In the recent past, you must have heard a friend or family member talk about the benefits of credit cards and how they claimed with their credit card rewards points.

It might have been a free hotel stay, flight ticket or massive savings at a restaurant but these deals might make you wonder “How do I get my own credit card reward points?” Well, we are here to help you out!

How Do I Get Started with Credit Card Reward Points?

To state the obvious, earning credit card reward points begins with signing up with the right credit card.

But before that, begin by grasping the basics of how credit cards work and why you need one. Analyze your spending habits to align with suitable rewards categories. Research various credit card options, considering sign-up bonuses and ongoing rewards.

If you’re not looking to switch, we would recommend checking with your bank about what benefits you can currently avail with your card, or if there is a possibility to upgrade.

How To Earn Your Credit Card Reward Points

Earning credit card reward points is all about making the most of your everyday spending.

Many credit cards offer bonus points for specific categories like dining, travel, or groceries. Use your card for these purchases to accumulate points quickly.

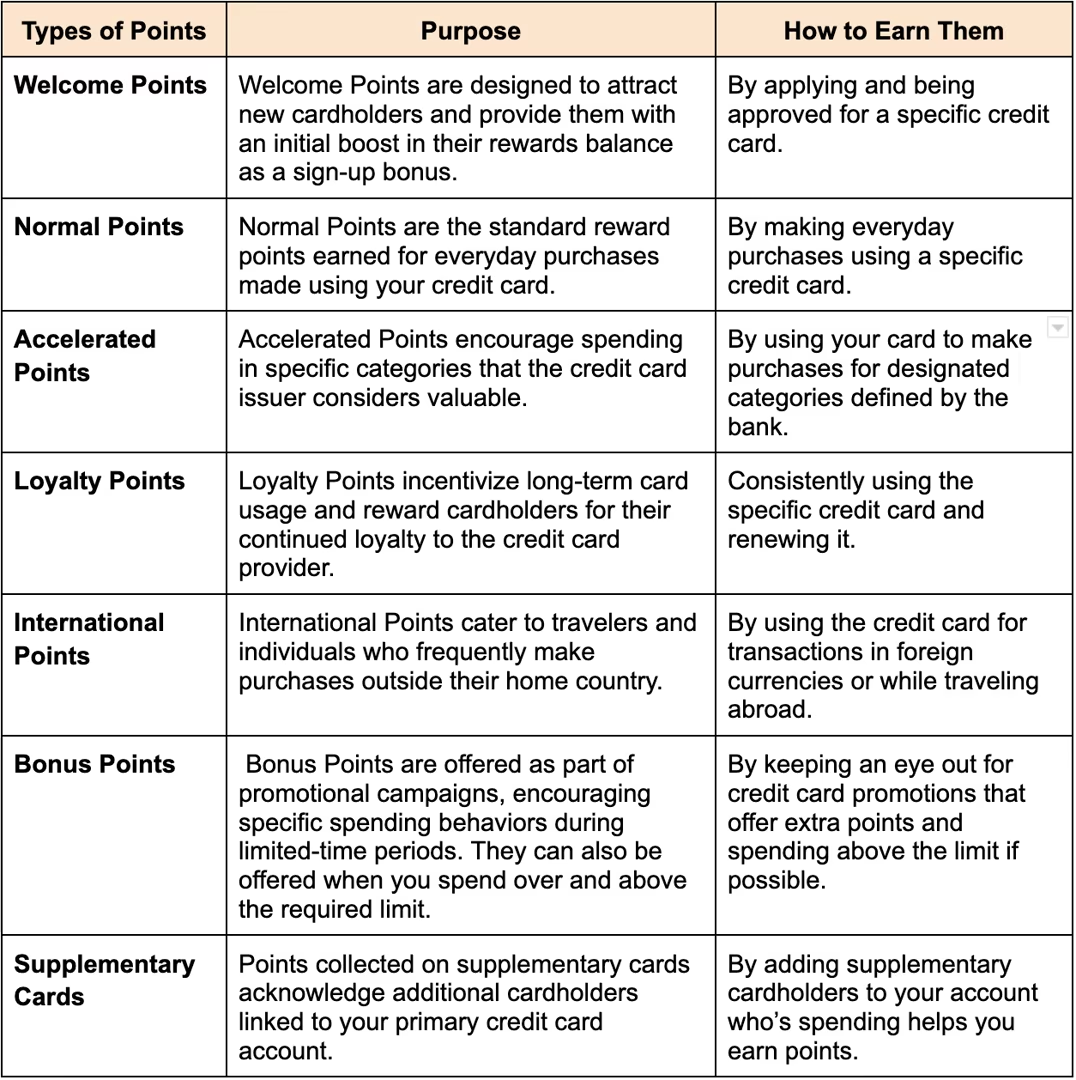

Based on the form of point and how it can be redeemed, there are largely 7 types of rewards points schemes offered by most banks and credit card companies.

Below, you can see a credit card reward points comparison along with their purpose and how to earn them.

What can I do with my Credit Card Points?

Once you've accumulated a substantial balance of credit card reward points, you'll have a range of exciting options at your fingertips.

