TDS stands for Tax Deducted at Source. A TDS return is a summary in the form of a quarterly document that contains all the TDS-related information and transactions that have been made in that specific quarter.

This TDS return usually comprises detailed data of the TDS that has been collected and further deposited to the income tax authority.

If you want to know how to file TDS return, this article is going to be your guide.

Eligibility criteria for filing TDS Return

Employers or organizations who possess a valid TAN (Tax Collection and Deduction Account Number) are eligible to file for a TDS return.

Any employee or person who makes payments that are specified under the I-T Act needs to deduct the tax at source. Don’t know how to file TDS return online? Keep reading.

ITA has laid down the following payouts against which TDS should be filed. Thus, if you fall among the following categories, you must know how to file tds quarterly return.

- Income generated from salary

- Income generated on securities

- Income generated via insurance commissions

- Income generated via NSC payouts

- Income generated on winning horse race

- Income generated on winning a lottery, prize etc

TDS Deduction rate

The rate of TDS that is levied on each income varies depending on several factors, like the total revenue that has been generated or the source of income.

Depending on these two factors, theTDS Deduction rate is calculated.

TDS is levied on incomes or earnings generated via several sources such as commissions, rent, salaries, interest on policies, professional fees, earnings from the lottery etc.

Each source has a different rate of TDS which will be calculated once you specify your income and its source. If you're wondering about how to file TDS returns online without software, you should keep reading this article, as JAR is here to help you out.

The TDS deduction rate for different sources of income are as follows.

- Salary: The TDS deducted on salary depends on the person’s income tax slab rates.

- Fixed Deposits: TDS deducted on interest earned from FDs is typically 10% (given the interest exceeds RS 10,000 in a financial year)

- Rent: TDS deducted on rent is 10% if the annual rent exceeds Rs 2,40,000

- Professional fees and Technical services: TDS deducted on Professional fees and technical services is 10%

- Commission: TDS deducted on commission is typically 5% of the commission earned.

What are the types of TDS Return Forms?

As discussed earlier, there are several sources of income on which TDS is levied.

Thus, there are several different forms depending on the income source that need to be filled up. If you want to know how to file TDS and know about the forms, the following points shall help you out.

- 24Q: This form is applicable for the tax that is deducted from salaries at the source. Use this form once you know how to fill TDS for salary.

- 26Q: This form is meant for the tax that is deducted at the source for income that isn't generated via salaries.

- 26QB: This form is meant to be filled when the income generated is via immovable properties.

- 27Q: This form acts as a Certificate of the tax amount that has been deducted from income generated via interest and dividends that are payable to NRIs or Foreign organisations.

How to file TDS return online step by step?

If you are wondering how to file TDS return online step by step, the following steps will help you out thoroughly.

