When we think of borrowing or debt, the only options that come to our mind are credit cards and banks, right? But are these the only ones?

Not at all. The buy now pay later option is quickly becoming a convenient choice among shoppers.

Today, online shoppers ‘want a product and want it fast.’ They don’t want to be limited by their bank account balance or lack thereof when they want to buy something that is out of budget.

BNPL service gives you instant credit and depending on your service provider, the repayment terms are generally quite flexible.

Even if clients miss payments, interest rates are lower, ranging from 0 to 24% versus 48% for credit cards.

BNPL providers are open to sign-up customers who might have little or no credit history as well but you must have your KYC.

A big number of fintech players have joined the market to bridge the financial gap between customers and their wants in response to the increasing demand for credit.

What is ‘BNPL’?

‘Buy Now, Pay Later’, or BNPL for short, refers to a customer buying a product or purchase without having to pay for it right away.

It's a short-term loan product in which the BNPL service lender pays the merchant or service provider at the time of purchase and allows you to repay the loan at a later period with little or no interest.

However, after this interest-free period, full payment was required, or the interest from the initial purchase date would be added.

The payback can be made in one lump sum or in equal monthly installments (EMIs).

Buy Now Pay Later (BNPL) is allowing customers to get instant credit and break payments into smaller, more "affordable" installments at the point of sale.

The current buzz around BNPL is due to its seamless integration with e-commerce websites and platforms as a checkout option, which is currently redefining the customer journey.

It basically makes it very simple, hence, merchant and consumer adoption is skyrocketing.

You don't have to speak to anyone, bargain, or wait any longer than necessary. In less than a minute, you may order your favourite chocolate cake on Swiggy using LazyPay and pay without using your account.

How Does BNPL Work?

Buy Now, Pay Later (BNPL) transactions involve three main parties: the consumer, the merchant, and the BNPL service provider, often a fintech firm.

1. For Consumers, BNPL services vary from one company to another, but typically, they follow a similar process:

- You shop at a retailer that supports BNPL and choose the BNPL option at checkout.

- After a quick approval process, you pay a small initial amount, usually around 25% of the total price.

- The remaining amount is divided into interest-free installments.

- Payments can be made through bank transfers or checks, or they can be automatically deducted from your credit card, debit card, or bank account.

2. For Merchants Merchants continuously look for ways to increase their average sales value. Particularly in e-commerce, cart abandonment is a common issue. Offering BNPL options can encourage customers to complete their purchases and potentially spend more.

- Providing credit at the point of sale would mean the merchant takes on the risk and administrative costs. By partnering with a BNPL service, they can offer this option for a fee, which is more appealing.

- As merchants already pay a fee to payment processors for credit card transactions, transferring these charges to another financial service in exchange for potentially higher sales makes more sense.

3. For BNPL Providers (Fintechs) The BNPL provider pays the merchant upfront and takes on the responsibility of extending credit and collecting payments from the customer.

- As a lender and payment processor, the BNPL provider assumes the risk if a consumer doesn't pay. They compensate for this risk by charging the merchant a percentage of the purchase price, then collecting the full purchase price from the customer in installments.

- Revenue comes from the difference between what they pay to the merchant and what they collect from the customer. Fees charged generally range from 2.5% - 12.5 %.

Common Features of BNPL Apps in India

Instant Credit

BNPL providers offer instant credit, which means you can get approved for a loan and start shopping right away. This is a major advantage over traditional credit cards, which can take days or even weeks to be approved.

Easy and Secure

The BNPL process is very easy and secure. You can apply for a loan online or through a mobile app, and you'll typically get a decision within seconds. Your personal information is, so you can shop with confidence.

Easy EMIs

BNPL providers offer flexible repayment terms, so you can choose to pay off your loan in easy installments. This makes it easy to manage your finances and avoid debt.

Low-Interest Rates

BNPL providers typically charge low-interest rates, which means you can save money on your purchases. This is a major advantage over credit cards, which can charge high-interest rates.

Convenience

BNPL is a very convenient way to shop. You can use it at any merchant that accepts BNPL, and you don't need to carry around a credit card. This makes it easy to shop online or in-store.

