What is the West Bengal Student Credit Card?

There are various benefits of having a student credit card. Responsible credit card usage can help students build a positive credit history, which is essential for their financial future

If you are a student looking for a credit card and you are residing in West Bengal, India, then the recently introduced scheme of the West Bengal student credit card can be the best one for you.

The West Bengal Student Credit Card (WBSCC) is an initiative introduced by the Higher Education Department of the Government of West Bengal which aims to provide financial assistance to the poor and needy who desire to pursue secondary, undergraduate and postgraduate education in any college, school, madrasah, university or any other institution in India or outside. The Government of Bihar has also launched a similar scheme as BSCC

The appropriate beneficiaries of this scheme can get funding for education in the fields of Medicine, Engineering, Law, IAS, IPS and many other fields.

Features of the WBSCC

The benefits of credit card can be explored once you clear all eligibilities. If the terms and conditions are fulfilled, a student, with the help of his/her West Bengal student credit card, can avail of the following features -

- A student/borrower can receive a maximum loan amount of Rs. 10 Lakhs.

- The simple interest rates will be 4% p.a to be offered by the State Cooperative Banks. Furthermore, any affiliated Central Cooperative Bank, District Central Cooperative Bank and public sector or private sector bank which is operating within the State of West Bengal are obligated to provide the loan at the specified rate.

- For a female student residing in West Bengal, a concession at the rate of 0.5% p.a. shall be provided.

- The loan amount shall be provided without any collateral security. Moreover, no third-party guarantee is required. This facility makes it easier for people to obtain this loan.

- The loan amount has to be repaid within 15 years.

- If the borrower is successful in paying the entire interest rate within the study period, then he or she is eligible to receive a 1% concession on the specified interest rate.

Eligibility for the WBSCC

To receive the benefits under the West Bengal student credit card scheme, a person must satisfy the following eligibility criteria.

- The beneficiary of the West Bengal student credit card scheme must be an Indian citizen, a student and most importantly a resident of the State of West Bengal who has been residing in West Bengal for the last 10 years.

- The student applying for the West Bengal student credit card scheme must be less than 40 years of age.

- There must be a co-applicant or a co-borrower which is usually the parent or the natural guardian of the student.

- The borrower or the beneficiary of the West Bengal student credit card scheme must pursue education in any college, school, madrasah, university or any other institutions like IITs, IIMs, IISc, IIESTs, ISIs, NLUs, AIIMSs, NITs, XLRI, BITS, SPA, NID, IIFTs, ICFAI Business School etc.

- The borrower can further avail of the scheme if they wish to study in institutions which coach students in competitive examinations in the fields of engineering, medical, law and others.

What is the Interest Rate of a WBSCC loan?

The interest rate of the WBSCC loan is 4% p.a for all students pursuing education from the specified institutions.

Female students residing in West Bengal shall receive a rate concession of 0.5% per year.

A borrower can receive a 1% concession on the specified interest rate if he or she successfully pays the entire interest rate within the study period.

Documents Required for to Apply for West Bengal Student Credit Card

If you want to take advantage of the fantastic WBSCC loan scheme, keep the documents mentioned below ready-

- Photograph of the applicant and co-applicant

To get benefits from the loan, it is necessary for the applicant or the student to submit their recent coloured photograph.

Photographs shall be used for identification purposes and therefore, the photograph must be of high quality and should be an accurate representation of the borrower.

The co-applicant needs to submit their photograph as well.

Please note that the coloured photograph should be in .joeg/.jpg format, and it should not be more than 50 KB

- Authorized document from the institution

The student must submit the official authorized document that they have received from their respective institution, which includes the admission receipt, the extensive details of the course that they are pursuing, the tuition fees and the other necessary costs required for the completion of the course.

This document is necessary in order to calculate the required loan amount. All the aforementioned documents must be in PDF format.

- Income Certificate

It is necessary to submit the income certificate in order to assess the financial capacity of the student.

- Aadhaar Card

It is mandatory for the applicant and the co-applicant to submit a copy of their Aadhar card in PDF format.

If the student has not applied for an Aadhar card yet, they must submit the registration certificate of their Class 10th Board in PDF format.

