India's relationship with gold goes back centuries. Investing in gold is seen as a sign of prosperity and financial status in society.

Gold jewellery has always been considered the safest investment mode in India as it remains unaffected by inflation or market fluctuations.

However, the price of the metal has been on a downtrend for quite some time now.

This can be attributed to global economic downturns, slow demand for electronics, jewellery, and other industrial metals, and India's shift to a digital economy.

Yet, the long queues outside jewellery stores during great Indian festivals like Diwali or Akshay Tritiya and the wedding season depict a different story.

But when it comes to physical gold as an investment option, we think it is time we look for safer options to invest in gold, and there are quite a few. Let's find out.

Why is an investment in gold jewellery a risky business in 2022?

We have crossed the half-year mark of 2022. And in the last six months, gold prices in India have been outperforming other stock options.

But let's not confuse overall gold prices with gold jewellery value. Financial experts say it's not a good idea to buy gold jewellery as an investment.

Here's why:

- Gold jewellery comes with wastage: Although gold jewellery is easily liquefiable and more tangible than other digital forms of gold investments, it comes with associated costs like making charges and wastage. While selling, these costs are non-recoverable. In India, top jewellery brands add 25-40% additional amounts as making charges to the selling cost of an ornament.

- Unproductive asset: When you buy gold jewellery, a coin, or a bar, it does not produce wealth. It stays as a lump of gold year over year just as you bought it. Its worth rises solely on the assumption that the future buyer would pay a higher price. But if this same amount of money is invested in other productive asset classes, it will produce real wealth.

- Safety risk: Since gold is a precious and expensive metal, keeping it in your home is a safety risk. The cases of stolen gold jewellery are always on the rise in India. Hence, to keep it safe, you must pay an additional amount for banks to use safety deposit lockers.

- Depreciating cost: Over 800-900 tonnes of gold are imported into India annually to fulfil the demand. As a result, the rupee's exchange rate determines how much we spend on gold. We wind up paying a lot more than the actual purchase price because the Indian rupee's value is declining, making the matter worse for retail buyers.

- Expensive investment: The minimum investment required to purchase actual gold is high. For instance, if you are interested in buying a gold bar, you must pay for at least 10 grams. That's the minimum quantity. Consequently, a sizable segment of the Indian population cannot own it as it's expensive.

- Taxable: You may have to pay tax on your gold jewellery based on how long you have been holding it. For instance, if you sell your gold ornament after 36 months of purchase, 20% tax with indexation benefit and an additional 4% cess and surcharge is levied. To make matter worse, for gold ornaments worth over 30 Lakhs, the buyer is required to pay wealth tax.

Why should you consider digital gold as a clever investment asset?

If you are still interested, there are other ways to invest in gold besides purchasing jewellery – digital gold. It is the future of gold investment. Already 1 Crore of Indians has started investing in Digital Gold using Jar App and you can also join them with just ₹10 in less than 45 seconds.

