Tax season. It is one of the most stressful seasons for every individual and organization. It's the time when you have to spend your days examining the Income Tax slabs in India to find ways to reduce your tax burden.

It's the time when you have to spend your days examining the tax slabs in India to find ways to reduce your tax burden.

And why not? No one wants to cough up their hard-earned money as taxes. So what do we do? We invest in various schemes; we hunt for charitable organisations that offer tax relief for giving donations; we take huge loans just to save a few thousand rupees from paying tax.

Yes, we are talking about the Income tax year.

But did you know income tax is the central government's primary source of income? This is used to create infrastructure, offer subsidies, provide education, and improve healthcare. So, the next time you contemplate avenues to save taxes, think about how much your small contribution can help this country flourish!

What is Income Tax?

As we mentioned before, tax is a major source of income for the government. It is a fee that the government levies on its citizens to leverage and enjoy all the resources the country has to offer. Among the different types of taxes, there are majorly two types: direct and indirect tax.

Income tax is one of the two direct taxes that the central government charges based on the income every individual and organization earns during a financial year. It is decided based on the various tax slabs defined by the Income Tax Department.

Every year, the government tweaks income tax rules to provide relief and offer better services to its citizens. So what are these changes, and why should you be aware of income tax changes? Keep reading to know more.

Why Should You Be Aware of Income Tax Changes?

Many taxpayers in India are unaware of Tax slabs In India. So, they come to pay more than they owe. The Income Tax keeps changing every year. It's important to understand the tax rules and the Income Tax changes. By keeping updated about developments in Income Tax rates and regulations, you will be able to:

- Correctly compute the right amount of tax you owe

- Identify the proper avenues of availing deductions

- Pay tax in advance

- File income tax returns promptly

- Declare your investments

Income Tax Slab For AY 2022-23

In India, Income tax is progressive in nature. It means your tax increases with salary increments. The income tax rates and slabs keep changing every year. Therefore, it is important to stay informed about the new development.

Currently, the central government of India offers two tax regimes: Old Tax Regime and the New Tax Regime.

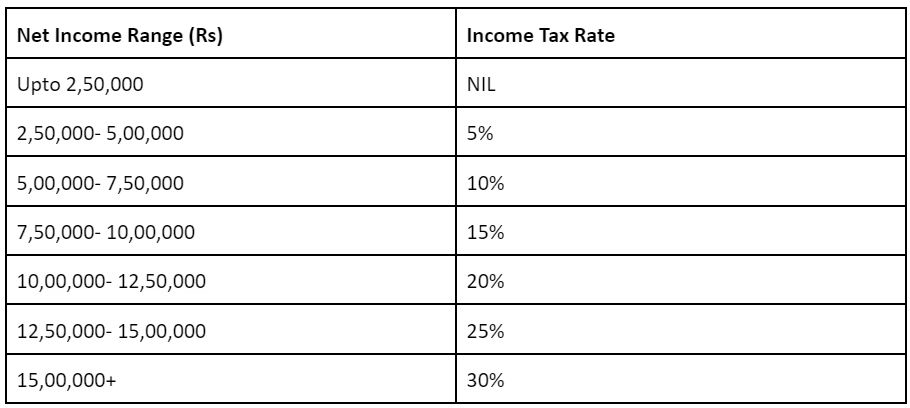

The income tax rate for Individuals for AY 2022-23 (Applicable For New Tax Slab)

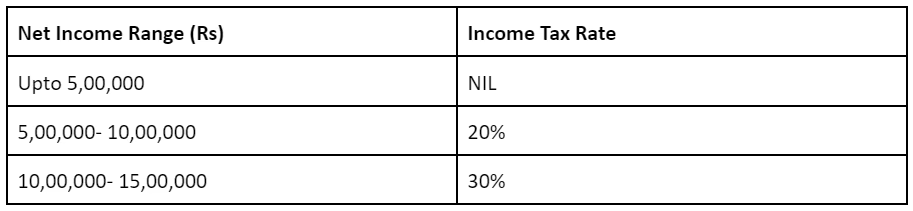

Income tax rate for Individuals for AY 2022-23 (Applicable For Old Tax Slab)

New Changes In Income Tax For FY 22-23

Like every year, this year too, finance minister Nirmala Sitharaman has made multiple amendments to the income tax rules for the financial year 2022-23. If your earnings are more than the minimum taxable income, you are subjected to paying taxes. However, this year we have seen multiple extraordinary changes in the Tax rules. Let's understand them better:

Pay Tax On Digital Assets

In a revolutionary decision, the central government has decided to levy a tax on virtual digital assets like cryptocurrency and NFTs for the first time in India. Since the advent of cryptocurrency, it has emerged as one of the most lucrative investment options due to its high returns.