Step 1 -

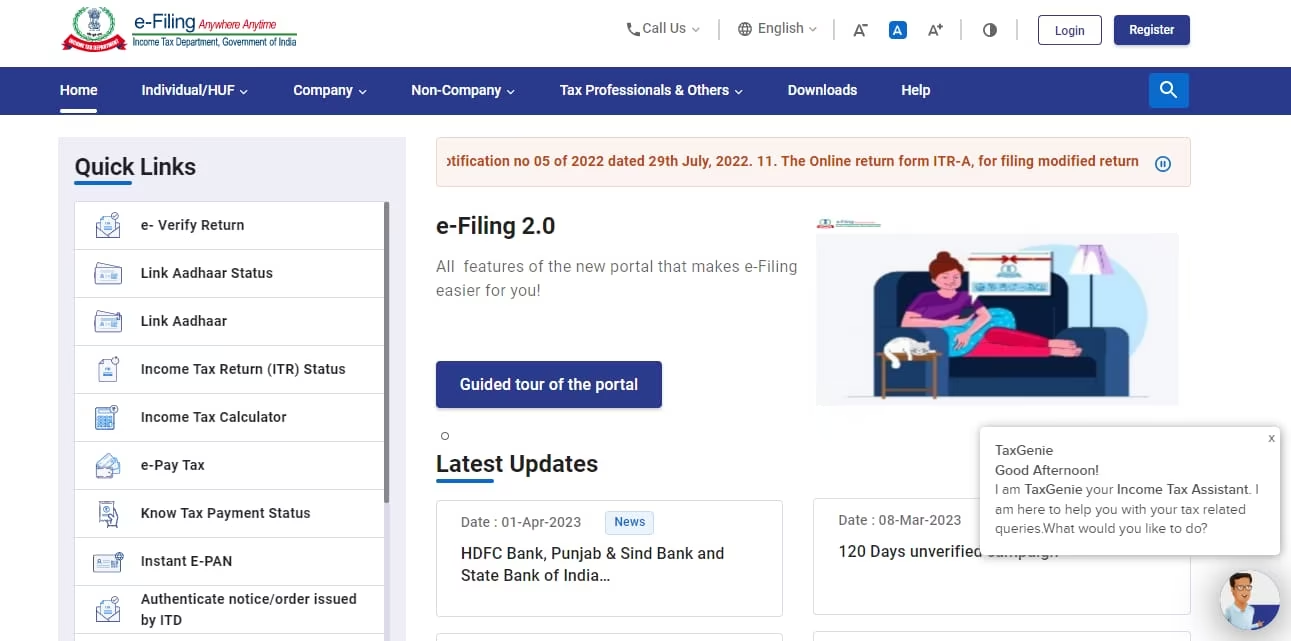

Visit the following website http://incometaxindiaefiling.gov.in/

Step 2 -

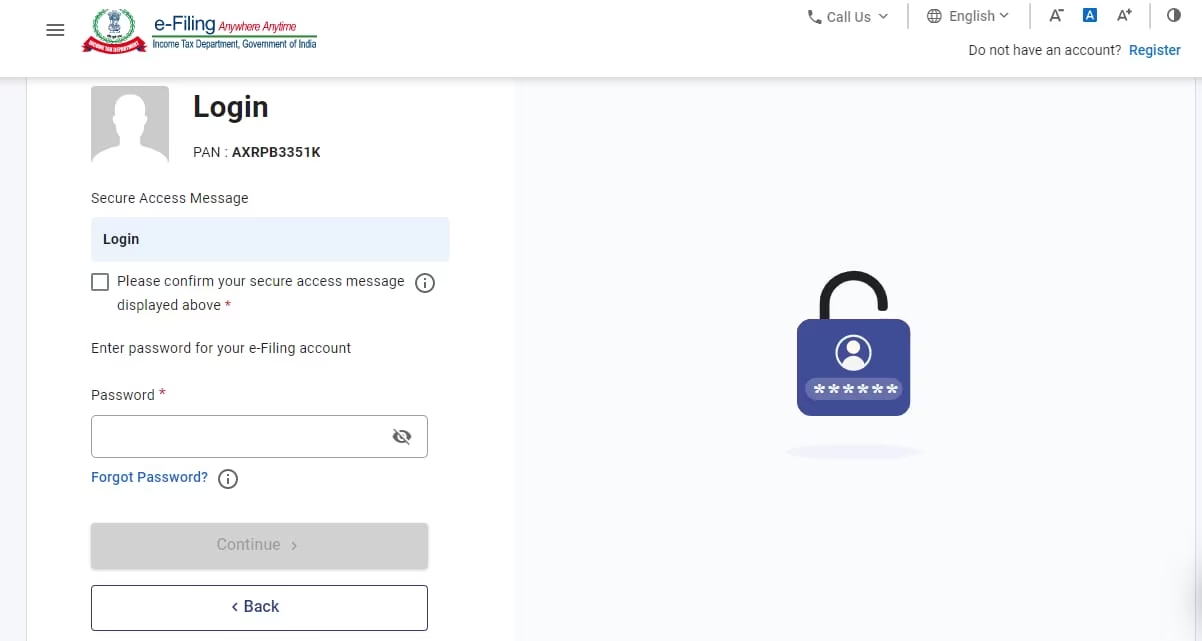

Log In to the website using your TAN details.

