Introduction

In May 2025, gold remains one of the top-performing global assets, supported by a weaker US dollar, ongoing geopolitical tensions, and strong investor interest.

While both China and India experienced price rallies in April, their domestic markets showed contrasting dynamics. China’s gold market surged on robust institutional investment and speculative trading, whereas India’s demand remained anchored in retail buying and cultural traditions, despite high prices and the recent key gold-buying festival.

This report delves into the unique drivers shaping gold’s performance in both countries, offering detailed insights and outlooks.

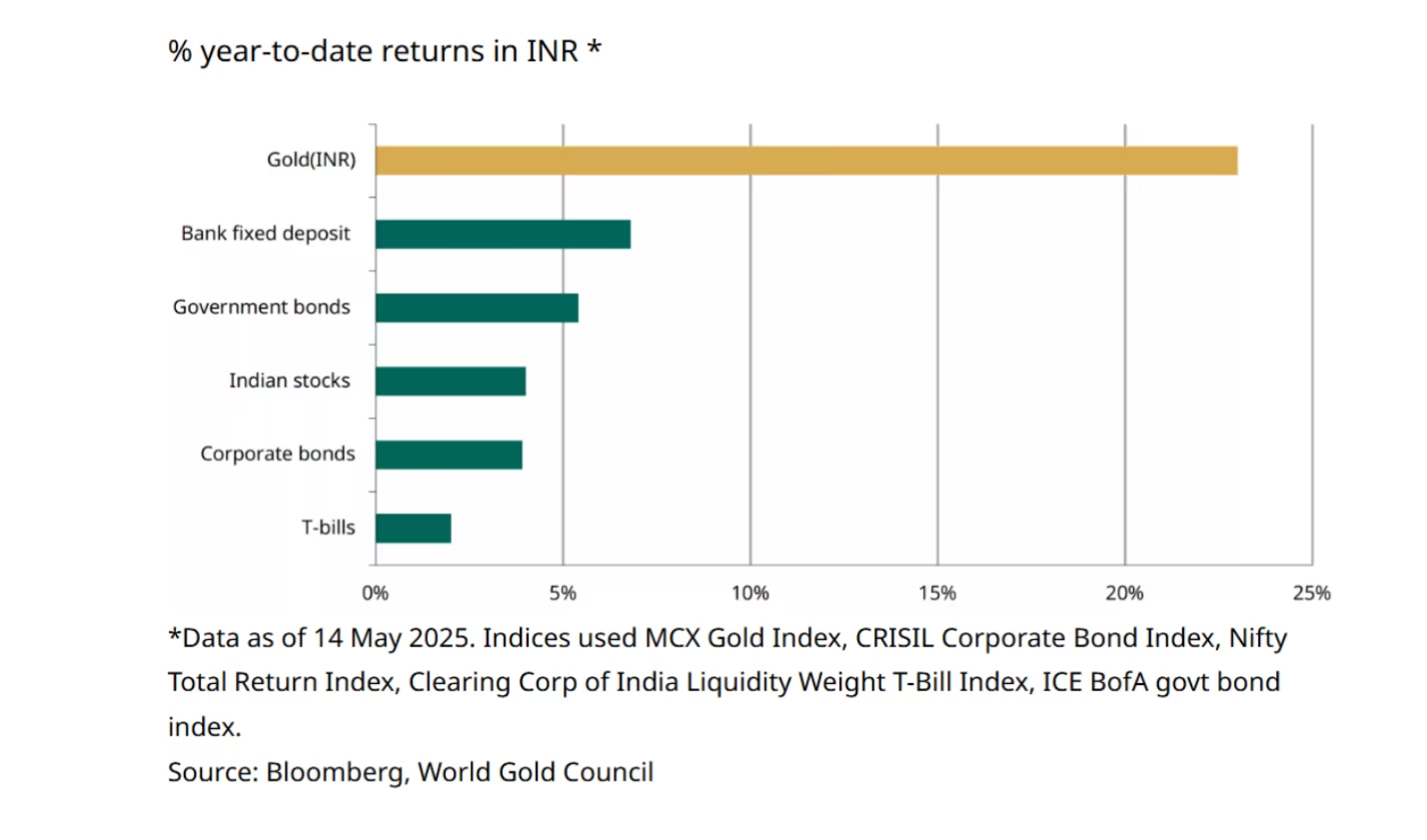

Chart: Gold dominates other asset classes

Gold Prices & Returns:

