In this modern world, there are various benefits of credit cards, and it has made our lives easy, allowing us to make purchases conveniently and reducing our reliance on cash.

Student credit cards, as the name suggests, are designed specifically for the needs of students generally of 18 years of age, they often have lower interest rates and lower annual fees than regular credit cards.

By introducing these to young adults we provide them a platform to learn how to manage finances responsibly. Understand various aspects such as budgeting, tracking expenses, and building a strong credit history.

In this article, we will dive deep into various options for students' credit cards in India, their features, benefits, and eligibility for their application, and how to apply for a student credit card.

We will also discuss the state government credit cards available, such as WBSCC and BSCC, and clear any confusion regarding their application process, eligibility, and features.

How can a Student get a Credit Card in India?

The process to get a credit card as a student is fairly simple as most of the process takes place online. Here are the steps to apply for a student credit card online –

- Visit the website and go to the credit card section.

- Check your eligibility for the student credit card.

- Fill the student's application form online for credit cards.

- Upload the supporting documents on the portal.

But with multiple banks offering student credit cards without requiring applicants to produce work documents or tax returns, there must be some confusion about how a student might apply for credit.

Here’s how to get a student credit card in your name:

1. Against security, such as a fixed deposit.

Because you are a student, the card company does not expect you to have a steady source of income.

If you have a Fixed Deposit in your name, you can apply for a Credit Card using this FD account.

You may be qualified for a secured Credit Card against Fixed Deposit if you are a student with no income or credit history, or if you work part-time or volunteer for non-profit organizations.

2. Using money from their savings.

You can simply get a student credit card based on your savings account if you have one.

To get a Student Credit Card, you don't need to keep track of your monthly income. The decision is purely dependent on your bank relationship.

If you have been a valued customer of the bank, the bank will conduct a background check and approve the request.

3. As an add-on card to their parents' current credit card.

You can get a student credit card by requesting an Add-On Credit Card from a family member who already has one.

The family member who is requesting an Add-On Card should have a strong credit history, which is a significant consideration.

Best Credit Cards for Students in India in 2023

There are a lot of options available when it comes to student credit cards in India. Each comes with its own unique benefits and features.

Here we will talk about some commonly used students credit cards so that it gets easy for you to choose which one best suits your needs:-

1. SBI Student Plus Advantage Card

The SBI Student Plus Advantage card has a slew of student-friendly features.

Although this card is only available to those who have an SBI educational loan, you can also receive one by creating a fixed deposit at any SBI branch.

You can also transfer debt from another credit card to your SBI student credit card to reduce your EMI interest rate.

You will be able to save money while paying off your credit card debt.

You may also book train tickets, pay your energy bills, and earn 10 times more reward points when you transact internationally.

The following are some of the card's unique features:

- No annual charge.

- Purchases made in departmental or grocery stores will receive a 2.5% value back.

- In India, all petrol pumps are exempt from a 2.5% fuel fee.

- For every ₹100 spent on the card, you will receive 1 reward point.

- Allows cardholders to convert large purchases into manageable EMI.

- Annual Fee Waiver: Encourages responsible spending by waiving the annual fee of Rs. 500 if the cardholder spends more than Rs. 35,000 in the previous year.

2. HDFC Student Add-on Card

The HDFC Student add-on card looks and functions similarly to a credit card, and it is issued to anyone over the age of 18.

The card's expenses are reflected in the parent card's monthly statement, allowing parents to keep track of their children's spending.

Transaction reminders may also be sent to help you keep track of your spending.

Add-on cards do not require a lot of paperwork, and the application process is simple.

Add-on cards can be used to make purchases both online and offline.

Unique features of HDFC Student add-on card:

- The parent card's monthly statement includes expenses from an add-on card. As a result, parents can keep track of their children's expenditures. You can also set up transactional alerts to keep track of your spending.

- To keep spending under control, you can set a sub-limit for the add-on card.

- Both online and offline purchases are possible with add-on cards.

3. Axis Bank Insta Easy Credit Card

Any Axis Bank branch can issue this credit card in exchange for a fixed deposit. Cash withdrawals of up to 100% of your credit limit are possible.

This card can be issued with a credit limit of up to 80% of the principal amount of the fixed deposit.

These are some of the card's unique features:

- gives discounts of up to 15% off meals at alliance restaurants.

- In India, all fuel transactions are subject to a 1% fuel surcharge waiver.

- secured with a platinum chip card.

4. ICICI Bank Student Travel Card

For students who desire to study abroad, the ICICI Bank student travel card is a fantastic option.

You can pay for your application and course costs with this credit card either online or in person.

The credit card allows you to keep track of your daily expenses and can be used at any Mastercard-accepting location worldwide.

This three-year card is available in five different currencies. It offers both travel insurance and aid in an emergency.

The five currencies that can be loaded onto a card are USD, EUR, GBP, AUD, and CAD. It can be used for both online and offline purchases anywhere in the world.