Step 3 -

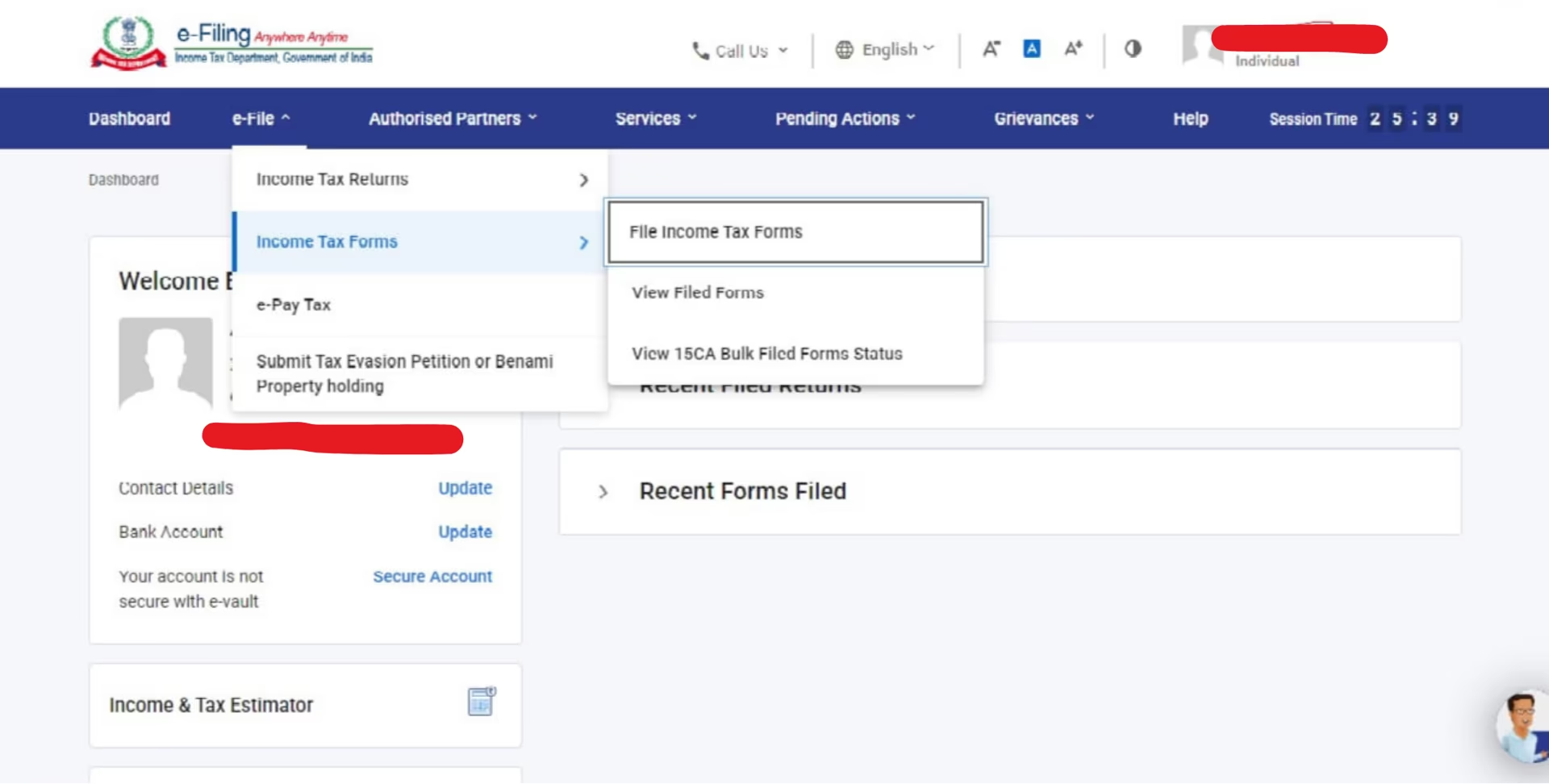

Click 'e-File' after that, click 'Income Tax Forms' then you need to click 'File Income Tax Forms'