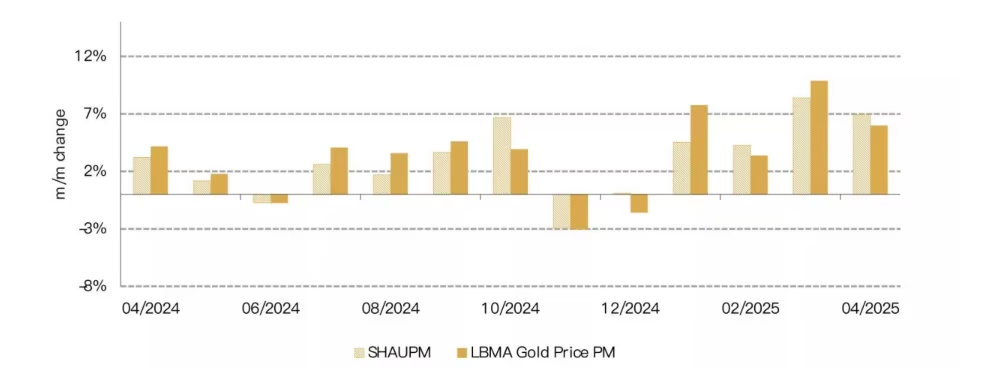

In April 2025, the Shanghai gold price (SHAUPM) increased by 6.9%, contributing to a strong year-to-date return of 24% since January.

This performance reflects robust buying activity from Chinese investors, further supported by the strength of the Chinese yuan (RMB).

The combination of active investment demand and a stable currency has propelled China’s gold market, giving it a slight edge in returns and market momentum.

Meanwhile, in India, the LBMA gold price rose by 6% in April, resulting in a year-to-date return of 23%. Indian spot gold prices touched ₹93,407 per 10 grams during this period.

While returns were marginally lower compared to China, gold remains a preferred asset class for Indian investors, largely driven by strong retail demand and cultural significance.

This resilience underscores gold’s continued appeal amid broader investment options in the Indian market.

Both Markets Gave Better Returns Than Stocks Or Other Investments. China Has A Slight Edge Due To More Investment Activity And A Strong Currency.

Gold ETFs (Exchange-Traded Funds)

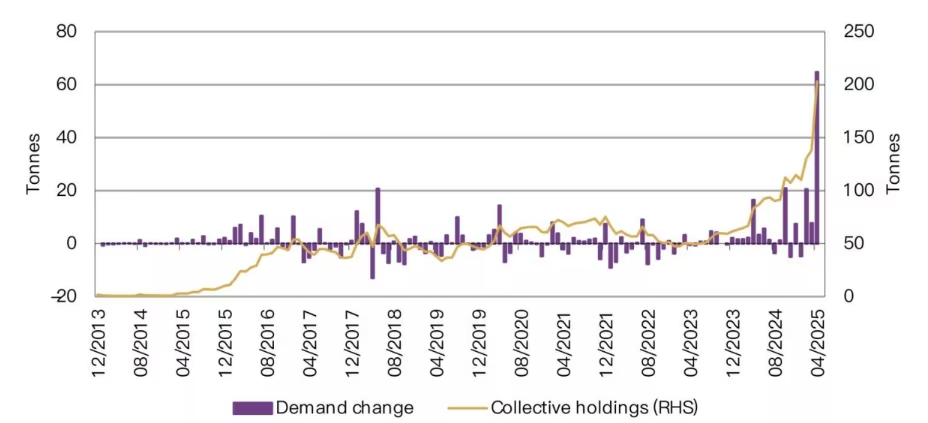

China:

In April, China witnessed significant gold buying, with an addition of 65 tonnes valued at over ₹56,000 crore. This strong demand pushed total gold ETF holdings to reach 203 tonnes.

Moreover, the total value of gold ETFs (Assets Under Management) surged by an impressive 57% within just one month, reflecting heightened investor confidence and active participation in gold investments.