These points can often be redeemed for a variety of rewards, including travel bookings such as flights and hotel stays, cashback to offset your card balance or statement, merchandise from partner retailers, gift cards to popular stores and restaurants, and even charitable donations.

Some credit card issuers also offer the flexibility to transfer your points to loyalty programs of airlines or hotels, unlocking potential for even greater value.

It's essential to explore the redemption options provided by your credit card issuer, as each program may have specific terms and conditions associated with point values and redemption methods.

By carefully selecting the rewards that align with your preferences and needs and understanding when your credit card rewards expire, you can truly make the most of your reward points and enhance your overall financial experience.

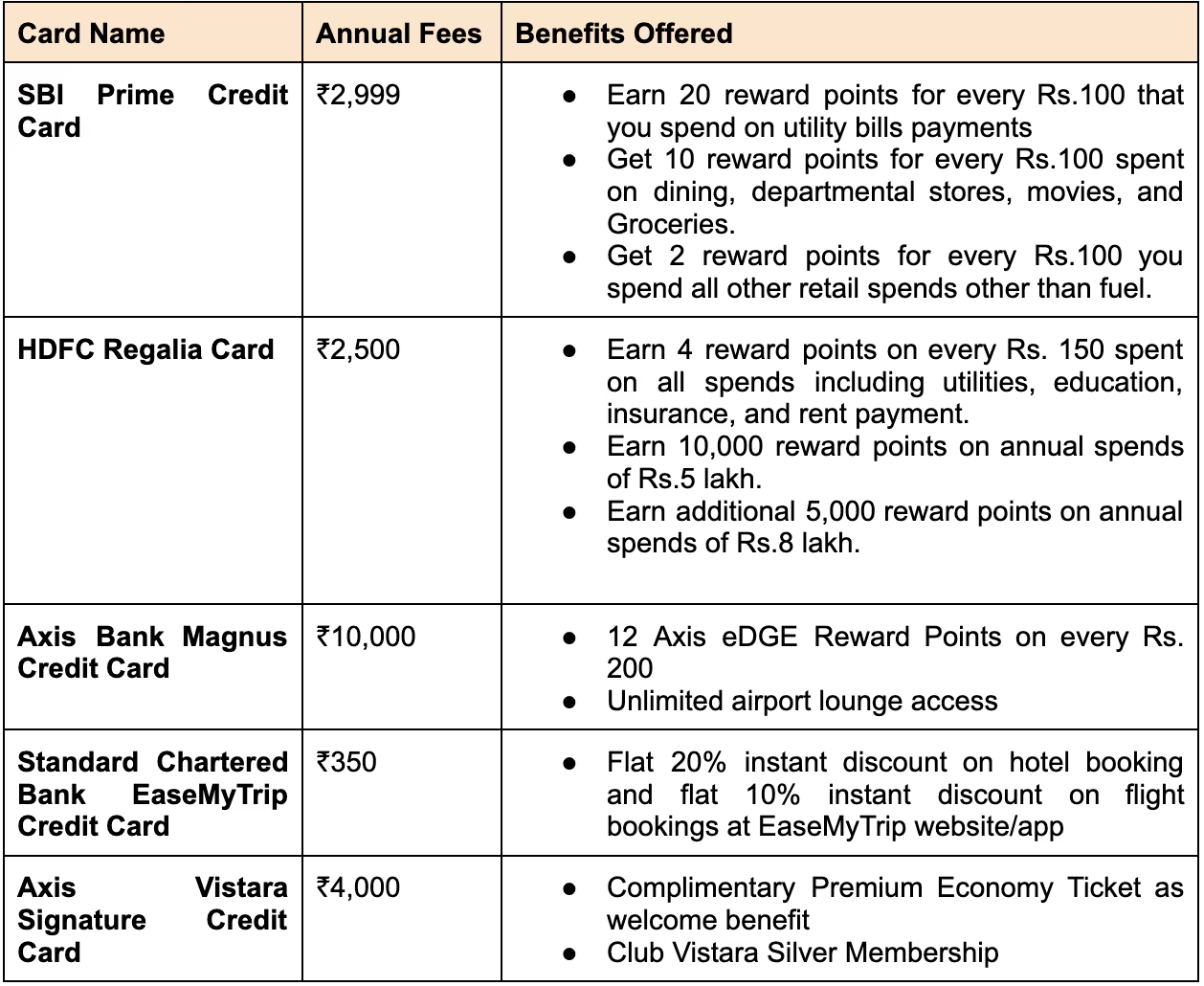

Top 5 Credit Cards: A Credit Card Reward Points Comparison

Now that you know how to earn your credit card rewards points and how you can redeem them, let’s discuss 5 of the best credit cards to sign up for in 2023 that maximise your savings and allow you to use your credit card rewards points effectively!

Takeaways

In the world of credit card reward points, strategic choices yield remarkable benefits.

Start by understanding the basics and assessing your spending habits to align with the right credit card.

Choosing wisely and crafting a personalized strategy can unlock a world of rewards, from everyday purchases to international spending. Stay informed about promotions and changes, and explore various redemption options that suit your lifestyle.

Remember, credit card rewards are not just points – they're opportunities to travel, save, and enjoy experiences like never before.

By mastering the art of earning and redeeming credit card points, you're on your way to financial savvy and rewarding adventures!