Step 4 -

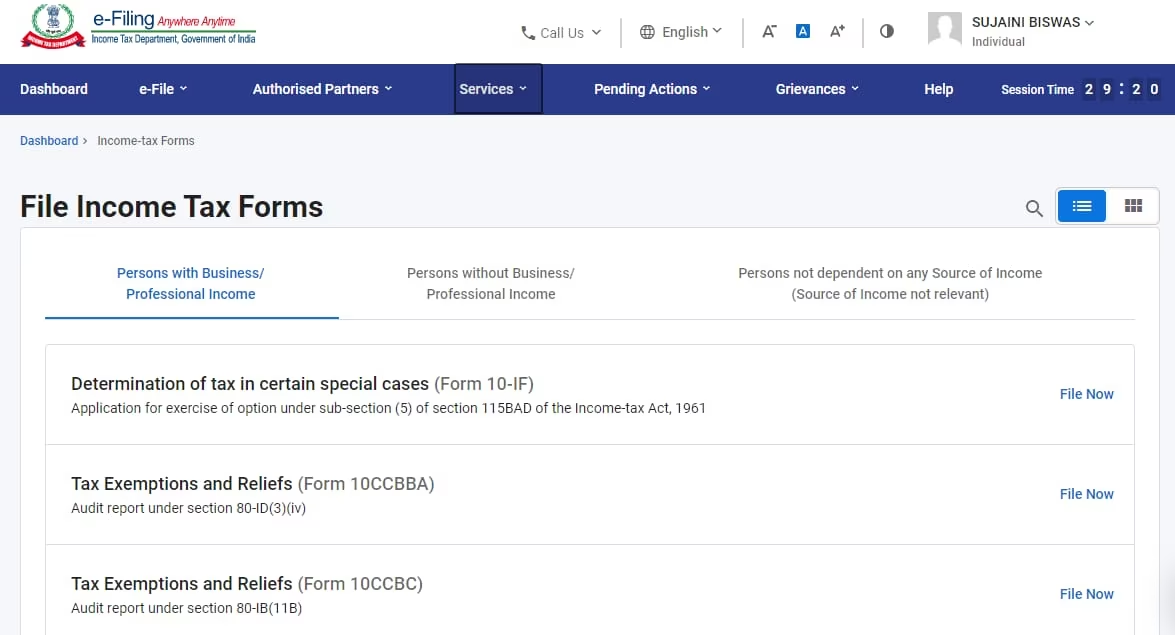

Select the form that is suitable for you. For example, if you want to file for TDS on salary and know how to file TDS return for salary, Choose form 24Q.