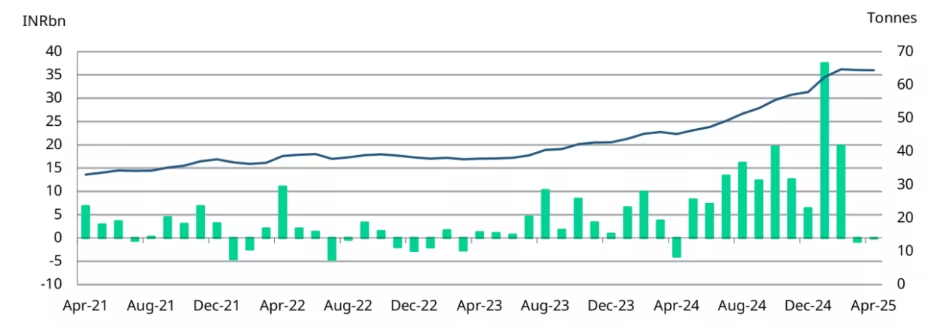

India:

In contrast, Indian investors experienced a net outflow from gold ETFs amounting to ₹1,669 crore, indicating some profit-booking during the period.

Nevertheless, the overall value of gold ETFs increased to ₹61,400 crore, supported by rising gold prices.

Additionally, new investor accounts continued to grow, suggesting sustained interest and long-term trust in gold as an investment option despite short-term profit-taking.

China is buying gold ETFs heavily. In India, investors are booking profits but still trust gold for the long term.

Central Bank Buying

China:

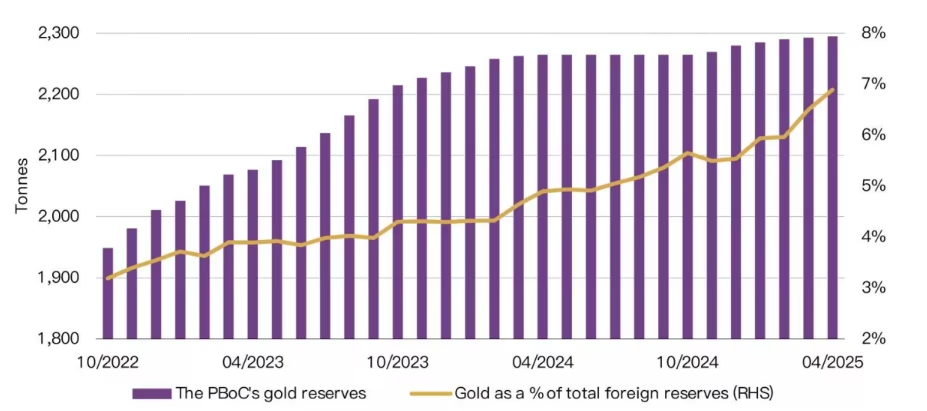

China’s central bank continued its gold accumulation for the sixth consecutive month, purchasing 2.2 tonnes in April.

This sustained buying trend has raised the country’s total gold reserves to 2,295 tonnes, which now account for approximately 6.8% of China’s total foreign exchange reserves.

The steady accumulation underscores China’s strategic focus on diversifying its reserve assets amid global economic uncertainties.

India:

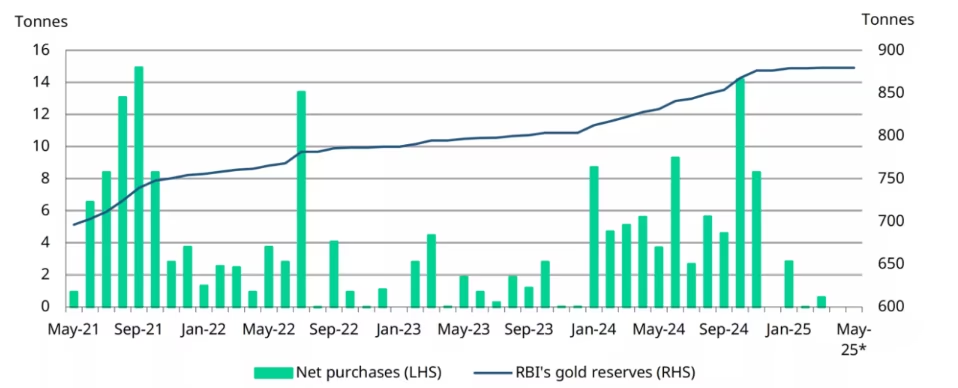

In contrast, the Reserve Bank of India (RBI) has adopted a more measured approach to gold purchases in 2025, acquiring just 3.4 tonnes so far this year.

Despite the slower pace, India continues to hold a record gold reserve of 879.6 tonnes. The RBI’s position reflects a stable long-term commitment to gold as a strategic component of the country’s reserve management.