The joining price is ₹150, the reload fee is ₹100, and there is a cross-currency charge of 3.5%+ GST.

You may also be qualified for an international student identity card (ISIC) membership, which grants you discounts in 130 countries and at over 1,26,000 retailer locations.

The following are some of the card's most notable features:

- Can be used for payments towards cab rentals, air bookings, accommodation, and recharge on international prepaid mobile.

- Allows easy online account management.

- Access to 24x7 customer care via international toll-free numbers across 16 countries.

5. HDFC Bank’s ISIC Student ForexPlus Card

HDFC's ForexPlus card, which provides you access to different currencies, is another excellent alternative for students studying abroad.

The transaction amount is charged immediately from the HDFC student ForexPlus card, similar to a credit card.

The card is accepted internationally at all Mastercard and Visa-affiliated merchants.

One of the most appealing aspects of this card is that it is unaffected by market rate fluctuations when you make a purchase.

The following are some of the card's key features:

- They work similarly to credit cards and offer their holders an ISIC membership.

- Reload it instantly anywhere or ask someone else to do it for you from any part of the world.

- Other credit cards benefits such as free insurance coverage, chip-based security, emergency cash, and discounts on food, books, and accommodation in 130 countries.

6. HDFC Multi-Currency Platinum ForexPlus Chip Card

This HDFC credit card is embedded with PayWave technology, allowing students to make contactless purchases in stores.

Students may save money and time by having 23 foreign currencies on the HDFC Multi-currency Platinum ForexPlus Chip Card, which can contain up to 22 different currencies.

Secure online wallets can be used to transfer funds. Furthermore, this card provides security against fluctuations in foreign exchange rates, which could cause the value of your currency to rise or fall.

Overall, this card is ideal for students who need to travel to multiple destinations and need to carry multiple currencies on one card.

Some of the card's unique features include:

- In case of card loss or malfunction, cash can be delivered worldwide through international toll-free numbers, HDFC Bank PhoneBanking services are accessible through international toll-free numbers across 32 countries.

- Protection up to ₹5 lahks is provided against any kind of theft or misuse of the card.

- Special discounts are offered to students to help them make extra savings.

- Complete protection against fluctuating forex rates.

Student Credit Cards by States

West Bengal Students Credit Card

West Bengal Student Credit Card (WBSCC) is an initiative launched by the Higher Education Department, Government of West Bengal which will allow students to pursue their education without any financial restrictions.

The scheme covers secondary, higher secondary, madrasah, undergraduate, postgraduate, professional degrees, and other equivalent courses, as well as coaching for competitive exams like Engineering, Medical, Law, IAS, IPS, WBCS, etc.

Benefits & Features -

- Students can use the loan to pursue their education at schools, madrasahs, colleges, universities, and affiliated institutes within and outside India.

- A maximum loan amount of Rs. 10 lakhs is available to eligible students, providing substantial financial support for their academic pursuits.

- The loan carries a 4% per annum simple interest rate, making it affordable for students and their families.

- Borrowers who fully service the interest during the study period will receive a 1% interest concession.

- The upper age limit for applicants is 40 years, allowing more individuals to benefit from the scheme.

Bihar State Student Credit Card

The Bihar Student Credit Card (BSCC) scheme, introduced under the Mukhyamantri Nischay Swayam Sahayata Bhatta Yojana (MNSSBY), offers financial support to students in Bihar for higher education.

The scheme aims to increase the Gross Enrolment Ratio from 14.3% (as of August 2018) to 30% within five years.

Benefits & Features -

Maximum loan amount of ₹4 Lakhs.

- Eligible for students pursuing technical, polytechnic, and general courses.

- Monetary assistance for fees, books, laptops, and other educational expenses.

- The preferential interest rate of 1% for girls, transgender students, and students with disabilities.

- Repayment commences after course completion and securing a job.

- Government-backed scheme with a flexible recovery process and potential loan waiver in extreme cases.

