Many people dream of owning a car, but financial constraints often delay it.

A more economical option is to buy a pre-owned car instead of spending lakhs on a brand-new one. Also, opting for a used car loan to finance a pre-owned car fits the budget much better.

With improved road conditions increasing the car’s lifespan and parts made of the latest technology along with the advantage of opting for flexibly used car loan repayment schemes, there are more people who are considering buying a pre-owned car instead of a new one.

Although much lesser than a new car, used cars come with a hefty price tag.

Here’s when opting for a used car loan helps customers fulfill their aspirations of being car owners. The best part is that you can get a pre-owned car loan with minimum documentation.

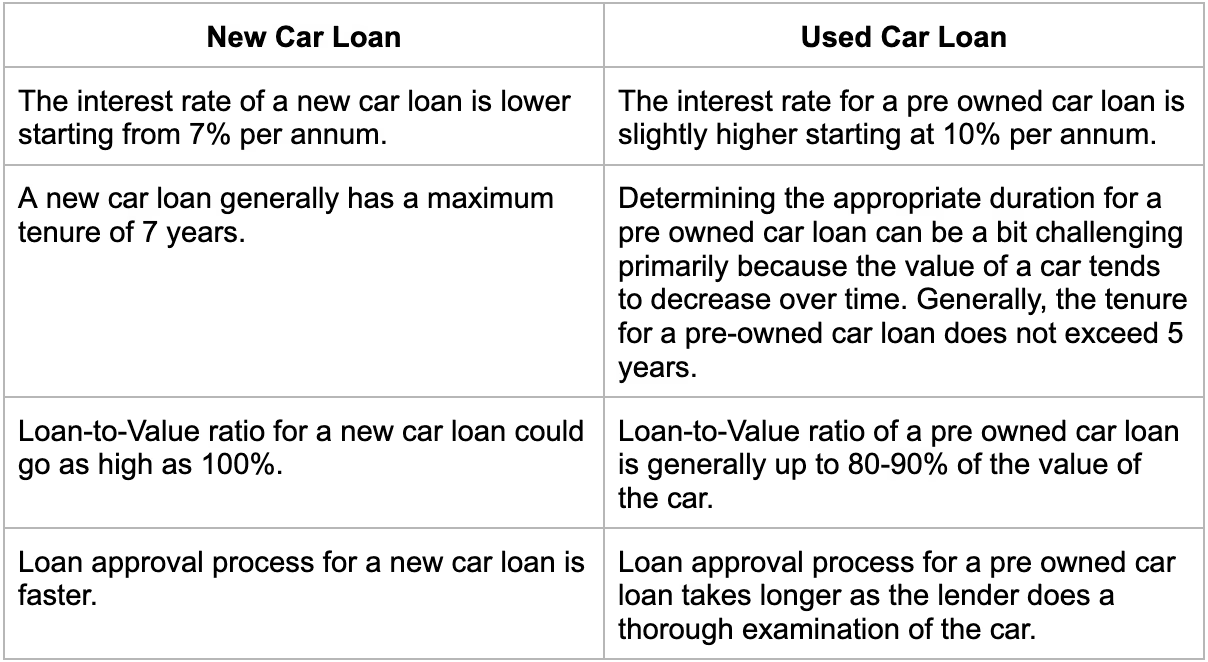

New Car vs Used Car Loan: What's the Difference?

For individuals looking to buy a new or a used car, there are various loan providers available in the market.

Car loans are designed to facilitate the purchase of a new car, while a pre-owned car loan can opt while buying a second-hand vehicle.

Although both loan options serve the purpose of enabling car purchases, they differ in several aspects. It is crucial to understand these distinctions in order to make an informed decision.

Let us now look into a few things you should consider before opting for a used car loan.

1. Used Car Loan Eligibility

Similar to any other loan, meeting specific criteria is essential to be eligible for a used car loan. These eligibility requirements are as follows:

Eligibility Criteria for Salaried Individuals:

- This category includes doctors, chartered accountants (CAs), employees of private limited companies, and employees from public sector undertakings, including central, state, and local bodies.

- Applicants must be at least 21 years old when applying for the loan and no older than 60 at the end of the loan tenure.

- They should have a minimum of 2 years of employment, with at least 1 year of service with the current employer.

- The minimum annual income requirement is ₹2,50,000 which includes the spouse's income.

Eligibility Criteria for Self-Employed Individuals (Sole Proprietorship):

- This category includes self-employed sole proprietors engaged in manufacturing, trading, or services.

- Applicants must be at least 25 years old when applying for the loan and no older than 65 at the end of the loan tenure.

- They should have been in business for a minimum of 3 years.

- The minimum annual income requirement is ₹2,50,000.

Eligibility Criteria for Self-Employed Individuals (Partnership Firms):

- This category includes self-employed partners involved in manufacturing, trading, or services.

- The minimum annual income requirement is ₹2,50,000.

- They should have a minimum turnover of ₹4,50,000 per year.

- Applicants should have a residence or office telephone line. If only one landline is available, a post-paid mobile phone that is at least three months old is acceptable.

Eligibility Criteria for Self-Employed Individuals (Private Limited Companies):

- This category includes individuals who own a private company engaged in manufacturing, trading, or services.

- The minimum annual income requirement is ₹2,50,000.

- Applicants should have an office landline.

Eligibility Criteria for Self-Employed Individuals (Public Limited Companies):

- This category includes directors in public limited companies engaged in manufacturing, trading, or services.

- The minimum annual income requirement is ₹2,50,000.

- Applicants should have an office landline.

