The pandemic was a watershed moment in human history. The pre-COVID era largely witnessed physical and phygital business models.

On the other hand, digital became the defining point of the post-COVID era, popularly referred to as the new normal.

The digital trend has made inroads into every aspect of our daily lives- personal, professional and business.

Gold investing is no exception.

The trend of buying digital gold has caught on, especially amongst the digital natives comprising millennials and GenZs.

Read on to find out all about the ascent of digital gold and the key drivers behind this novel investing trend.

No holds barred when it comes to gold

Over the ages, Indians have held a fascination for the yellow metal.

The qualitative aspects are traditions, festive gifting customs and cultural significance of gold as a valued possession A plethora of factors – qualitative as well as quantitative contribute to the high demand for gold in India.

A study by World Gold Council throws light on the long-term and short-term quantitative factors driving the gold demand, based on a study during the period 1990-2020:

- In the long-term, the following are the key gold demand drivers:

- Income levels: Roughly for every 1% jump in gross national income per capita, the gold demand clocks a 0.9% rise.

- Gold Price level: It is estimated that for each 1% spike in Rupee denominated gold prices, the demand drops by 0.4%. The long-term demand is influenced by a steady price increase.

- Statutory levies: Import duties also impacts the gold demand

For example consider the following data between 2000-2010, where both income levels and gold prices impacted gold demand

- In the short-term, the following are the key gold demand drivers:

- Inflation impact: Indian investors hold gold as a hedge against inflation. For every 1% rise in inflation, the gold demand shot up by 2.6%

- Gold price level: A sudden price change influences the short-term demand. For every 1% dip in gold prices in a year, the demand jumped by 1.2%

- Tax impact: The spike in import duties rate since 2012 has slashed demand by 1.2% per year

- Monsoons: Above-normal rainfall positively impacts consumer sentiment in the short run. A 1% higher rainfall causes the gold demand to be enhanced by 0.2%.

Broadly, while jewellery demand was greatly impacted by long-term drivers, demand for bullion such as gold coins or bars was dependent on short-term drivers such as inflationary pressures or tax imposition.

The rise of a golden revolution

While this strong affinity for gold continues amongst investors, there has been a marked transformation in the modes of buying gold with growing traction towards digital gold.

As per a report by World Gold Council, the purchase of gold through jewellery retailers has declined from 90% to 80-85%, with digital gold accounting for up to 5% of overall gold purchases.

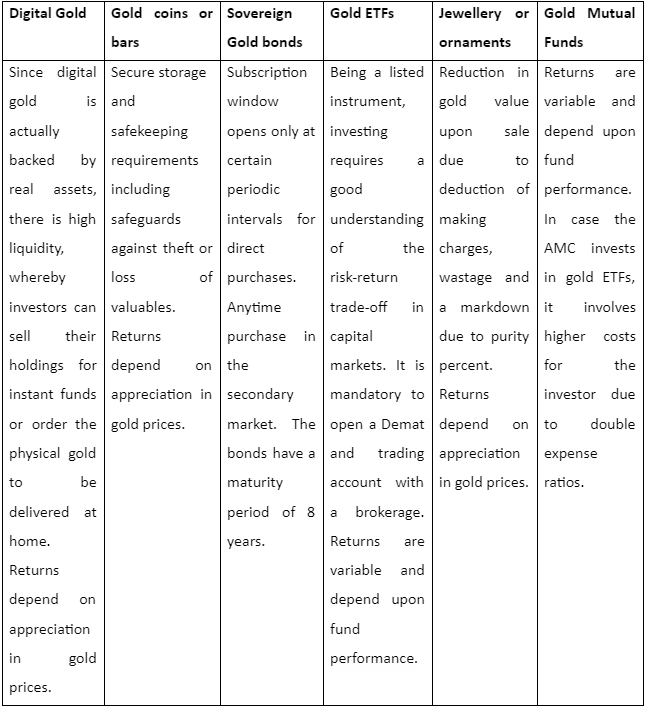

Further, special festive occasions like Diwali and Akshay Tritiya make up over 50% of the online gold sale. The table below compares the advantages of digital gold over other gold acquisition routes:

Recent development: It is worthwhile to note that in August 2021, SEBI issued a notification, barring stock brokers from selling digital gold. Following this announcement, stock brokers have discontinued selling digital gold. Mobile wallets and investment portals continue to sell digital gold.

The ’Sone pe Suhaga’ moment for gold

Digital gold is the option of buying and accumulating pure 24K gold via online platforms in any denomination including fractional quantities, starting with a nominal investment amount of just INR 10.

In other words, gold investments are held in digital form, while the underlying physical 24K gold is securely stored in a locker. The following are the prominent advantages of digital gold:

- Redefining convenience: Being 100% digital, investors have the option of anytime-anywhere secure purchase, sale and physical delivery of the precious metal. No need to save up a lump sum amount and then buy gold. Now buy small measures of gold at all auspicious Muhurats throughout the year. Digital gold offers anytime entry and exit options.

- High on transparency: Investors can digitally access and view details of their gold holdings i.e. weight, purity and current value.

- Collateral benefits: Digital gold holdings may be used as collateral for availing online loans.

- More bang for every buck: The gold purity is completely guaranteed as the gold purchased is 24K gold standard made up of 99.5% purity, certified by Government-licensed authorised bodies. Thus, every Rupee spent is towards the gold holdings, unlike jewellery purchase, which involves payment towards ornament making charges, wastage and other relatively low-value elements like semi-precious stones etc.

- Anyone can become a gold investor: For a minuscule investment size of INR 10, one can start investing in digital gold. This enhanced gold affordability encourages greater retail participation in return for fractional gold ownership. Thus, one need not wait to accumulate a corpus in order to start buying digital gold. Digital gold is truly for everyone.

- Secure storage: Physical gold has the added challenges of safety and possible risks of theft, which requires bank lockers and carries an annual service charge based on the locker size that houses the valuables. These security concerns are eliminated under digital gold, where the underlying physical gold is securely stored in insured vaults by the custodians, on behalf of the buyers. Investors in digital gold can enjoy complete peace of mind as the security facility is available at negligible charges.

- Flexibility of conversion: Under digital gold, the online purchase of every gram of gold is backed by a corresponding, equal quantity of physical gold. Investors can opt to sell their gold holdings at the prevailing market rate and get the transaction value credited to their bank account or alternatively avail doorstep delivery of physical gold in the form of bullion coins or gold bars.

Go long to prosper

It is well-known that time is money.

After considering the above advantages of holding digital gold, it may be inferred that gold, too, is money.

The returns from digital gold are realised from the capital appreciation due to gold price rise over a period of time. Therefore, when it comes to investing in real assets like digital gold, it is prudent to go long and book higher gains.

About Jar App

Jar App is an automated Investment App that empowers investors to fruitfully channelise and securely invest spare change from online transactions into 24K Digital Gold in any denomination including fractional units, at any time and from anywhere.

Be a smart investor. Switch to Jar today. Buy pure 24K gold at the best prices.

Visit us at https://www.myjar.app/ to know how automated savings in digital gold investment can secure your future and help achieve your long-term financial goals.