Planning for making safe investments with high returns in India? But not really sure how to invest your money? Well in a country like India where you have a plethora of options to choose from and to start off, it can get a little overwhelming.

Securing high-return investment that involves minimum risk is the real motto of every investor.

In India, investment options can be broadly classified into two categories: financial assets and non-financial assets. The financial asset class can further be bifurcated into market-linked securities (like mutual funds, live stocks, etc.) and fixed-income products (like bank FDs, PPFs, bank RDs, etc.).

Whether you seek short-term investment plan, long-term stability, or a balanced approach, we'll help you identify investment plans that align with your goals. With this article, you can figure out what is the best investment plan in India depending on your goals.

10 Safe Investment Options with High Returns

Questions around investing usually tends to revolve around long term investment plans. Best investment plan for you will always depend on your risk appetite, liquidity requirements, financial goals, and investment horizon.

Here are some safe investment options with high returns in India with their features that will help you identify the best options which suit your needs :

Mutual Funds

Mutual funds are a type of investment that allows you to pool your money with other investors to buy a variety of assets, such as stocks, bonds, and money market instruments.

This gives you diversification, which can help to reduce your risk. Mutual funds are also professionally managed, which means that you don't have to do the research yourself.

Mutual funds are of three types - Equity funds, Debt funds, and Hybrid funds

Equity funds

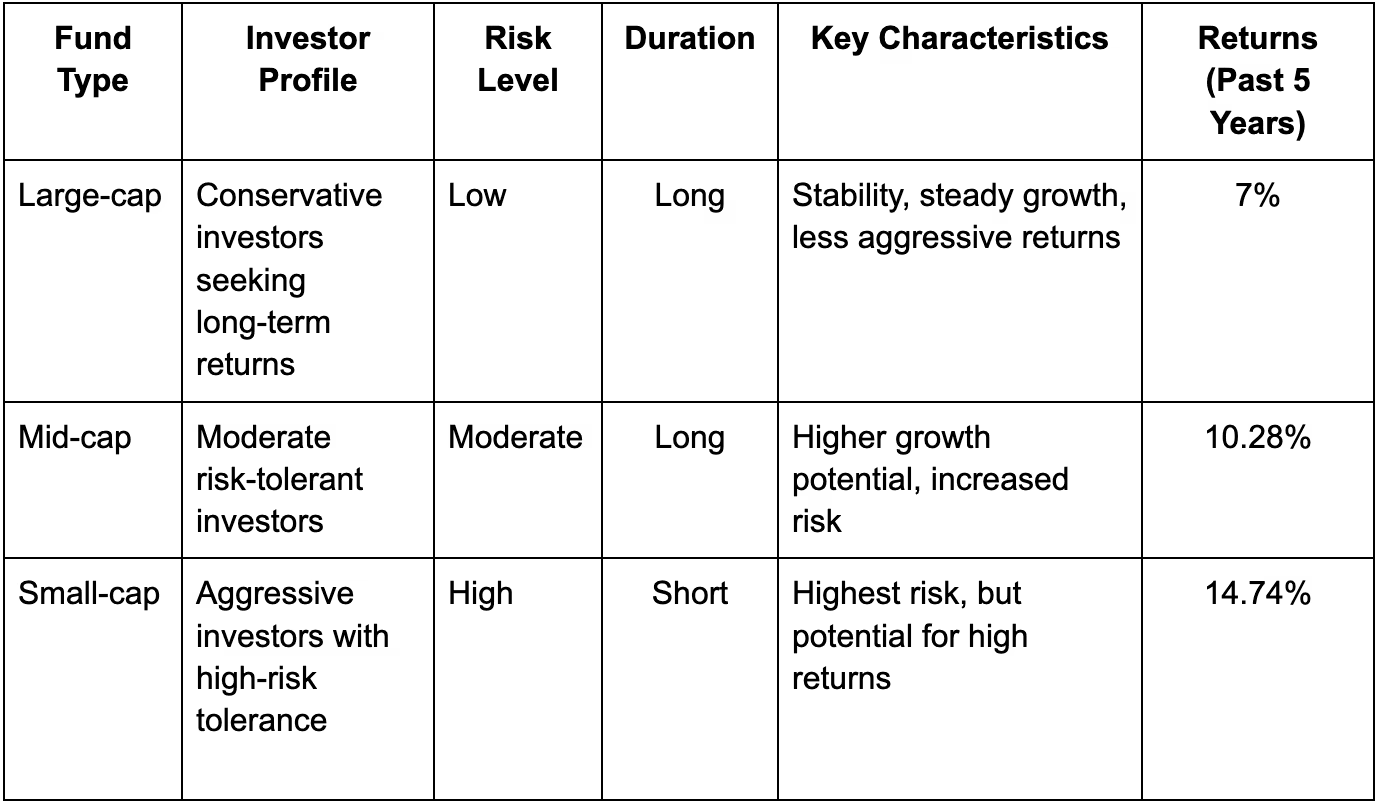

Invest in stocks, which are shares of ownership in a company. When you buy an equity fund, you are buying a small piece of ownership in many different companies. This diversification helps to reduce your risk because if one company performs poorly, the other companies in your fund may help to offset the loss. Further on the bases of market capitalization they could be classified into -

- Large-cap funds: These invest in the top 100 companies listed in the stock market with high market capitalization (around Rs. 20,000 crores and more).

- Mid-cap funds: These invest in companies ranked from 101 to 250 in terms of market capitalization (around Rs. 5,000 to Rs. 20,000 crores).

- Small-cap funds: These invest in companies ranked from the 251st position onwards in terms of market capitalization (below Rs. 5,000 crores).

Debt Funds

Debt funds allocate their investments to fixed-income securities such as treasury bills, corporate bonds, commercial papers, government securities, and various other money market instruments.

These instruments have a predetermined maturity date and interest rate, which investors receive upon maturity – hence, they are called fixed-income securities.

Since the returns on these securities are generally not influenced by market fluctuations, debt securities are regarded as low-risk investment options.

They are an ideal option for those looking for a safer investment alternative to equity funds. Some scenarios where debt funds may be suitable include:

- Higher returns than savings accounts: Instead of keeping money in a regular savings account, investing in liquid funds can offer better returns (7-9%) without compromising liquidity.

- Low-risk investment for 3-5 years: For investors seeking a low-risk instrument with a 3-5 year horizon, debt funds can potentially provide better returns than bank fixed deposits.

Hybrid Funds

Hybrid funds are managed by experienced fund managers who adjust the allocation between equity and debt based on market conditions and the scheme's investment objectives.

This professional management ensures that the portfolio remains optimized to achieve the desired balance between growth and income.

- Portfolio Allocation - The fund manager allocates funds in equity and debt instruments in varying proportions, based on the scheme's investment objective.

- Market Movements -The fund manager may buy or sell assets if market movements are favorable, adjusting the portfolio accordingly.

- Investor Suitability - Hybrid funds are ideal for investors seeking a balance between risk and return, as they are riskier than debt funds but safer than equity funds. They are also suitable for new investors who want to test the equity market while maintaining some stability in their investments.

Public Provident Fund (PPF)

Public Provident Fund is a long-term, government-backed investment instrument that allows individuals to accumulate wealth with low-risk exposure.

It is predominantly used for retirement planning and offers various tax benefits.

Features of Public Provident Fund (PPF):

- PPF is a long-term investment tool with a minimum tenure of 15 years, making it suitable for retirement planning and wealth accumulation.

- Since PPF is backed by the Government of India, it is considered a low-risk investment option and provides steady return of 7.1%.

- The interest earned on PPF is not taxable, and the amount deposited each month is tax-deductible up to Rs. 1.5 Lakh per annum under Section 80C of the Income Tax Act.

- PPF allows partial withdrawals after the completion of five financial years from the end of the year in which the account was opened.

- Investors can take a loan against their PPF account, up to 25% of the available balance, which is repayable within three years.

Unit Linked Insurance Plans (ULIPs)

Unit Linked Insurance Plans are financial products that combine a life insurance policy and investment opportunity through mutual funds.

They provide life insurance coverage along with the potential for long-term capital appreciation.

If you are looking for a short-term investment you must consider the 5-year lock-in period and the kind of ULIP that you are selecting.

Features of ULIPs:

- Investors pay premiums for their ULIPs, with a portion allocated towards the life insurance component and the remaining amount invested in mutual funds managed by fund managers.

- ULIPs have a lock-in period of five years, but it's recommended to hold them for 15 years or more to maximize the benefits of both insurance and investment components.

- There are charges related to ULIPs, including premium allocation charges, fund management charges, mortality charges, policy administration charges, switching charges, and surrender charges.

- ULIPs can be categorized into equity funds, debt funds, balanced funds, and new-age (4G or Whole Life) ULIPs, based on the type of mutual fund they are attached to.

