If you're a freelancer and wondering how to file ITR, you're at the right place. We've made a comprehensive guide to filing ITR for freelancer.

Are you a freelancer? Don’t work as a regularly paid 9 to 5 employee? But your income exceeds the income tax exemption level? If yes, you need to be aware of the process of filing ITR for freelancer.

You must file an Income Tax Return according to Income Tax Legislation. Freelancers, like other salaried or corporate taxpayers, must pay taxes on their earnings.

We at Jar are here to help you with the process to pay your taxes easily and on time.

What are Freelancers and should they file ITR?

Freelancers are self-employed individuals who work on multiple projects for multiple clients, from the convenience of their own homes.

Consultants, website designers, software designers, social media managers, and content writers - are all some of the professionals who qualify as freelancers. These freelancers earn money by supplying their clients with manual and intellectual services.

However, this convenience does not come without a cost.

Freelancers, like any other business or salaried person, are required to pay taxes to the government on their earnings under the Income Tax Act.

How do Freelancer Pay Tax?

Filing ITR for freelancer may be a little more difficult because you don't have an HR department to offer you the famous Form 16 and help you through the procedure.

On top of that, having more clients and varying amounts of income and expenses requires more calculations and record-keeping.

Even as a freelancer, you must follow the same basic principles for ITR filing as you would for any other profession or firm - Income and Expenses.

Freelancers with a gross annual income of up to Rs. 50 lakhs can take benefit from the Presumptive Taxation Scheme under Section 44ADA of the Income Tax Act, 1961.

This scheme allows them to pay tax on only half of their gross income, which can save them a significant amount of money. However, it is important to note that not all freelancers are eligible for the scheme. Only those with a gross annual income of up to Rs. 50 lakhs can use it.

Freelancers earning more than Rs. 1 crore are required to get their business income audited. They must also deduct TDS at the rate of 10% on all payments made to professionals that exceed Rs. 30,000 in a financial year.

Freelancers can file their income tax returns using the ITR-4 form under the Presumptive Taxation Scheme, which allows them to pay tax on only half of their gross income.

Do Freelancers Pay Tax in India?

In India, freelancers are subject to Income tax and GST (Goods & Services Tax). If a freelancer's annual turnover exceeds INR 20 Lakhs (INR 10 Lakhs in the North Eastern and hill states), he/she must register for GST.

The GST rate is 18% for the majority of services but may differ depending on the freelancer's goods and services.

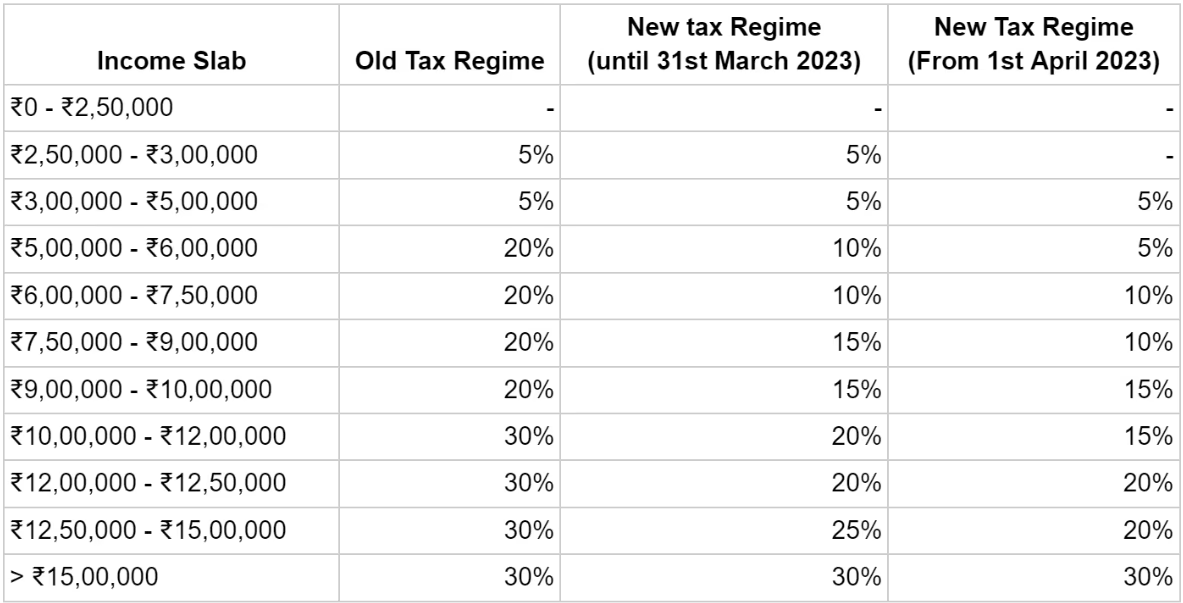

Freelancers must additionally pay income tax at the current rate. The following are the income tax rates that apply to freelancers under the age of 60:

Which ITR Form to Fill for Freelancers?

