Buying a home or a car is almost everyone's dream. Although these dreams are expensive, managing a good credit score can make them come true quickly through loans and EMIs

But wait a second. Are you paying almost an equal amount of money as interest? How do these happen?

But before you start questioning yourself, 'is it even worth investing in such expensive dreams!' let us tell you the answer that may be hidden in your credit score.

Yes, you've heard it right. But how do you even determine if your credit score is good or bad? Keep reading; we'll explain in a jiffy.

What is Credit Score?

In simple words, a credit score is a three-digit number that measures a person's ability to pay back borrowed money. It shows a money lender your creditworthiness. Credit score ranges from 300-900.

Your credit score directly impacts your financial health. The higher you are on this scale, the better your credit score is. Alternatively, you are in deep waters if your score dips below 750.

If you have a low credit score, you may not get approved for loans, be unqualified for many lucrative credit card benefits, or may have to pay higher interest if you manage to get credit.

In short, the state of your credit score can impact your short-term and long-term fiscal goals and even your financial future.

Highlight: Most money lending companies or individuals recognize 850 as a good credit score. However, the minimum requirement for availing loan, EMI, or credit card is 750. Anything below 750 gets automatically rejected.

How Credit Score is Calculated?

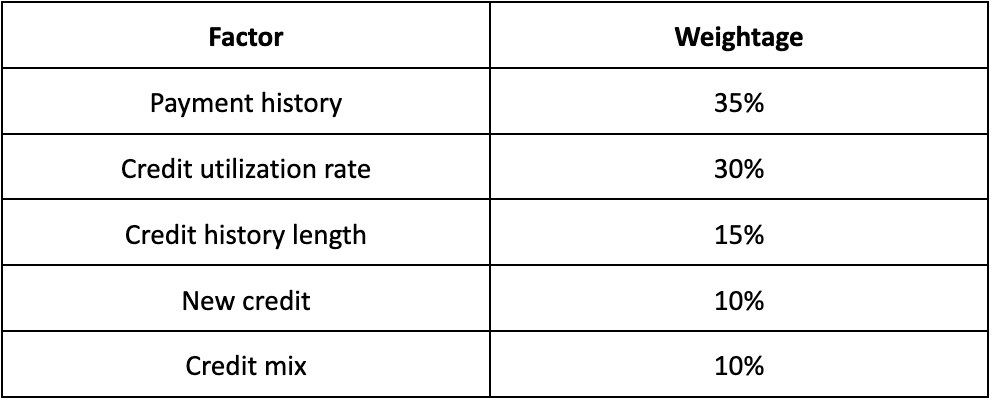

The credit score is calculated based on your credit history, credit score report, and rating. Every credit bureau follows a different formula to calculate the credit score. However, some factors are common among them all. These are:

What Affects Your Credit Score?

Multiple factors affect an individual's credit score. But two factors have the biggest influence:

- Payment history - It is the most important factor that affects your credit score. Your payment history shows how disciplined you are when paying your dues every month. It also shows how regular you are while making these loan payments.

- Credit utilization ratio - In simple terms, the credit utilization ratio is how much of your credit limit you are using. It is one of the two major factors that are checked while calculating your credit score.

As you can see from the table above, the credit utilization ratio constitutes 30% of your credit score. The lesser this ratio, the better is your score.

According to financial experts, keep your credit utilization ratio below 10% by splitting your expenses into up to three cards. Read how you can calculate your credit utilization ratio at home easily.

Other Important Factors That Affect Your Credit Score

- Money owed - Maxing out on credit cards or having multiple high debts for months negatively impacts credit score immensely.

- Length of credit history - Credit history makes up 15% of your credit score. The length of your credit history shows a lender that you can handle a loan and pay religiously. So, the longer the credit history, the higher your credit score.

- Credit mix - As the name suggests, credit mix shows what type of credit you have. It can be a credit card, home/car loan, student loan, etc. In short, your credit score remains healthy if you have a healthy mix of revolving credit and installment credit.

Type of credit example:

- Credit cards (Revolving credit)

- Credit on house equity (Revolving credit)

- Education loan (Installment credit)

- Car/bike loan (Installment credit)

- Mortgage/home loan (Installment credit)

- Personal loan (Installment credit)

Why Having Good Credit Matters?

Worried about your bad credit score? A healthy credit score can help you be eligible for and approve loans faster, avail a lower interest rate, and easily qualify for high-value credit cards. With responsible credit habits, you can boost your credit score easily.

- Attractive credit card benefits - A good credit score can help you get credit cards with lucrative rewards, discounts, Airmiles, and even exclusive access to many venues. Paying your dues in full every month on time shows your healthy credit management habits. So, credit card providers and banks feel secure offering you a larger credit limit.

- Quick loan approval - A good credit score can smoothen your road to avail quick and hassle-free loans. Furthermore, banks approve loan applications quickly for individuals with a healthy credit history.

- Better interest rate - If your credit score is good, it gives you immunity to bargain for a lower interest rate on loans and credit cards. A small drop in the interest rate can save you lakhs of rupees, if not crores. It is especially helpful if you are applying for a loan of a large amount of money.

For instance, If you are applying for a 30-year loan worth ₹60 Lakh at 7.5% interest, you have to pay back over ₹1 crore 51 lakh.

But with a good credit score, if you can get the same loan at a 6.5% interest rate, you'll have to repay over ₹1 crore 36 lakh.

That means, just by reducing 1% interest, you can save over ₹14 lakh 50 thousand. Don't you think that's a lot of money!

How To Improve Your Bad Credit History

Rebuilding a credit score from a bad past is hard. It may take years. But, with good credit management skills, you can build your credit score anew. Here's how you do it:

Pay Your Bills in A Timely Manner

This is the golden rule for improving your credit score. Avoid missing your credit card payment due date.

Thus, you won't have to be burdened with late fees and high-interest rates.

Even if you are in the middle of a financial crisis, do not put off loan repayment. It will only make your situation worse.

If you are incapable of paying a high-interest rate, contact your credit card issuer and arrange a payment plan that suits you.

From them, maintain responsible credit management habits.

To know interesting hacks to ward off paying penalties, don't miss our beginner's guide on avoiding credit card penalties.

Find Errors in Your Credit Report & Fix Them

No mistake is too small to fix. It is much more applicable for errors made in your credit report. A small mistake in your credit report can dip your credit score immensely.

So, review your credit report every month diligently. In case you have found an error, lodge a complaint and get it rectified immediately.

Get Secured or Rebuilding Credit Cards

Many banks and credit card companies offer specialized credit cards for people with poor credit scores. These credit cards help in credit rebuilding.

These secured or rebuilding cards are issued against collateral like bank fixed deposits.

If the borrower fails to pay their bill for 90 days and more, the lender has the right to recover the borrowed money from the fixed deposit.

Repair Your Credit Score

If you do not have time to wait for 7-8 years to improve your credit score, this hack can help you do it in 8-12 months.

Credit repair companies are third parties that can help you boost your credit score for a fee.

This way, you can quickly become eligible to get a loan or all other benefits by improving your credit score.

This comes in handy, especially when you need to invest in something major and cannot wait many years to become eligible for a loan.

Key Takeaway

Hope you now understand that there's more to it than the loan and credit card beyond offers, rewards, and interest rates.

Pay your dues on time, avoid getting penalties, paying late fees, and follow a good credit management habit.

By keeping the above-mentioned points and following the tips and tricks you can keep reaping the benefits of a good credit score and maintain a healthy financial life.