What is Digital Gold?

Digital gold, also known as E-Gold, is a digital representation of physical gold that allows investors to purchase, hold, and trade gold electronically without the need for physical possession.

Each unit of digital gold represents 99.9% pure 24-karat gold, certified to ensure quality (99.5% purity).

When investors buy digital gold through platforms, the companies buy an equivalent amount of physical gold and store it in secure vaults under the investor's name.

This form of investment eliminates the need for investors to worry about storage, purity, or security, as these aspects are managed by the digital gold platform.

Providers in India: Key players include Augmont Enterprises Private Ltd., State-Owned Metals and Minerals Trading Corporation of India (MMTC), Produits Artistiques Metaux Precieux (PAMP) Switzerland, and Digital Gold India Pvt. Ltd. (SafeGold brand).

Mobile e-wallets like Paytm, Google Pay, and PhonePe, along with brokers like HDFC Securities and Motilal Oswal, also offer digital gold investment options.

Comparative Returns on Gold Over the Past 75 Years

Gold has shown remarkable long-term returns in India.

In 1950, gold was priced at Rs. 99 per 10 grams, and by 2025, it reached Rs. 1,00,000 per 10 grams, reflecting a gain of approximately 1,00,000% over 75 years (CAGR of about 10%).

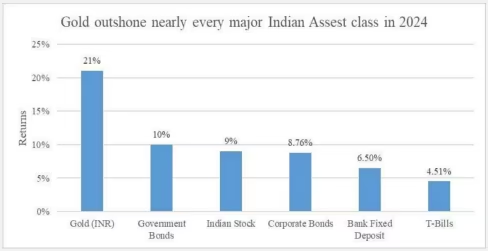

Adjusting for various economic fluctuations, gold has consistently achieved an impressive CAGR of 15%. In 2024, gold outperformed major Indian asset classes with a return of 21%, compared to 9% for Indian stocks.

Gold’s value is driven by price appreciation, as it does not generate cash flows, and its performance is bolstered by its role as a hedge against inflation and economic uncertainty.

Benefits of Digital Gold

Digital gold offers several advantages that make it an attractive investment option:

- Convenience: You can buy and sell digital gold anytime, anywhere, without visiting a physical store. This feature is especially beneficial for those who prefer online transactions.

- Security: The gold is stored in insured, secure vaults by the provider, eliminating the risks associated with storing physical gold at home.

- Liquidity: Digital gold can be easily bought and sold at live market prices, making it highly liquid compared to physical gold.

- Small Investment Options: You can start investing with as little as Rs.1, making it accessible to small investors.

- Purity: Digital gold is typically 24K 99.9% pure, ensuring you get the highest quality gold.

- No Storage Hassles: Unlike physical gold, you don’t need to worry about storage costs or security measures.

- Modern Appeal: Attracts tech-savvy, younger investors, particularly in rural areas, where 82% of youth have internet access (per government surveys).

Drawbacks of Digital Gold

While digital gold has many benefits, it also comes with some drawbacks:

- Lack of Regulation: Unlike gold ETFs or Sovereign Gold Bonds (SGBs), digital gold is not regulated by bodies like SEBI or RBI. This can lead to uncertainties and potential risks.

- Digital Literacy: Only 20% of rural India is digitally literate, limiting the ability to navigate online platforms or conduct secure transactions.

- Taxation: Buying of digital gold is subject to 3% GST, along with capital gains taxes on selling.

- Counterparty Risks: Since the gold is held by the provider, there is a risk that the company might face financial issues or default, potentially affecting your investment.

- Investment Limits: Some platforms have a daily investment limit (e.g., ₹5,000 on Paytm), which might not suit investors looking to invest larger amounts.

- Delivery & Other Charges: If you want to convert your digital gold to physical gold, you may incur making charges and delivery costs.

How to Buy Digital Gold in India?

Digital gold can be purchased through various apps and platforms, making it incredibly convenient for investors. Here’s how you can buy digital gold through some of the most popular apps in India:

Jar

- Download the Jar app from the Play Store or App Store.

- Sign up using your registered mobile number.

- You can start saving in gold from just ₹10 through any UPI app like Google Pay, Paytm, or PhonePe.

- Jar also allows you to set up autopay for daily, weekly, or monthly contributions, making it easy to build a savings habit.