The risks associated with ULIPs depend on the type of fund attached to the plan.

Bank Fixed Deposit

A Fixed Deposit is a financial instrument provided by banks, non-banking financial companies (NBFCs), and post offices that allows investors to deposit a lump sum amount for a fixed period, earning higher returns compared to regular savings accounts.

FDs are considered a low-risk investment option that offers guaranteed returns on the principal invested.

Features of FDs:

- Fixed deposits have a fixed tenure, which can be short-term or long-term, depending on an investor's investment portfolio. FDs range from seven days up to ten years, and it varies across banks.

- The return on investment is compounded periodically; it may be monthly, quarterly, or annually. The interest rates on fixed deposits vary from one company or bank to another, influenced by factors such as the deposit's tenure and the institution's policies.

- Withdrawing money from a fixed deposit before maturity may result in financial penalties, reducing the overall returns.

- Though investors can avail of loans against their fixed deposit investment, with a maximum loan amount of up to a certain percentage of the fixed deposit amount.

FDs could be a good investment option for those who are looking for safe investments over a short period of time. It can be kept for a long period of time as well but may not provide very exciting interest rates over the long term.

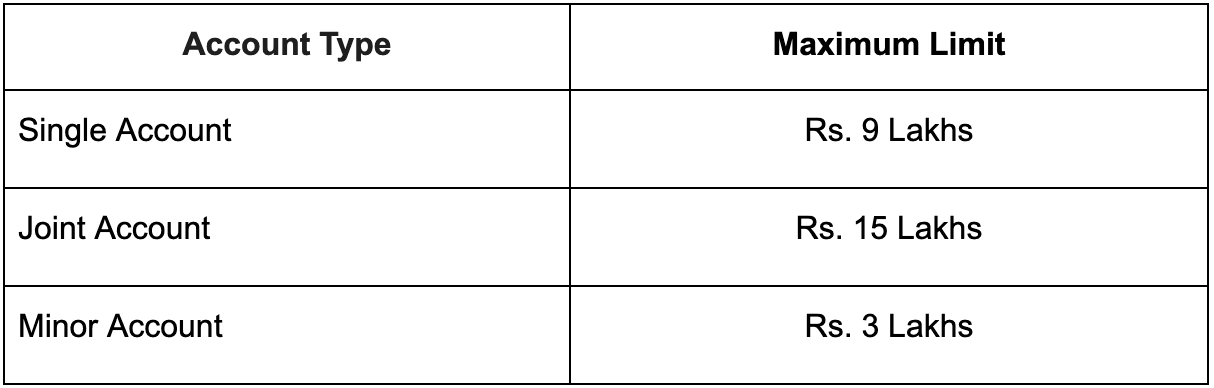

Post Office Monthly Income Scheme (POMIS)

POMIS is a low-risk government-backed investment scheme offered by the Indian Postal Service.

It comes with a lock-in period of 5 years, in case of early withdrawal there is a penalty.

If it’s closed between 1-3 years a penalty of 2% is levied on the principal amount whereas if the account is closed between 3-5 years a penalty of 1% is levied on the principal amount.

The returns are guaranteed at the rate of 7.40 %, making the investment stable and secure, albeit with relatively lower returns compared to market-linked investments.

The minimum investment amount is Rs. 1,500. POMIS accounts can be transferred between post offices if you change your residential location within India.

So if you don’t want to take a lot of risks and look for steady returns over a period of 5 years. POMIS could be a part of your investment plan.

POMIS could be a good option for conservative investors who are looking for investments in the medium term around a period of 5 years

Gold

As an investment gold is a highly liquid investment and acts as a hedge against inflation. Could be helpful for investors who are looking for diversification in their portfolios.

When inflation rises, the value of paper money decreases. Gold, on the other hand, tends to hold its value or even increase in value during times of inflation. This makes it a good way to protect your wealth from the erosion of inflation.

Digital gold offers a hassle-free and safe form of investment in Gold. This eliminates the need for locker charges and concerns about theft or loss. Digital gold is 24K with 99.99% purity, ensuring buyers don't have to worry about purity and genuineness

With digital gold, individuals can invest in any amount, even as low as one rupee. This flexibility allows investors to buy gold according to their budget.

Can be easily exchanged for physical gold, coins, or bullion at any time and place, providing flexibility for those who want to convert their digital assets into physical ones.