Step 5 -

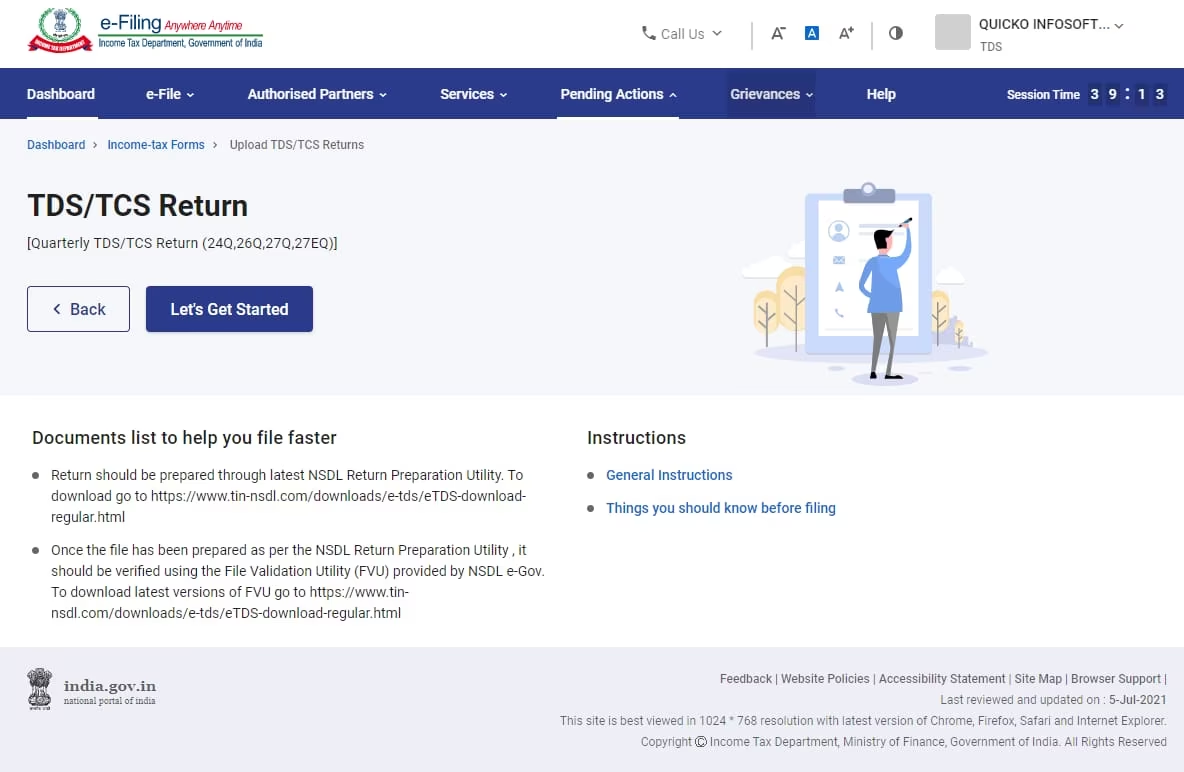

Select 'Upload TDS form' and then, go to 'Let's Get Started'