- Additionally, Jar offers a "round-off" feature, where spare change from your transactions is automatically invested in digital gold.

PhonePe

- Open the PhonePe app and navigate to the "Savings" section.

- Choose among daily, monthly or one-time gold investment options.

- You can buy digital gold starting from ₹10 with 1.2 Cr existing e-Gold buyers.

- PhonePe has also partnered with Jar to offer "Daily Savings" in digital gold, allowing users to save small amounts daily.

Paytm

- Open the Paytm app and tap on the "Paytm Gold" option.

- You can buy digital gold starting from ₹9 to ₹1,00,00,000 with 5.35 Cr existing e-Gold buyers.

- Paytm also offers occasional deals and discounts on digital gold purchases.

These platforms make buying digital gold as simple as a few taps on your smartphone, eliminating the need to visit a physical store.

Taxation on Digital Gold

Goods and Services Tax (GST):

Digital gold purchases are subject to a 3% GST, applied at the time of transaction.

Capital Gains Tax:

Profits from selling digital gold are subject to capital gains tax, depending on the holding period:

- Short-Term Capital Gains (STCG): If held for less than three years, taxed as per the investor’s income tax slab.

- Long-Term Capital Gains (LTCG): If held for more than three years, taxed at 20% with indexation benefits.

Unlike SGBs, digital gold does not offer tax exemptions on redemption.

Additional Costs:

Storage and insurance charges may apply, which are not standardised and can impact overall returns.

Physical gold delivery (redemption) incurs separate charges, which may include additional taxes.

Impact on Returns:

The 3% GST, potential hidden charges, and capital gains tax reduce the short-term appeal of digital gold compared to tax-efficient options like SGBs.

Comparison With Other Gold Investment Options

|

Investment Type |

Pros |

Cons |

Taxation |

|

Digital Gold |

Convenient, secure, liquid, small investment options, no storage hassles |

Lack of regulation, counterparty risks, investment limits, and delivery charges |

3% GST on purchase; STCG as per income slab, LTCG at 20% with indexation |

|

Physical Gold |

Tangible, sentimental value, can be used as jewellery |

Storage costs, risk of theft, purity issues, less liquid, and making charges |

Same as digital gold |

|

Gold ETFs |

High liquidity, traded on exchanges, no storage costs, SEBI-regulated |

Market fluctuations, management fees |

STCG as per income slab, LTCG at 10% (without indexation) or 20% (with indexation) |

|

Sovereign Gold Bonds (SGBs) |

No credit risk, 2.5% annual interest, tax-free on maturity, demat form |

Less liquid, fixed 8-year tenure (exit after 5 years) |

No capital gains tax if held to maturity; otherwise, as per capital gains rules |

Comparison Summary:

- Digital gold is ideal for those who want convenience, security, and small investment options but are willing to accept the lack of regulation and potential counterparty risks.

- Physical gold is best for those who value tangibility and sentimental attachment but are prepared for storage hassles and lower liquidity.

- Gold ETFs are suited for investors who prefer liquidity and regulation but are comfortable with market fluctuations.

- SGBs are ideal for long-term investors who want tax benefits and guaranteed interest.

Who is Digital Gold Best Suited For?

Digital gold is particularly well-suited for:

- Small Investors: With the ability to invest as little as Rs.1, it’s perfect for those with limited capital.

- Digital-First Users: People who are comfortable with online transactions and prefer digital investment platforms.

- Those Valuing Convenience and Security: Digital gold eliminates the need for physical storage and offers the security of insured vaults.

Conclusion: Is Digital Gold a Smart Investment in India?

- Digital gold has the potential to transform India’s investment landscape, particularly in rural areas, by combining cultural significance with modern accessibility.

- If challenges like regulation, trust, and digital literacy are addressed, digital gold can become a cornerstone of financial inclusion, enabling more Indians to invest in a secure, flexible, and contemporary format.

- Given India’s projected gold demand of 855 metric tonnes by 2028 and its status as a global gold consumer (802.80 metric tonnes in 2024), digital gold is poised for significant growth, making it a smart investment for those prioritising convenience, accessibility, and long-term value preservation.

Disclaimer: The recommendations and opinions shared by experts regarding the stock market and other asset classes are their own. These views do not reflect the official stance or position of Jar.