For further clarifications, you can visit the official user manual released by the West Bengal Government.

How do I register with WBSCC?

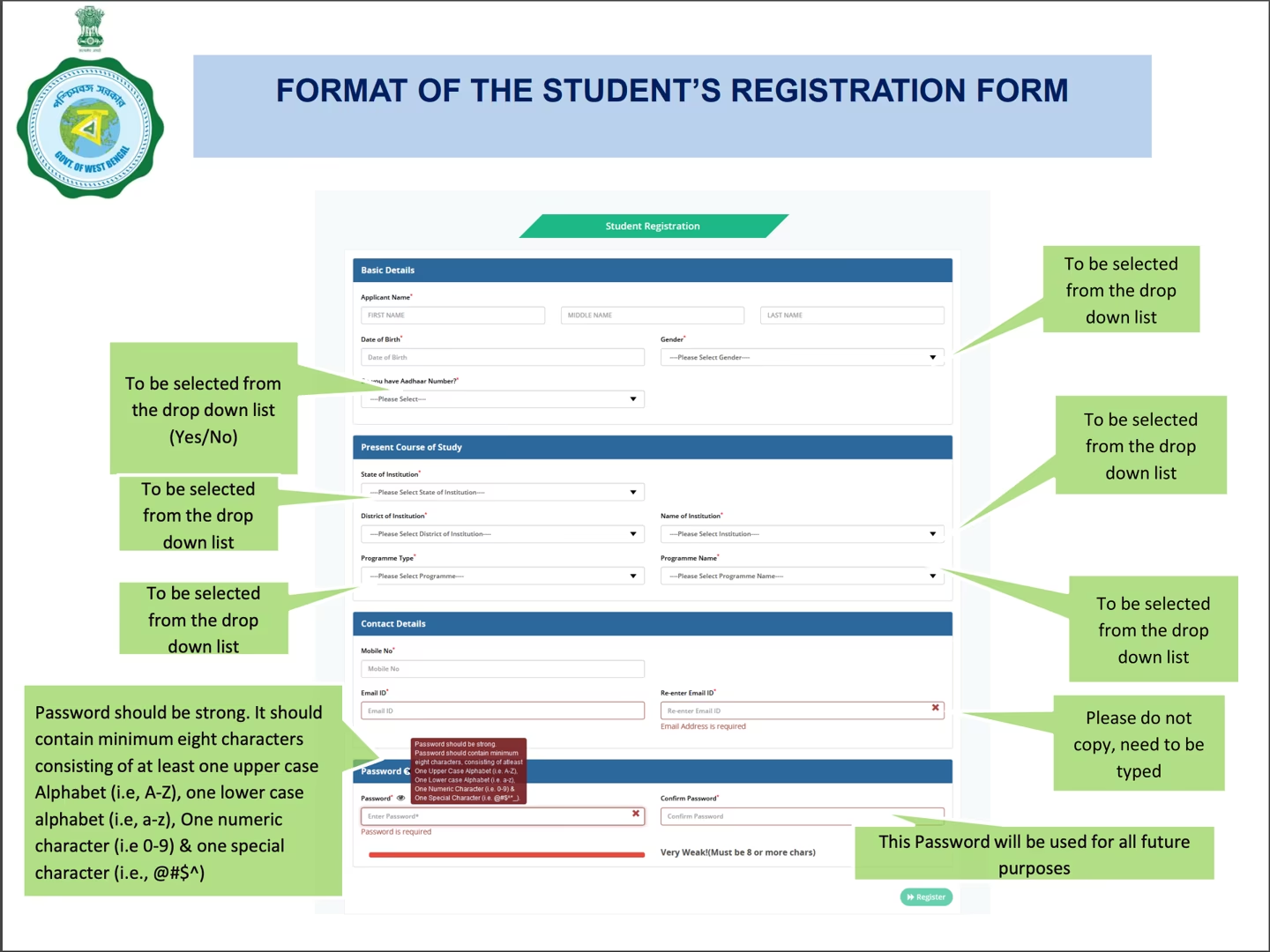

Registration for the West Bengal Student Credit Card Scheme (WBSCC) is very easy. Follow the procedure to get registered under the scheme.