- Now income from cryptocurrency will be taxed at a flat 30% from April 1 onwards.

- According to the proposed Section 115 BBH of the Income-Tax Act, 1961, a loss acquired from transferring a virtual digital asset won't be allowed to be set off from another type of virtual digital asset income.

- Meanwhile, 1% TDS will be deducted at source under section 194S for every Crypto transaction from July 1 2022.

- The Finance Minister also declared that the TDS would be deducted on redemption, whether the investor makes a profit or loss.

Save More Taxes With NPS

In the financial year 2022-23, State Government employees will be able to claim tax relief of up to 14% of their basic salary and dearness allowance with the National Pension Scheme.

Until now, this facility was only allowed for Central Government employees. Where State Government and Private sector employees can claim only 10% through the NPS, but if you are a private sector employee, the rule remains unchanged.

Enjoy Tax Relief On Covid-19 Treatment Expenses

In the last two years, covid-19 has devastated the entire country. To offer some financial relief to the affected families, the Central Government of India has announced that if an individual is receiving expenses for covid-19 treatment from the employer, then income tax in India will not be charged.

Suppose any deceased covid-19 affected individual's family receives an ex-gratia payment of up to ₹10 lakh from the employer within 1 year from the date of death. In that case, it will also be exempted from the income tax.

Income Tax Relief For The Differently-Abled

If a parent or guardian of a differently-abled person takes insurance for the latter, it will be exempted from tax under certain conditions.

Tax on Provident Fund Income

The government has decided to levy income tax on the interest earned on over Rs 2.5 lakh from the Employees' Provident Fund account from April 1.

The tax relief bucket for government employees is Rs 5 lakh.

As per the new norms, from April 2022, once the interest for FY22 gets credited, the EPF account statement will reflect two sections – one for the taxable income and the other for the non-taxable income.

Pay Tax on Capital Gains From ULIPs

To the dismay of ULIP policyholders, the central government will charge income tax on capital gains from now on. If the long-term gain exceeds Rs 1 Lakh a year, it will be subject to 10% tax. On the other hand, short-term gains on ULIPs with high premium amounts will also be subject to 15% income tax.

Major Updates on Income Tax Facilities

This news is especially a happy one for those who struggle to understand Income tax return rules. In the 2022 Budget, the finance minister Nirmala Sitharaman announced that from now on, taxpayers could file an updated income tax return within two years of the assessment year. This facility is applicable only to those who have missed out on declaring and filing returns for certain incomes.

For example, if you have forgotten to disclose income from foreign, earned interest from your savings bank account, or equity investment income, you can now file those by updating your income tax return. But you can do it for the gains earned within two years of the assessment year.

But it comes with a cost. The individual has to pay additional tax, more than the regular tax and a penalty. If you apply for an updated income tax return within a year of the end of the assessment year, you are subjected to a 25% tax.

And if you file an updated return after 1 to 2 years from the end of the assessment year, you have to pay 50% income tax. This additional tax will include a cess and a surcharge on the base tax.

Final Thoughts

Back in 2020, while launching a platform for 'Transparent Taxation', Prime Minister Narendra Modi commented that India is a nation with 130 crore citizens but only 1.5 crore people pay income tax routinely. But lack of tax payment and tax stealing have negatively affected the nation's Gross Domestic Product (GDP) immensely.

As we know, income tax is India's primary source of income that is used for various socio-economic development. Stay updated about the changes in income tax rules, and pay on time to stay on the right side of the law. So, be a responsible Indian. Pay your taxes on time and play an active part in the nation's development.