China’s Central Bank Is Buying Steadily. India Is Holding Back This Year After Heavy Purchases In 2024.

Jewellery Demand

China

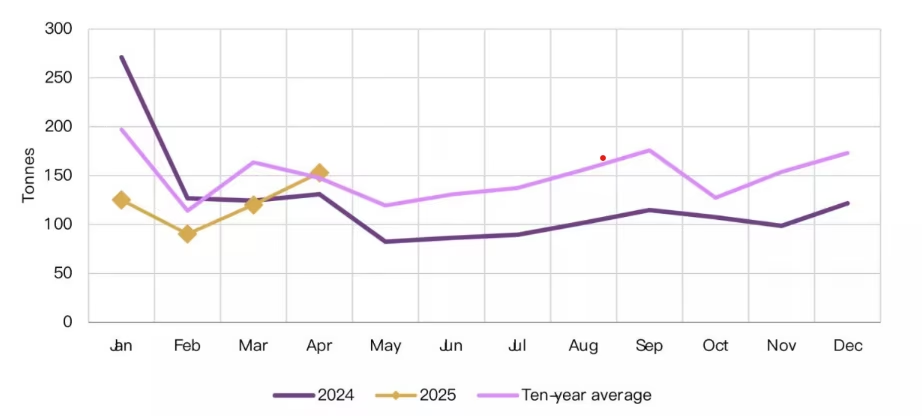

In April, the Chinese gold industry withdrew 153 tonnes of gold from the Shanghai Gold Exchange (SGE), marking a 27% increase month-on-month and a 17% rise year-on-year.

This surge in wholesale gold demand was further reflected in the sharp rise in the local gold price premium, which averaged US$37 per ounce, significantly higher than March’s US$2 per ounce.

Several factors contributed to this strength. Investor interest in gold bars and coins remained robust, with gold continuing to be viewed as a top-performing asset amid rising US-China trade tensions.

Additionally, jewellers were actively restocking ahead of the early May Labour Day holiday, following relatively lower withdrawals during the first quarter.

India

Gold demand in India in April and early May was mixed, with overall jewellery sales subdued due to high prices and economic uncertainty.

Akshaya Tritiya saw stronger sales for large retailers, driven by promotions, while smaller jewellers faced weaker demand.

Consumers preferred lightweight jewellery and low-weight coins, with many opting for online purchases. Southern India led regional demand.

Despite lower volumes, the value of sales rose due to higher gold prices. Old gold exchange and recycling remained a key trend.

High prices are slowing jewellery sales globally. India saw festive support during Akshaya Tritiya, while China’s retail demand dipped, though wholesale and investment activity remained strong.

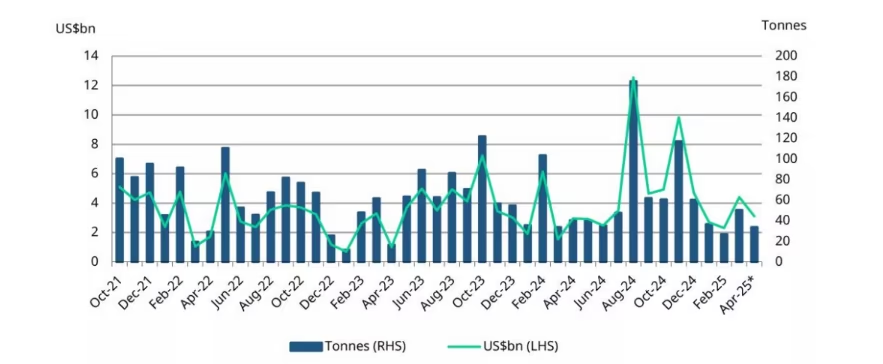

Gold Imports

China

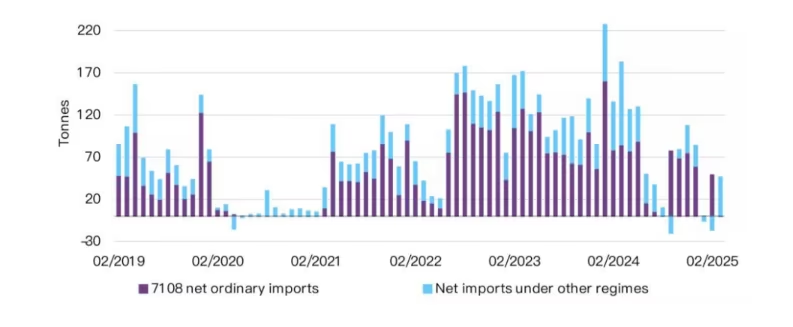

China's gold imports declined sharply in March, falling to just 46 tonnes compared to 183 tonnes during the same month last year.