ITR-4 is the ITR form for freelancer. Remember, your account books should be audited if your income exceeds INR 1 crore.

There is no need for an audit if your turnover is less than INR 1 crore. ITR Form 4S should be used if a freelancer chooses the Presumptive Method of Taxation.

How to File ITR for Freelancer?

The simple steps to file Income Tax returns for freelancers are as follows:

Step 1: Go to the e-filing portal for Income Taxes.

Step 2: ITR-4 is available for download under the 'Download' page.

Step 3: Complete the ITR-4 form with all of your information. Fill in general information, gross total income, deductions, and taxable total income, details of business and profession income, TDS (tax deducted at source) details, and advance tax and self-assessment tax details.

Step 4: Use Form 26AS to calculate your Tax. To save money on taxes, you can claim tax deductions and exemptions under numerous sections. Any expenses during the tax year, such as property rent, repair charges, travel expenses, municipal taxes on company property, and domain registration expenses, can also be claimed.

Points to keep in mind while submitting ITR for freelancer:

- Gross receipts must be listed - Freelancers must keep track of all receipts from freelancing work accomplished over the course of a financial year.

- Claim expenses - When claiming expenses, freelancers should remember the following points:

- The cost is incurred as a result of the freelance work.

- Expenses aren't personal, and neither are capital expenditures.

- If the cost is not incurred for any cause. That is a criminal offense forbidden by law.

- If paid in cash, expenses totaling more than INR 10,000 per day are not recognized as a deduction.

- There is no way to claim Capital Expense as an expense. For example, purchasing laptop, furniture, and so on.

How to Save Tax on Freelance Income?

You may have incurred a number of costs in your quest to give freelance services to your clients.

Internet fees, rent, travel expenses, hospitality and entertainment costs, depreciation, maintenance, subscription charges, office furniture costs, and other utility bills are just a few examples.

You may have also enlisted the help of others to help you with your freelancing employment. This is another cost to consider when calculating your spending.

To arrive at your net taxable income for a given assessment year, you must subtract all of these expenses directly related to generating your freelancing income from your gross income.

Some of the Applicable Deductions as per the Income Tax Department of India

- Section 80C: You can claim a deduction of up to ₹1.5 lakhs on investments in a variety of financial instruments, such as ELSS, ULIP, insurance, FDs, etc.

- Section 80 CCD: You can claim a deduction of up to ₹1.5 lakhs on investments in central government schemes, such as PPF, NSC, Sukanya Samriddhi Yojana, etc.

- Section 80CCB: You can claim a deduction of up to ₹20,000 on investments in government-notified infrastructure bonds.

- Section 80D: You can claim a deduction of up to ₹25,000 on health insurance premiums paid for yourself, your spouse, and your dependents.

- Section 80DD: You can claim a deduction of up to ₹1.5 lakhs on expenses incurred on the treatment of disabilities.

- Section 80E: You can claim a deduction of up to ₹100,000 on interest paid on education loans taken for yourself, your spouse, or your dependents.

- Section 80G: You can claim a deduction of up to 50% of the amount donated to charitable trusts and relief funds.

TDS Adjustments

Deduct 10% tax from your total payment for clients for whom you freelance (as per section 194J of the IT Act) as tax deducted from the source (TDS).

Furthermore, if you hire someone to help you with your freelance work, you must remove a 10% tax from their money before passing it on to them. When filing ITR for freelancing work, you must deduct this amount as TDS.

GST for Freelancers

If your total revenue for the year reaches INR 20 lakhs, you must register for GST. If your annual revenue is less than INR 20,000, you are exempt from the GST.

You must charge GST to your clients if you are eligible for GST registration or already have a GST number. The GST rate varies depending on the freelance service you provide, but most services covered by GST have an 18% tax.

Advance Tax

If your tax liability for a given year exceeds INR 10,000, you will be required to pay taxes quarterly as a freelancer.

This type of tax is known as 'Advance Tax' since it is paid in advance. You are required to pay a minimum defined proportion of your tax before the end of each quarter under this arrangement.

Payments for Advance Tax can be made using the IT department's Challan 280. You will be given a receipt once you have completed this payment.

Keep this receipt handy because you'll need it when filing your ITR. You will be penalized if you are entitled to Advance Tax but choose not to pay it under sections 234B and 234C.

When Should I File My Tax Return?

The deadline for filing an ITR for freelancer is July 31st (after the end of each financial year for which it has to be filed). The Income Tax Department has the authority to extend this deadline.

What if you miss the deadline or wish to file a Tax Return after the Income Tax Return Filing Deadline has passed?

Even if you miss the deadline, you can still file a Late/Belated Return. Three months before the relevant assessment year, a late income tax return can be filed.

Now that you know how and when you are required to file an ITR, you must ensure that you finish the process each year before the deadline.

You don't want to jump on the wrong side of the law, right? Start making your Income Tax files cleaner and stronger.

As a freelancer, keep an account book and records of everything & choose the right form.

File accurate income tax returns; and if you require any assistance, do not hesitate to contact a professional.