, you can unlock many savings and benefits.

Let's take a look at some aspects that you can unlock with a higher credit score

Significant Savings on Interest Rates for Loans

When you are taking a large number of loans for major purchases like a mortgage, car loan, education loan, etc., even a small dent in interest rate can save you lakhs of rupees.

Having a good CIBIL score can help you secure a loan at the lowest interest rate.

That means you save big bucks!

For instance, if you take a 30-year fixed-rate loan of ₹60 lakh at 7.5% interest, you have to pay ₹1,51,03,033.

But with a good CIBIL score, you can get the same loan at a 6.5% interest rate; you repay ₹1,36,52,669. That means you are saving ₹14,50,364. Now, that's a lot of money!

Credit Card Benefits

Apart from loans, having a good credit score can help you get high-value credit cards with more lucrative rewards.

Furthermore, it means that you can handle your debt and pay your bills in a timely manner.

So, credit card providers and banks are more likely to offer you a higher credit limit.

Quicker Loan Approvals

It is one of the most significant benefits of having a good credit score.

Many money lenders offer pre-approved loans or loans on credit cards to borrowers who have a long and healthy credit history.

Your loan application gets a better chance of getting approved immediately. If you have a good credit score, you are more likely to skip the waiting period.

Adds Value to Your Visa Application

Did you know that your foreign travel may get hampered because of a bad credit score?

Yes, a high credit score adds additional importance to your visa application.

That's not all; countries like the US and UK also consider your income tax records while approving your visa application.

Thus, a high credit score can offer you multiple benefits. That's why you should maintain a healthy credit rating.

How to Boost Your Credit Score Fast

You have understood how important it is to maintain a good credit score.

If you have reached this point, you may be looking for ways to improve it.

But building a good credit score is a prolonged process. Improving a bad score takes years, the good news? It's not impossible. Here's how:

Use 3 Major Credit Cards

Using only one credit card puts an unnecessary burden on your credit summary.

While this is true, many people may suggest you use multiple credit cards to keep your credit score in check. That's a myth.

Using too many credit cards also creates a bad impression on creditors. Therefore, use a maximum of three credit cards from major creditors to maintain a balance.

Minimize Your Credit Utilization Rate

A credit utilization rate is the proportion of a borrower's total available credit against the current debt.

It is instrumental in calculating your credit score. It constitutes 30% of your score. Experts suggest keeping the rate below 10% by splitting your expenses among all three cards.

For instance, suppose you have three credit cards.

Card 1: total outstanding ₹5,000. Used ₹1,000

Card 2: total outstanding ₹10,000. Used ₹2,500

Card 3: total outstanding ₹8,000. Used ₹4,000

Your total credit outstanding in all three cards is ₹5,000 + ₹10,000 + ₹8,000 = ₹23,000

You totally used ₹1,000 + ₹2,500 + ₹4,000 = ₹7,500

Your credit utilization rate is $7,500 / $23,000 = 32.6%

Get a Bigger Credit Limit

A smaller credit limit tends to increase the burden on your credit utilization ratio, which brings down your credit score.

Suppose your total credit limit is ₹25,000 and you have used ₹12,500. Then your credit utilization rate is 50%.

Instead of struggling to reduce that rate, you can simply ask your creditor to increase your credit limit.

For example, if your credit limit doubles to ₹50,000, your credit utilization rate will automatically reduce to 25%. This will have a major impact on your credit score.

Get an Add-On Card from Your Family Member

Do you have any family members whose credit scores are high?

Then get an add-on credit card from them. Thus, their long credit history, on-time payments, and minimum credit utilization ratio can substantially improve your credit score.

Repay Your Debts On-Time

This is the ultimate rule for improving your credit score.

Don't miss your credit card payment due date by even one day.

Remember, your credit history makes up 35% of your credit score. Avoid paying late fees and high-interest rates.

Not only will you save your hard-earned money, but your credit score will also improve drastically if you pay your bills on time.

Apart from your dues, there are various penalties you should steer clear of to avoid being in a debt trap.

Before making any payment, check your credit card statement well. Ensure you are not being overcharged.

Check out this beginner’s guide on avoiding credit card penalties that can help you start your credit journey sans the heavy fees.

Fix Error in Your Credit Report

It's natural to make mistakes. But one small mistake on your credit report can significantly affect your credit score.

So, review your credit report every month diligently.

If you have never missed your payment date and you have found an error in your report, make sure to lodge a complaint. Remember, no mistake is too small to correct.

Repair Your Credit Score

You can get your credit score repaired and rebuilt by a third-party provider.

There are many affordable credit repair organizations available that will boost your credit score.

They can fix the damage you might have done because of faulty financial behavior. Thus, you can easily become eligible to get a loan by improving your credit score.

Good to remember: Credit repairing is a long process. It sometimes takes 4 to 12 months to improve your credit score and become eligible for a loan.

Remember Building A Credit Score Is A Long Process

If you are a new borrower, do not expect a spectacular credit score in the beginning.

When you take a loan or credit card for the first time, you have zero credit history. It takes long usage and patience to build a good credit history.

For multiple years, the credit information bureau monitors whether you are paying your EMIs and bills in a timely manner or not, and whether you have low credit balances.

Upon checking only, you become trustworthy to lenders. Remember, your responsible behavior over time is the most reliable way to build a good credit score from scratch.

It may take you nearly a year to generate an adequate score. But, years of smart credit usage only can help you reach an excellent credit score.

Apart from the above points, there are different types of credits that can also boost your score in a short period of time.

Check this blog to know more about the tricks to increase your credit score.

Key Takeaway

The credit score is a major benchmark for checking your credit eligibility.

It is a crucial deciding factor in your loan or EMI approval. But it's unfortunate that many consumers are not even aware of this until their loan application is rejected.

Therefore, you should be vigilant about checking your credit score every year because it is always a good idea to prevent your credit score from slipping rather than repair it.

You will reap the result of having responsible credit behavior when you apply for a loan, visa, or credit card.