- Step 1

For registration purposes, visit https://wbscc.wb.gov.in/. Click on student registration. Choose whether you are studying in an institution in India or outside India.

- Step 2

Next, you shall see the registration form. Fill up the form with your basic details. You need to enter the details of your institution as well. It is suggested to create a strong password in order to ensure safety.

- Step 3

Click on the “Register” button to complete the registration procedure.

- Step 4

Submit the OTP sent to your registered mobile number.

Once you have submitted the OTP, your registration procedure for the West Bengal Student Credit Card is complete. You shall receive a unique ID for your student credit card account. Please note that all the necessary communications with regard to your student credit card account should be regulated with this ID.

How Do I Apply for WBSCC?

You can apply for the education law in a simple way.

- Step 1

Visit https://wbscc.wb.gov.in/ and click on “student login”.

- Step 2

Enter your registration number and password.

- Step 3

You shall be taken to the dashboard. To apply for the loan, click on “Apply for loan”

- Step 4

Put all your personal details and the details of the co-applicant. You need to add your permanent address, quotes and income details. Furthermore, add your bank details and the bank details of the co-borrower. Fill up your program details carefully. You need to enter your Aadhar details as well. If you do not have any other, you need to submit an undertaking.

- Step 5

Upload a scanned copy of your Aadhar. It is mandatory to upload the latest coloured photograph of the student and the co-applicant as well. Moreover, you need to upload a scanned copy of your signature too. If you do have an Aadhaar card, upload your Class 10th Board registration certificate.

- Step 6

Once you fill in all the compulsory details, cross-check them and click on “save and continue”.

- Step 7

Once you click on “save and continue”, a gist of your application will be visible. Proofread it and submit your application.

- Step 8

You shall see a pop- up menu which specifies that the student cannot opt for modification of application if they submit their application. If you are satisfied with all the required data, click on “yes” very cautiously.

- Step 9

Your application form for the West Bengal Student Credit Card (WBSCC) has been submitted. You can visit your dashboard Where you can see the statement “application submitted to HOI”

- Step 10

Keep observing the status of your application. In case your application is returned by the concerned institution in case of any discrepancy, the application shall be returned to you. The option to edit is now open where you need to edit properly and resubmit it.

- Step 11

When approved by the HOI, the application shall be forwarded to the HED of the concerned institution.

- Step 12

When the application is approved by the age ET of the institution, it shall be forwarded to the concerned bank.

Thats it! Now your application is successfully forwarded to the bank. After that, you have to follow all the instructions to be provided by your respective bank for the successful disbursement of the loan amount.

How To Tack the West Bengal Student Credit Card Application Status?

Follow these steps to track your application status:

1. Step 1

Visit the Official Website: Go to https://wbscc.wb.gov.in/.

2. Step 2

Log in to Your Account:Enter your registration number and password in the student login section.

3. Step 3

Enter Captcha:Fill in the captcha code displayed on the screen.

4. Step 4

Track Application: Click on the “Track Application” option to view the current status of your application.

5. Step 5

Address Discrepancies: If the bank finds any issues, the application will be returned to you. You can correct and resubmit it using the 'Edit Loan Application' option.

Contact Details

You can reach the WBSCC officials by email or hotline number if you need support or have any issues. Here are the specifics:

- Helpline Number: 18001028014

- Email ID: contactwbscc@gmail.com

- Support: wbscc@bangla.gov.in

FAQs about WBSCC

Q) Does WBSCC have a helpdesk?

Answer: Yes, the West Bengal Student Credit Card (WBSCC) has a helpdesk facility for all the students. The students may contact the State Help Desk (Toll-free no. 18001028014, Support mail ID: supportwbscc@bangla.gov.in )

Q) Do I need to submit a No Objection Certificate from my college?

Answer: No, a No Objection Certificate is not necessary for the WBSCC scheme.

Q) Is student credit card good in West Bengal?

Answer: Yes. The West Bengal Student Credit Card (WBSCC) scheme is good and active in the State of West Bengal.

The WBSCC has a grievance cell as well to address the issues and concerns of the applicants. The students who are resident of West Bengal but wishes to pursue education outside India can also apply for this scheme. However, students pursuing a course in distance mode are not eligible for this scheme.