RBI Bonds

RBI bonds are fixed-income securities issued by the Reserve Bank of India. They are a safe and secure investment option, as the RBI is a sovereign entity.

The minimum investment is Rs 1000 and then in the multiples of Rs.1000, there is no upper limit as such

RBI bonds mature after 7 years. On maturity, investors will receive the full amount invested, plus interest.

There is a premature withdrawal facility available for senior citizens. Senior citizens can withdraw their investments after a lock-in period of 4 years (for those above 80 years), 5 years (for those between 70 and 80 years), and 6 years (for those between 60 and 70 years).

There is a penalty of 50% of the last coupon payment for premature withdrawals.

Hence we could say that rbi bonds are not a very good option for people who are looking for a liquid investment over the period of 1-3 years. However, it may be a good option for people who are looking for safe investments over the long run.

However, it is important to note that RBI bonds are not without risks. The interest rate on RBI bonds is not guaranteed, and the value of RBI bonds can fluctuate in the secondary market.

The interest rate on RBI savings bonds on May 4 was announced as 6.97%.

Equity

Investment in direct equity would be a good option for those who are looking for high returns and can bare with the high risks, equity stocks are highly liquid.

In order to invest money you will have to open a Demat account. As an investor, when you will invest in direct equity, you will basically be signing legal terms regarding the ownership of the company.

In order to make the best use of this type of investment, you must have advanced knowledge of stocks & shares. This is because you will have to do intensive research on your entry and exit time, and the right stock.

As distinguished above in the section on equity mutual funds, equity stocks are also distinguished in three categories on the bases of market capitalization Large, mid, and small. Given below are examples of companies that are listed on the stock exchanges of India under the same category:-

- Large-Cap Stocks - Reliance Industries and Infosys

- Mid-Cap Stocks - Metropolis Healthcare, Castrol India, and LIC Housing Finance

- Small-Cap Stocks - Bajaj Consumer Care, Shobha Ltd, and VST Industries are some examples

Real Estate Investments

Real estate can be a good investment, but it is important to do your research and understand the risks involved.

Direct ownership of real estate investments can be illiquid, which means that it can be difficult to sell them quickly if you need to.

REITs are a type of investment trust that invests in real estate. They can be a good option for investors who want to invest in real estate without having to buy and manage properties themselves.

Real estate investment trusts (REITs): REITs are companies that own and operate income-producing real estate. They are traded on stock exchanges, which makes them a more liquid investment than direct ownership.

REITs are more liquid, meaning that you can sell your investment more easily.

Returns can vary depending on the type of real estate investment you choose. Direct ownership of real estate can generate income through rent payments and capital appreciation.

REITs and real estate can generate income through dividends and capital appreciation.

N.S.C

National Savings Certificate (NSC) is a fixed-income investment scheme offered by the Government of India through post offices. NSCs have a five-year lock-in period, which means you cannot withdraw your money before the five years are up.

NSCs are relatively liquid investments, so you can easily sell them if you need to access your money.

NSCs are backed by the government, so they are a very safe investment.

Interest earned gets compounded annually and reinvested by default but will be payable only at maturity.

The NSC interest rates are fixed by the government and revised quarterly. The current NSC interest rate for the quarter April-June 2023 stands at 7.7%,

FAQS

Q) What is the safest investment plan with the highest returns?

Answer - There is no one-size-fits-all answer to the question of what is the safest investment with the highest return, as the best investment for you will depend on your individual circumstances and risk tolerance. However, some of the safest investments with the potential for high returns are fixed deposits (FDs), and public provident fund (PPFs).

Q) Which is best investment for money in India?

Answer - The best investment in India is subjective and varies based on an individual's financial condition. Equity funds, and direct equity are investment options that offer the potential for high returns but the risk associated is high.

It's crucial to assess personal risk tolerance, conduct thorough research, and seek professional advice before considering these high-risk, high-return investment options.

Q) How to invest 10 lakhs for good returns?

Answer - Diversifying your investment across asset classes would help you diversify your risks.

Consider fixed-income options for stable returns (there are multiple options but it depends on your financial goals), and allocate funds to equity funds or direct equity for potentially higher returns. Investing in gold can help you diversify your risk as during the time of inflation it has been observed gold retains its value.

Consult a financial advisor for personalized guidance.

Q) What is a good rate of return?

Answer - A good rate of return is generally considered to be one that surpasses the current inflation rate, ensuring that the investment's value grows in real terms.