Step 6 -

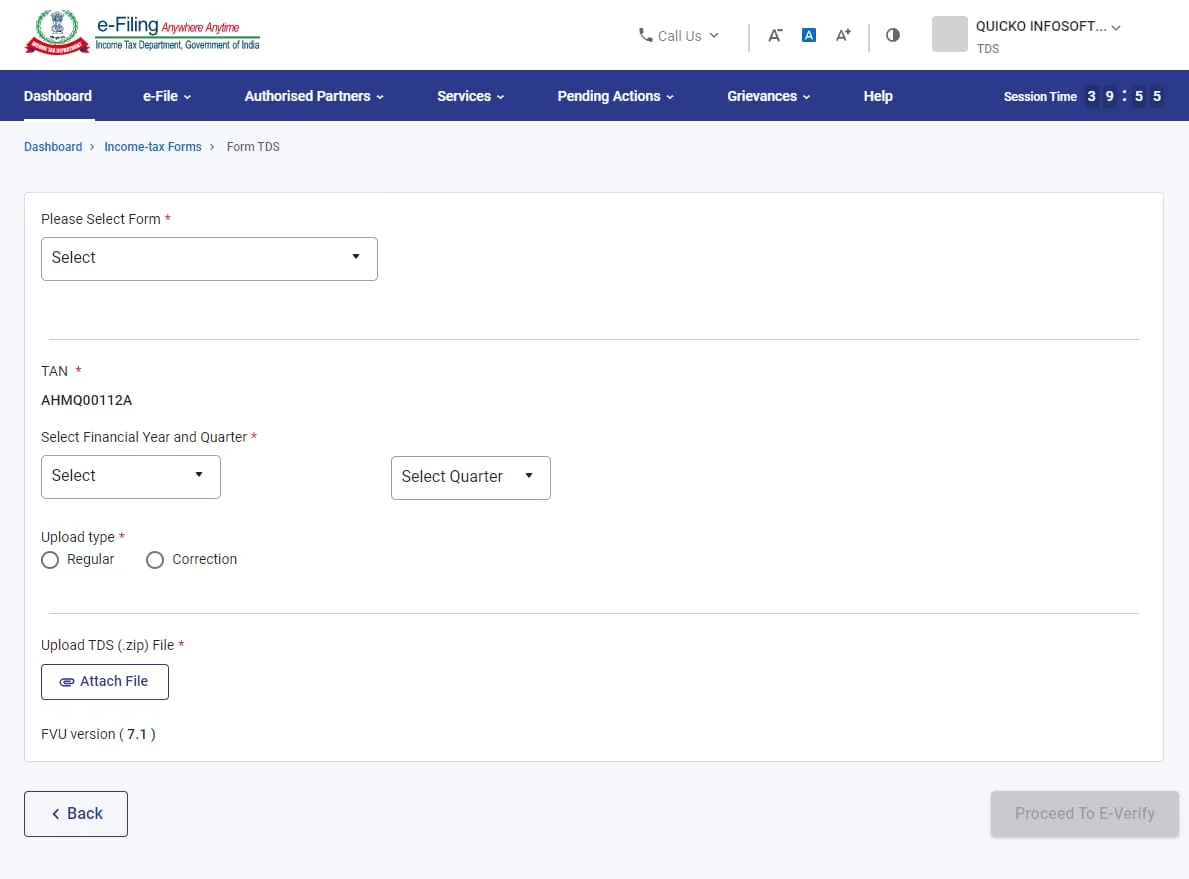

Fill in with the required details correctly and then select 'Proceed to Verify'

Step 7 -

An OTP will be sent to the registered mobile number that you need to enter in order to authenticate the return and complete the process.

Once the process has been completed, you shall receive a message that will state that your TDS filing process has been executed successfully.

Requirements for Uploading your TDS return online

Every taxpayer must go through the following points before uploading their TDS returns after they have been acquainted with how to fill TDS online. Thus, keeping all the necessary data handy will become more convenient.

- Taxpayers must have a valid Tax Deduction and Collection Account Number or TAN.

- Taxpayers must be registered on the e-filing portal to upload their TDS return online.

- A Digital Signature Certificate or DSC must be registered for e-Filing.

- File Validation Utility (FVU) and Return Preparation Utility (RPU) should be used in preparing and validating the specific TDS statement.

- All the necessary details of the taxpayer's Demat account or Bank account must be provided correctly.

- Linking PAN with Aadhar is a must for taxpayers who want to upload TDS returns via EVC.

What are the Due dates to file TDS return

The due dates set to file for TDS returns for each quarter are given below. One must try to not miss the due dates and file for their TDS on time.

Quarter 1: 31st July

Quarter 2: 31st October

Quarter 3: 31st Jan

Quarter4: 31st May

FAQs

Q) Can I file TDS return online myself?

Answer - Yes, you can file TDS returns online yourself. The Income Tax Department provides an e-filing portal where you can register as a taxpayer and submit TDS returns electronically. Ensure you have the necessary documents and follow the instructions on the portal to complete the process accurately. Scroll up to know how to fill TDS first time.

Q) How To fill the TDS return file online?

Answer - Register on the e-filing portal of IT Dept. Choose the correct form. Enter TAN and other details. Validate data and generate a (FVU) file. Use DSC or e-verification to authenticate. Upload FVU on the portal. Keep a copy of the acknowledgment for records.

Q) How can I return my TDS amount?

Answer - To claim a refund of the TDS amount, File ITR online on the official website or tax portals. Declare TDS details in the ITR form. If TDS exceeds your actual tax liability, you'll get a refund. Verify ITR using Aadhar OTP, DSC, or e-verification code. The refund will be credited to your bank account.

Q) What is the TDS return filing professional fees?

Answer - The TDS return filing professional fees can vary based on several factors, including the complexity of your financial transactions, the volume of TDS entries, and the expertise of the professional or firm you hire.

Q) What is NSDL TDS return?

Answer - NSDL TDS return refers to the online platform provided by the National Securities Depository Limited in India for filing TDS returns. It allows entities to submit their TDS returns electronically.

Q) How to proceed with TDS return login?

Answer - To log in for TDS return filing, visit the NSDL e-filing portal (www.tin-nsdl.com). Select "TDS" under the "Login" section. Enter User ID (TAN), Password, and Captcha. Click "Login" to access your TDS account.