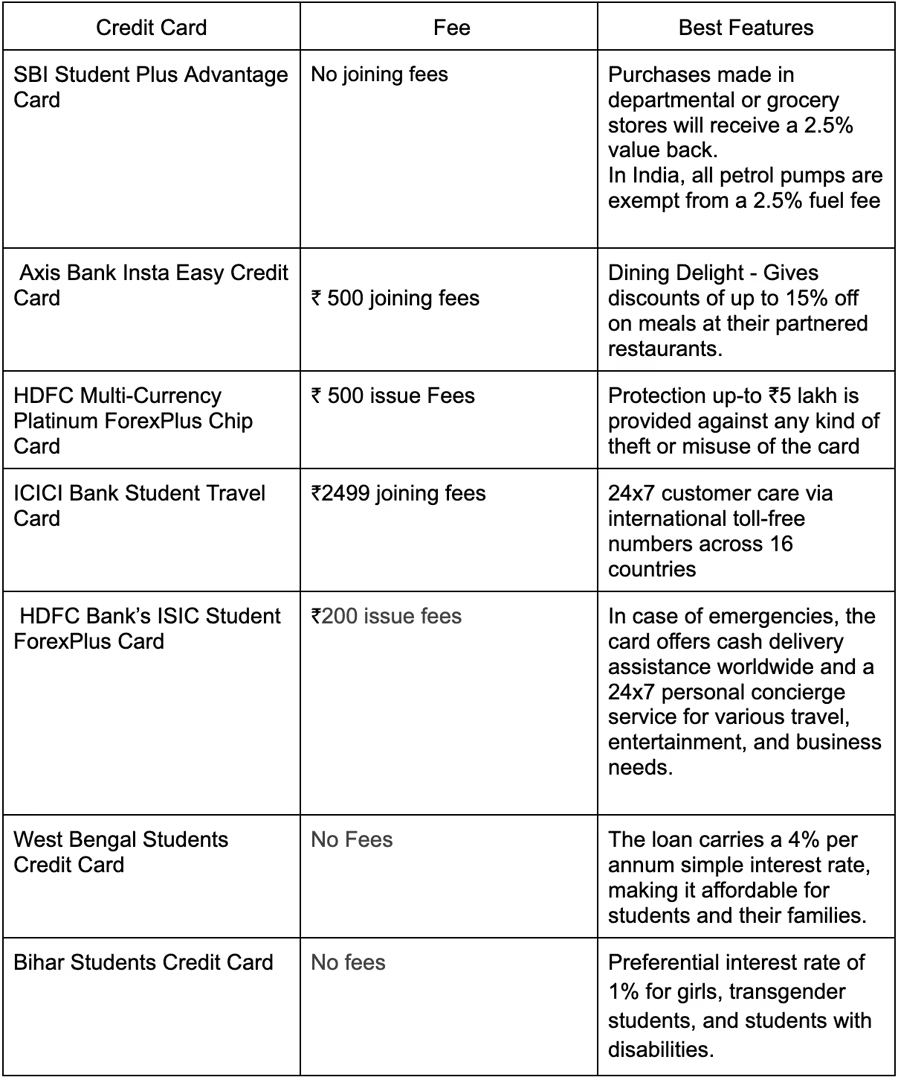

Fees and Features for Commonly Used Student Credit Cards

Application Portal for Common Student Credit Cards in India

Here are the application portals for some commonly used student credit cards in India :-

- HDFC Student Add-on Card - https://applyonline.hdfcbank.com/credit-cards/pre-approved-credit-cards

- SBI Student Plus Advantage Card - https://onlineapply.sbi.co.in/personal-banking/credit-card

- Axis Bank Insta Easy Credit Card - https://clctab.axisbank.co.in/DigitalChannel/WebForm/

- ICICI Bank Student Travel Card - https://loan.icicibank.com/asset-portal-all/checkEligibility

- HDFC Bank’s ISIC Student ForexPlus Card - https://getprepaidcard.hdfcbank.com/Foreign-Exchange-Details/ISIC-ForexPlus-Chip-Card

- HDFC Multi-Currency Platinum ForexPlus Chip Card - https://www.hdfcbank.com/personal/pay/cards/forex-cards/multicurrency-platinum-forexplus-chip-card

- West Bengal Students Credit Card (WBSCC) - https://wbscc.wb.gov.in/Applicant_Login

- Bihar State Credit Card - https://www.7nishchay-yuvaupmission.bihar.gov.in/addFtrUserPage

FAQs about Student Credit Cards

Q) Can I get credit card as a student?

Answer - Yes you can get a credit card as a student. Companies offer student credit cards designed especially for the need of students. If you are 18 years old or above and ready to go to college you can easily apply for a student credit card.

They provide various benefits such as lower credit limits, cash back offers. However, some companies offer student credit cards to high school students of 15 years of age as well

Q) Is student credit card good or bad?

Answer - Student credit cards are a good way to teach your kids how to be financially responsible. They come in handy especially when they are away for studies in a different country or city. Student/these credit cards come with various benefits and features such as low-interest rates, cashback offers, and travel benefits

Q) Can I get a student credit card with no income?

Answer - Yes you can get a student credit card with no income, different credit card companies have different requirements but against a fixed deposit or as an add-on credit card against your parent's income or against a savings account.

However, you should check the requirements for your variant since the eligibility may vary depending on the card’s variant.

Q) What are the documents that are needed to apply for a student credit card in India?

Answer - To apply for a student credit card in India, you typically need the following documents:

- identity proof (Aadhaar card, passport, etc.)

- address proof (utility bill, rental agreement, etc.)

- age proof (Aadhaar card, birth certificate, etc.)

- income proof (salary slips, bank statements, etc.)

PAN card and proof of enrollment in an educational institution. However, these requirements may vary and you need to check the documents required for your credit card variant.