Do you know what your Credit Score is?

No matter what the answer is, it is important for everyone to pay attention to their credit score and credit report.

Why the credit report, you ask? Well, it's not just about whether you can receive a mortgage, credit card, or loan.

It can also affect your mobile phone EMI, monthly vehicle insurance, bank accounts, and other financial transactions.

Unsure about what a decent credit score and credit report is, or how it's calculated? Don't worry, Jar has got you covered.

What is a Credit Score?

A credit score is a three-digit figure that ranges from 300 to 900 in general. The score is based on the information in your credit report, such as your payment history, the amount of debt you owe, and the length of time you've had credit.

Potential lenders and creditors, such as banks, credit card companies, and car dealerships, consider credit scores as one aspect in evaluating whether or not to provide you credit, such as a loan or credit card.

It's one of many factors they use to estimate how likely you are to repay money you've borrowed. They analyse different data, like - how many applications you've made recently, how much you owe, what credit products you've had, and whether or not you've paid them off on time.

Credit bureaus such as Equifax, CIBILTM, ExperianTM, CRIF High MarkTM, and others generate credit scores in India.

Now, as each credit agency uses a different algorithm to calculate credit ratings, the credit scores may differ from each other slightly.

What is a good Credit Score?

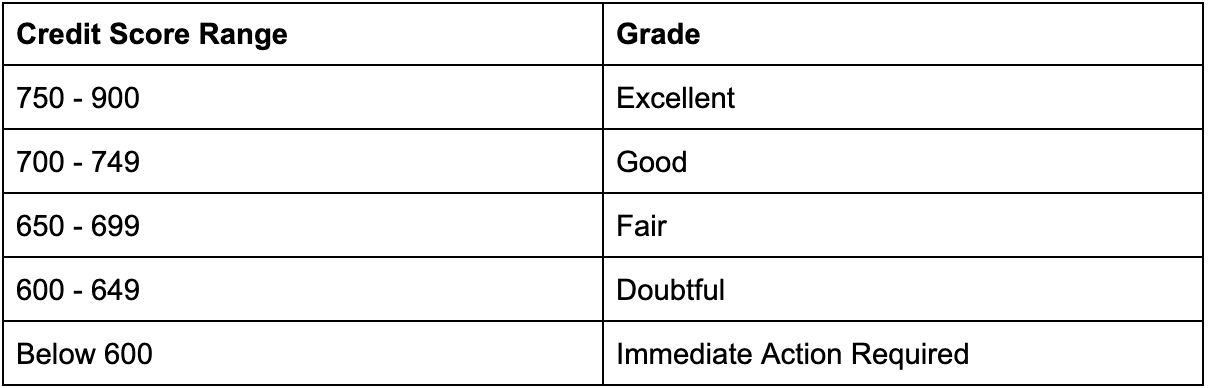

Here's a table for you to understand the Credit Score grading system easily:

Just remember, higher credit scores indicate that you have a history of good credit activity, which may give potential lenders and creditors more confidence when reviewing a credit request.

How to build a good Credit Score?

Here's how you can build a good Credit Score as you start to create – or maintain – responsible credit habits:

- Pay your Bills on Time, Always: Regular and timely repayment of credit card dues and loan EMIs usually receive the most weightage among all the things factored in by credit bureaus when computing the credit score. So pay your loan and credit card balance on time to maintain your Credit Score. If you're experiencing problems paying a bill, get in touch with your lender right away.

- Don't apply for many Loans or Credit Cards in a Short Period of Time: When you apply for a loan or a credit card, the lender gets your credit report from a credit agency in order to assess your creditworthiness. Each lender-initiated credit report is known as a hard enquiry which lowers your credit score by a few points. In easy words, making multiple loan or credit card applications in a short period of time will drastically lower your credit score.

- Review your Credit Report on a Regular Basis: Credit bureaus generally use information provided by lenders and credit card issuers to calculate credit scores. To ensure that your personal information is right and that no account information is incorrect or incomplete, request a free copy of your credit report and review it. Keep an eye on your credit reports on a frequent basis. You can also get your free credit reports and regular updates by going to online financial marketplaces.

- Pay Off your Debts as soon as possible: This is common knowledge. Pay off all your debts. Maintain a credit card balance that is substantially below the credit card limit. Your credit score may be impacted if you have a bigger balance than your credit limit.

What are the Benefits of a Good Credit Score?

Here are some of the key benefits of having a good credit score:

- You get Low Interest Rates on all Types of Loans : Everyone strives for a good credit score so that low-interest loans can be obtained. This can also help you pay off your debts faster and save money. Even a minor reduction in big loans, such as a home loan or a loan against property, can save you a lot of money over time.

- Improves your Loan and Credit Card Approval Chances : When you apply for a loan or a credit card, every lender looks at your credit score and reports first. After a hard enquiry, if the application is denied, the consequence could be detrimental to your credit score. However, if you have a decent credit score, your chances of getting credit are better because lenders will not have a compelling reason to reject your application.

- Increases your Credit Limit: Your salary, when combined with a solid credit score, is a big factor in whether or not you get a loan or a credit card. These can help you obtain a larger loan or a bigger credit limit on your credit cards. By considering these two, lenders will assess your creditworthiness and believe you to be a responsible borrower. If you have a low credit score, you may be able to receive a loan or a credit card, but the interest rates and credit limit will likely be higher.

- Increases your Negotiating Power: When you have a bad credit score, you have a higher chance of acquiring a loan with a higher interest rate. The repayment of these loans may become difficult in the future. You will also have little negotiation power when it comes to requesting a lower interest rate.

On the other hand, if you have an excellent credit score, you will have a better chance of getting approved for loans and credit cards. You will also be able to negotiate cheaper interest rates with lenders by comparing offers from different lenders.

How To Know Your Credit Score?

It's simple to find your credit score. You can get a free credit report from each of the four credit bureaus once a year - with a quick and easy process that may be completed online.

Enter your basic information and your identity information such as your PAN card, voter identification number and Aadhaar card, among other things. There you have it - Your Credit Report with the Credit Score. It will also reveal your previous credit history, as well as any debts you have taken out and paid back.

A credit score serves as a benchmark for your credit usage as well as a crucial deciding element for lenders when assessing you. Many folks aren't aware of it until their loan is turned down.

So it's better to maintain it rather than getting disappointed while buying your new car or a house. Take the first step towards improving your credit score and develop healthy credit practises. See your credit score gradually increasing.