‘Be worth your weight in gold’. You may have come across this term which simply means being extremely valuable.

This holds equally true in the context of savings towards wealth-creation as well.

Gold’s appeal as an invaluable asset class continues unabated, clocking a 15% annual rise in investment demand between 2000-2020.

Historically too, gold has performed well and has yielded rich returns for investors (a whopping 7x jump in gold prices during the period 2000-2020).

Let’s find out the key factors that are fuelling the ‘gold rush’.

What makes Gold so Attractive

Gold’s deep significance in Indian culture is evident from the trend of buying gold during auspicious occasions such as Deepawali, Akshay Tritiya, Dhanteras and other festivals.

As per a Niti Aayog Report, globally, India is the 2nd Largest Consumer of Gold (25% of Global Demand).

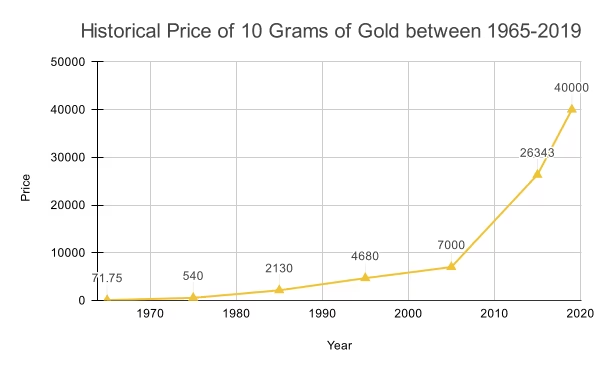

The overwhelming preference for the yellow metal has translated into a surge in gold demand and a consequent steep rise in the price of gold as depicted by the chart below:

The decade between 2000-2010 saw record high returns of around 320% for investors when the gold prices of each 10 gms soared from INR 4400 to INR 18500.

Gold is old, though. In terms of its relation with Indians. Since time immemorial, Indians have had a special close relation with gold –as an ornament for adornment purposes, an investment vehicle and a valuable possession to be owned with considerable capital appreciation potential.

The growing relevance of the yellow metal(Gold)

Being a valuable, almost-indestructible commodity, most Central banks including RBI hold gold as reserves to support the currency value.

As per the 2017 World Gold Council report, it is estimated that Indian households hold 23500 tonnes of gold, with 745 tonnes comprising RBI’s gold reserves.

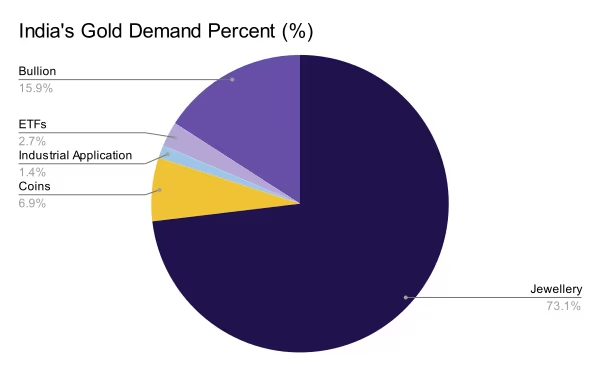

At 800-900 tonnes p.a. average domestic demand, a Niti Aayog report captures India’s gold demand as the following components:

The key reasons behind the high value of gold, as a commodity is attributed to its scarce availability, zero credit risk and its diverse use cases- as a consumer good in the form of jewellery, reserve asset held by RBI and for investment purposes.