No or Nominal Maintenance Charges

Some BNPL providers don't charge any maintenance fees, while others charge a nominal fee. This is a major advantage over credit cards, which can charge high annual fees.

Easy Approval Process

The BNPL approval process is very easy. You'll typically need to provide some basic information, such as your name, email address, and phone number. You may also need to provide a soft credit check, but this won't affect your credit score.

Some Of The Best Buy Now Pay Later Apps In India –

When it comes to buy now pay later services in India, there are a lot of options to choose from, giving consumers the advantage of selecting the perfect option for their requirements. Let's explore some of the top BNPL apps and their distinctive features that can enhance your shopping experience:

- Simpl

- LazyPay

- ZestMoney

- Amazon Pay Later

- Paytm Postpaid

- Ola Money Postpaid

- Flipkart

Eligibility for Buy Now, Pay Later Services

The eligibility criteria for buy now pay later might differ with different service providers, they might have their own unique requirements Here are some common eligibility criteria you must meet if you wish to avail of buy now pay later services in India:-

- You must be a citizen of India.

- You must be at least 18, in some cases maximum age ranges from 55-65.

- Should have your KYC, without KYC it won’t be possible for you to access these services.

- Have an id proof, Aadhar Card, and driver's license. In most cases BNPL service lenders expect you to have a pan card.

- You should have a fixed source of income or be a salaried individual

Advantages & Disadvantages of BNPL

Buy Now, Pay Later (BNPL) services have gained popularity in India lately, providing consumers with the convenience of credit for their personal purchases. While it offers certain advantages for both consumers and merchants, it also comes with certain limitations. Let's go through some pros & cons of BNPL in India:

Advantages For Merchants

Increased sales: BNPL can help merchants increase sales by making it easier for consumers to buy more expensive items. For example, a consumer who might not be able to afford a TV outright might be able to afford it with BNPL, which could lead to an additional sale for the merchant.

Better checkout conversion: BNPL can help improve checkout conversion rates by reducing buyers' hesitation. When consumers are presented with the option to pay for their purchase over time, they may be more likely to complete the purchase.

Lower interchange fees: BNPL providers typically charge merchants lower interchange fees than credit card companies.

Increased average order value (AOV): BNPL can help increase the average order value by encouraging consumers to purchase larger items. This is because consumers may be more likely to add more items to their cart if they know that they can pay for them over time.

Advantages for Consumers

Low Interest: Many BNPL providers offer 0% interest and if any interest is applied it’s lesser than the interest rates on credit cards, which can save consumers money on their purchases.

Easy to qualify: BNPL providers typically have less stringent credit requirements than traditional lenders, which makes it easier for consumers to qualify. This means that even consumers with poor or no credit may be able to use BNPL to make purchases. The registration process is quite easier in most cases, but you must have valid id proof and KYC.

Convenient: BNPL provides consumers credit instead and allows them to spread out their payments over time. This makes it easier to afford large purchases. This can be especially helpful for consumers who have irregular income or who are on a tight budget.

Disadvantages

Easy to overspend: BNPL can make it easy for consumers to overspend, as they may not feel the full financial impact of their purchases until they are due to make their payments. This is because BNPL payments are typically spread out over several months, so consumers may not see the total cost of their purchase up front.

Late fees: If consumers miss or make late payments, they may be charged late fees. These fees can be expensive, so it is important to make sure that you can make your payments on time.

Negative Impact On Credit Score: Failure to make payments or experiencing even a slight delay in your payment cycle can have a negative impact on your credit score. Regardless of how small the missed or delayed payment may be, it can disrupt your existing credit score and have a negative impact on your CIBIL score. This can create challenges when it comes to securing loans in the future.