As a result, total gold imports in the first quarter of 2025 were the lowest since 2021, reflecting softer retail demand and reduced appetite for imported gold.

India

In April 2025, India imported around 30 to 36 tonnes of gold, valued at approximately US$3.1 billion (₹25,000 crore).

- Although this was lower than March, it was still higher than the January–February average.

- Compared to April last year, imports were 5% higher, showing that demand remains steady.

- Even with high gold prices, people are still buying, which shows continued interest and trust in gold.

(Despite price pressures, India's gold demand stayed strong in April.)

China’s imports are declining, while India is showing resilience by maintaining steady demand despite high prices.

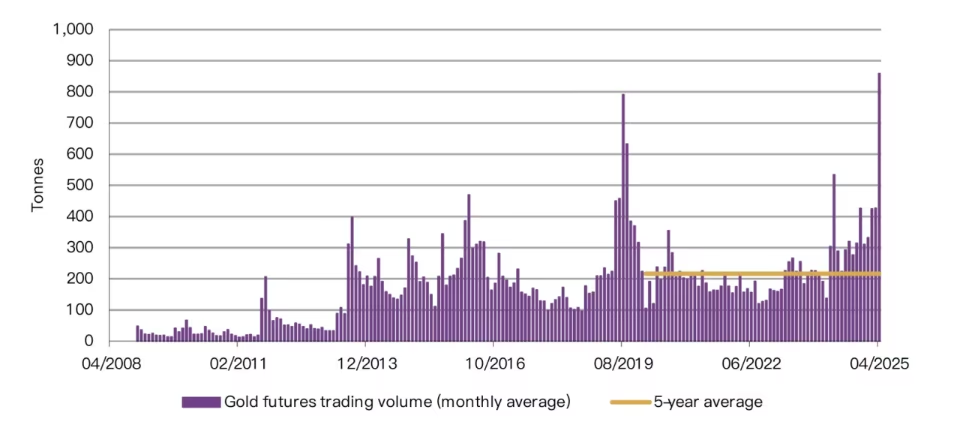

Trading in Gold Futures

In April, Chinese investor interest in gold futures reached record levels. The average daily trading volume on the Shanghai Futures Exchange (SHFE) doubled compared to March, hitting 859 tonnes.

This sharp rise was mainly due to strong gold prices and big price swings that attracted more traders. In early May, trading slowed slightly but still stayed high at around 756 tonnes per day, showing that investor interest in gold futures remains strong.

Stay up to date with gold trends through the Jar app.

Macro Outlook

Short-Term Outlook

In the short term, gold demand in China may slow down as the jewellery buying season ends and interest in gold ETFs starts to cool.

On the other hand, India could see a recovery in demand if gold prices stabilise, especially with upcoming festivals and the wedding season, which are likely to boost consumer interest.

Long-Term Outlook

Over the long term, China is expected to maintain a strong strategic interest in gold. Both the central bank and institutional investors continue to view gold as a reliable asset, supporting steady and purposeful buying trends in the market.

Technical Outlook

Gold prices are currently trading within a key range, with support levels identified at $3,200, $3,155, and $3,120.

On the upside, resistance is seen at $3,270 and $3,340. A sustained move above $3,270 could trigger further buying momentum, potentially pushing prices toward $3,300 to $3,340.

Conversely, if prices fall below the $3,200 support, the next downside targets are $3,155 and $3,120, where stronger selling pressure may emerge.

A breakout above resistance or a breakdown below support is needed to determine the next clear directional trend; otherwise, gold may continue to trade in a range-bound pattern for the near term.

Conclusion

China leads in large-scale and institutional gold investments, focusing on ETFs, futures trading, and central bank purchases.

Meanwhile, India maintains strong retail demand driven by cultural traditions, festivals, and long-term physical gold buying. Both countries play vital roles in the global gold market, but their investment styles differ.

China favours financial instruments and strategic accumulation, while India emphasises physical ownership and traditional buying.

Together, these diverse approaches underpin a positive outlook for the global gold market going forward.