Beat financial blues with gold

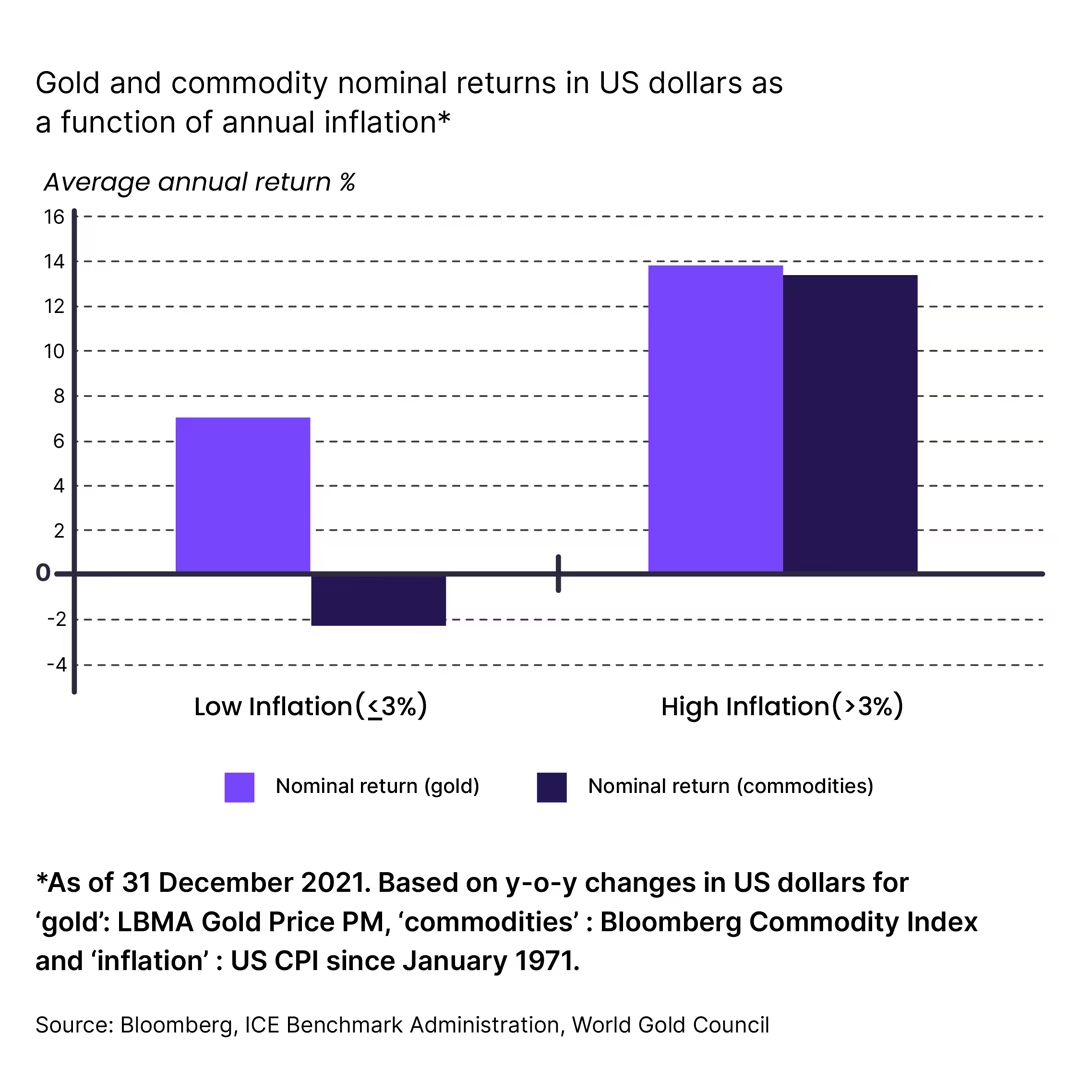

In the long-run, gold acts as a natural hedge against inflation. As per a 2022 study by the World Gold Council, during the years when inflation crossed the 3% threshold, gold’s price shot up by 14% per year on average, protecting investor returns, as summarized below:

During adverse economic conditions, gold is perceived to be a safe haven choice that would not lose value and can provide liquidity during market stress. History is replete with such examples including the 2009 financial crisis, when the gold prices shot up and breached the $1000 an ounce price mark, owing to its high demand.