Eligibility Criteria for Self-Employed Individuals (Hindu Undivided Family - HUF):

- This category includes self-employed individuals involved in a business that falls under the Hindu Undivided Family (HUF).

- The minimum annual income requirement is ₹2,50,000.

- Applicants should have a residence and office telephone line. If only one landline is available, a post-paid mobile phone that is at least three months old is acceptable.

- The Karta (head) of the HUF should be the co-applicant in their individual capacity.

2. Assessing the Valuation of the Car

To avoid paying excessive amounts for the vehicle, buyers should have a clear understanding of the car's worth prior to seeking a pre-owned car loan.

When assessing the value of a used car, lenders take multiple factors into consideration, such as -

- the car's age

- mileage

- overall condition of its body

- engine, transmission

- other mechanical components.

Typically, a second-hand car loan is approved based on this valuation rather than the car's actual price.

The type and age of the vehicle are important considerations when applying for a second-hand car loan. For example, the typical lifespan of a car is commonly considered as 15 years. Consequently, many banks may decline financing for cars that are older than 8-10 years. Additionally, most banks have a limit of three resales for which they are willing to provide financing for.

3. Planning for Second Hand Car Loan

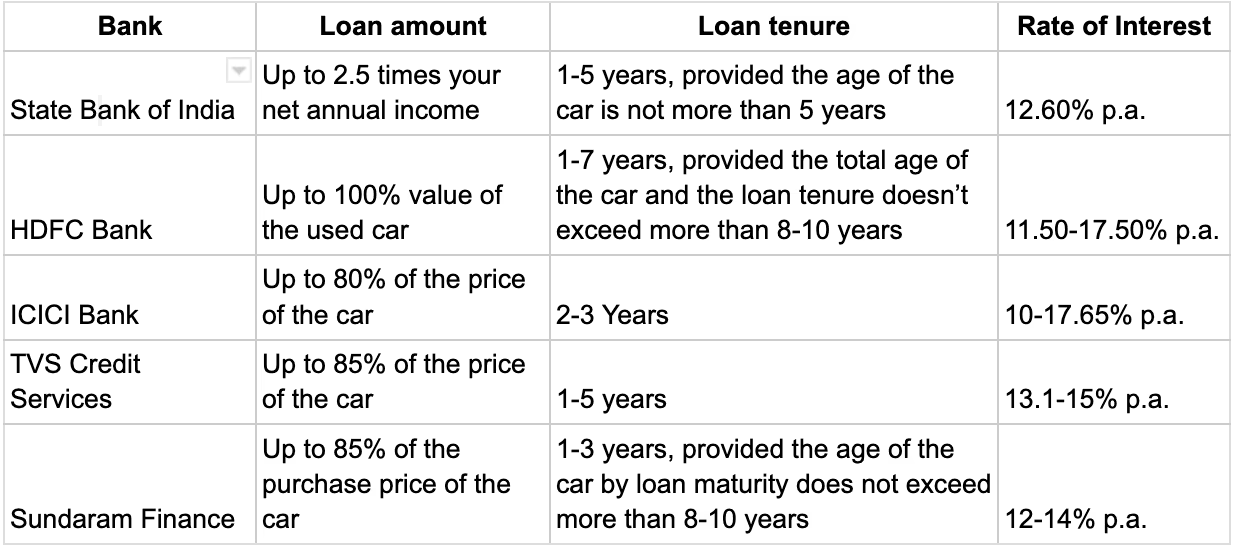

Secondhand car loan has become highly affordable owing up to 100% of the car cost available as loan amount. Other benefits include- flexible repayment terms, longer repayment tenure of up to 7 years, and a warranty from the manufacturer.

Below is a list of the top banks and NBFCs providing second-hand car loans in India:

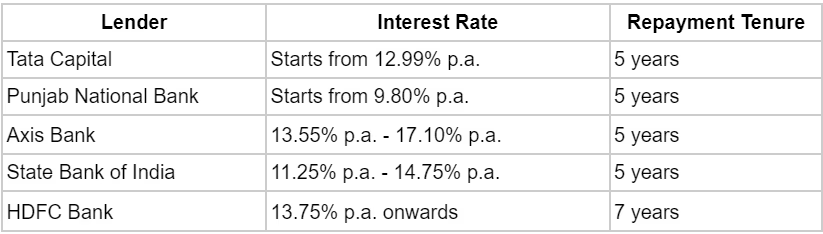

4. High Loan Interest

Pre-owned car loan interest rate is shocking for almost every buyer. While interest for new cars ranges between 7-15%, in the case of used car loan interest rate, it starts from 9% and can go up to 18%.

Second hand car loan interest rate is decided based on the car’s age and the number of reselling. Financial institutions commonly offer used car loans against cars less than 8-10 years old.

You can check used car loan interest rates provided by leading banks below:

5. Check For Hypothecation

Hypothecation means either the vehicle is bought on loan which is still not closed, or the current owner has pledged the vehicle as collateral for the loan.

Before opting for a used car loan, make sure the car’s registration is free of hypothecation to any bank or lending company.

When you buy a used car with a loan, make sure hypothecation is removed from the registration certificate, and also make sure to get a new certificate for yourself.

6. Check All Documents

Ensure that all necessary documents, such as insurance and registration certificates, are in order.

Don’t forget to check the car’s engine and chassis numbers and ensure they match the numbers mentioned on the registration certificate.

Also, you must ensure whether the car has been in an accident or has any servicing issues.

Final Words

With the number of financing options opening up, it is becoming easier for people to fulfill their dream of owning a car.

However, it is important to analyze the used car loan rate and be responsible for your credit.

You should only borrow an amount for a car loan that you can repay comfortably and make sure to pay your dues regularly without fail.