The Future of Buy Now, Pay Later

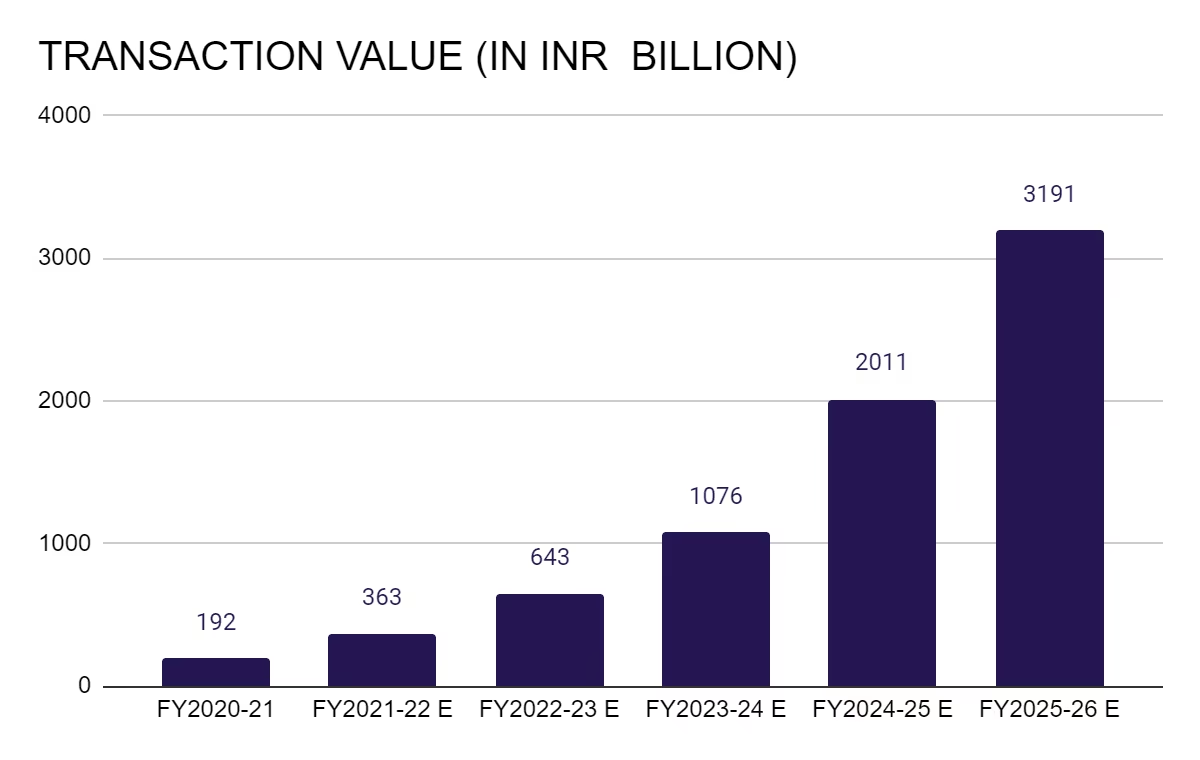

According to HDFC Securities, India's 'Buy Now, Pay Later 'market is expected to rise to $56 billion by FY26.

In India, the ‘Buy now, Pay later’ business is expected to grow tenfold. The BNPL market would be worth $45 billion to $50 billion by 2026, according to research firm Redseer.

The number of BNPL clients in the country might reach 80 million to 100 million, up from 10 million to 15 million presently.

The graph below shows the estimated transaction value on BNPL for the year 2025-26.

However, at its core, it is still a sort of loan that the consumer must repay in the end. Lenders who provide this service must stay cautious, as not everyone will be able to return the loan within the specified time frame. Again, the future of BNPL appears bright, only as long as consumers are able to make effective use of the facility and pay on time.

FAQs on BNPL services

Q) Are there any pay-later apps that provide credit without KYC?

Answer - Currently, no BNPL apps offer credit without KYC. KYC, or "know your customer," is a process that helps BNPL companies understand their customers and assess their creditworthiness. This information is essential for BNPL companies to make responsible lending decisions. It’s important for them to prevent thefts and fraud.

Q) Is buy now pay later a loan?

Ans- Buy now pay later is a form of loan facility that provides instant credit with a simpler and more convenient process compared to traditional loans. It offers quick access to credit without the need for lengthy procedures. While the credit amount may be lower compared to traditional loans, the interest rates associated with buy now pay later options are generally lower as well.

Q) How much credit score do I need to get approved for a BNPL facility?

Ans - BNPL lenders take into account multiple factors to determine the approval of may be an important factor for some lenders, but many lenders are willing to provide credit services to people with no credit history as well. Thus individuals with lower credit scores or no credit history can also apply.