Gold continues to retain its sheen

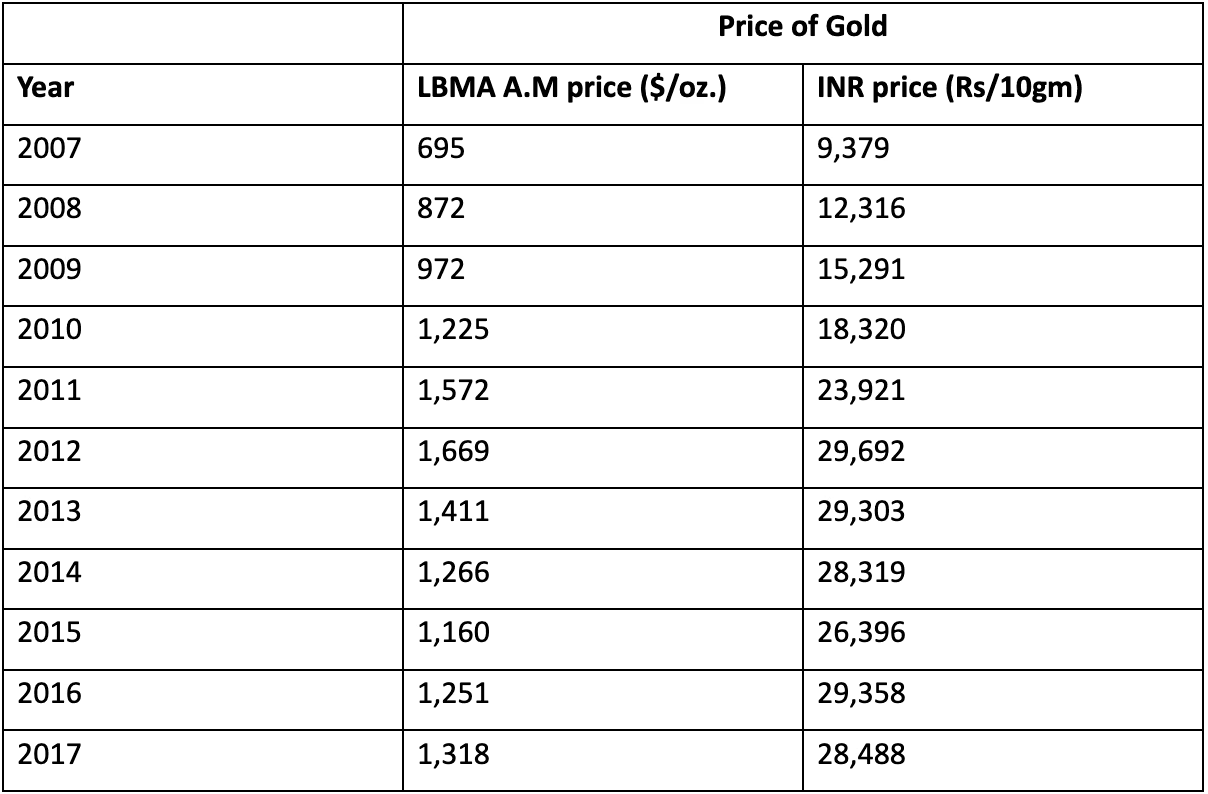

Superior returns with easy liquidity is another big draw when it comes to gold. Even during times when gold prices dipped by 21% between 2012-2017 in international markets due to economic decline, the gold prices in India were largely stable (a marginal drop of 4%) as follows:

Besides the demand-supply dynamics that impact gold prices, gold brings with it an associated prestige factor and premium tag as a precious metal, thus serving as collateral for credit access.

By leveraging tools like Indian Gold Rate Calculator, you can navigate the gold investment landscape with confidence and precision.

The golden question that remains

With the kind of robust returns delivered and wealth creation advantages, holding gold as a part of one’s investment portfolio is rapidly gaining traction, especially amongst millennials and GenZs. However, there is a catch. Which is the best way to buy gold without breaking the bank?

With multiple gold buying options ranging from physical gold, sovereign gold bonds, gold ETFs to digital gold, investors are spoilt for choice and often have a tough time when it comes to the gold buying decision.

Jar App: The preferred choice of the discerning investor

A fundamental tenet of investing is ‘Buy low, Sell high’. In other words, spend minimum money on acquiring an asset and liquidate the asset at the maximum price, so as to book higher profits. Applying this to gold purchases, buying digital gold via the Jar App as part of micro-investing emerges as a prudent option. Here’s the deal.

About Jar App:

Jar App is an automated Investment App that empowers investors to fruitfully channelise and securely invest spare change from online transactions into 24K Digital Gold in any denomination including fractional units, at any time and from anywhere.

- How it works: The Jar App works like a digital piggy bank that enables small-ticket gold purchases by deploying small change i.e. rounding off the difference in the billed amount to the nearest 10.

- Key advantages: Owing to the nominal investment size including amounts as low as Re 1, this affordable mode of gold investing works out to be highly economical without impacting the monthly budget. This way even first-time investors can cultivate the healthy habit of saving for long-term wealth accumulation.