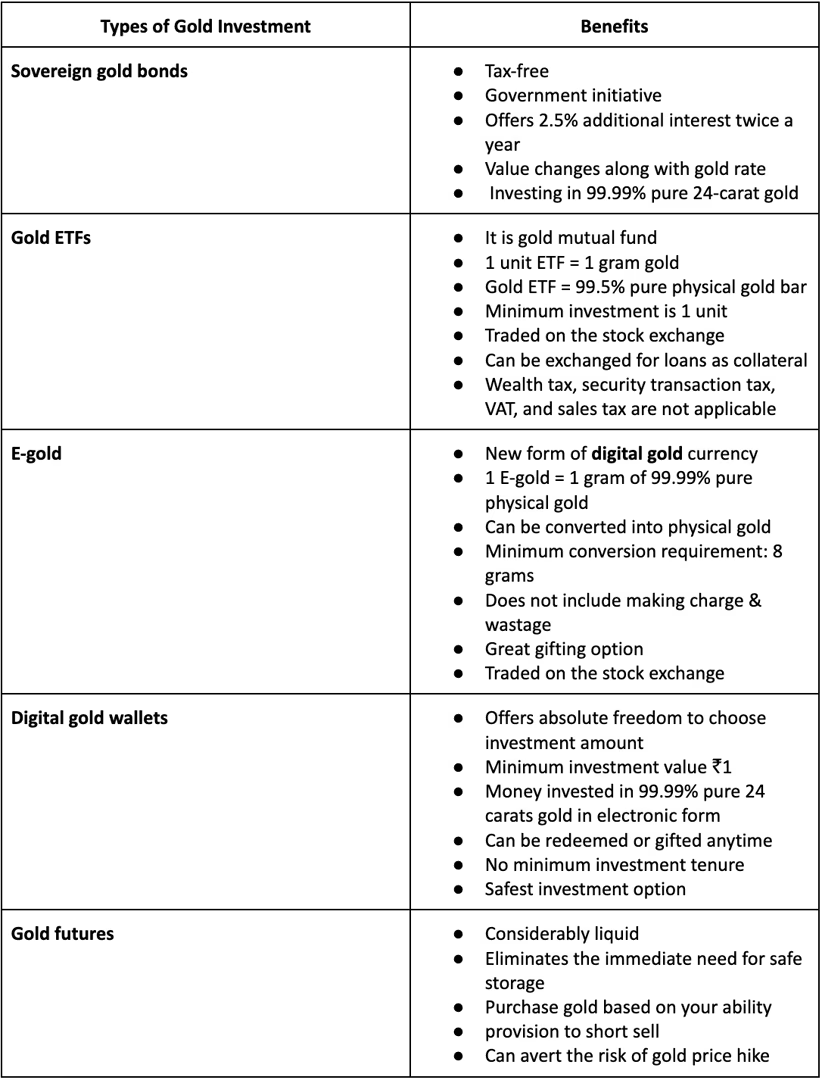

Alternate ways to invest in gold:

Benefits of investing in digital gold

- Pure & economical: Digital gold allows investors to choose their investment amount. There is no minimum investment requirement; you can acquire 99.99% pure 24-carat gold for as little as ₹10.

- Easy to sell & buy: Unlike physical gold, digital gold is simple to redeem. It's extremely easy to buy and sell the units. One can also immediately withdraw their money without any questions asked.

- Collateral for loan: Similar to physical gold, digital gold can also be used as security for loaning money.

- Theft-proof: Because digital gold assets are insured and securely kept in a vault of the issuer, they are impervious to theft. Hence, as the investor, you do not need to pay additionally for a safety locker and stay stress-free.

- Excellent portfolio diversifier: It is a great asset to diversify your investment portfolio. However, many financial gurus advise against holding more gold than 10-20% in the portfolio.

- Hedge against inflation: It has been historically proven that gold is an excellent hedge against inflation. Due to the COVID-19 pandemic between 2018-2020, when Nifty50 in India became extremely volatile and recorded a CAGR of only 10%, gold's CAGR was 19%.

How is the Jar app revolutionising the saving habit of Indians with digital gold?

Jar app is a micro-savings platform that acts as a Digital Piggy Bank for its users.

You can Invest in gold with the Jar app and start saving and growing your Money.

You can invest as little as ₹10 in 99.99% pure 24 carats of digital gold.

Jar app helps you to automatically invests your money in this well-known asset - Digital Gold, it is Powered by SafeGold & backed by the VISTRA - Trustee of the Gold.

Once you download the Jar App, it detect the payments you made for online purchases. It then rounds off the amount nearest to 10 and generates a spare change for your expenses.

Then the app automatically deducts the change amount from your bank account using UPI(once you approve the UPI mandate) and then invest it in 99.9% pure digital gold through SafeGold.

Let's understand this with a small example.

Suppose you just ordered a pizza worth ₹562 from your mobile. As soon as you receive a message from your bank about the deduction, the Jar app rounds it off to the nearest 10. In this case, it is ₹562-₹570=₹8. This ₹8 gets auto-debited from your account using UPI and gets invested in digital gold.

Thus, you can easily save money and invest in gold without effort. The jar app's auto-investing feature makes it easy for those who are not very good at diligently saving and investing.

By automatically deducting money from your bank account and investing in digital gold for better and sustainable returns, it helps develop a habit of saving money effortlessly. Additionally, it makes for a great gifting option.

Conclusion

Gold has been a highly coveted asset for centuries because of its rarity, beauty, and inherent value. It has always held a unique place in the world.

When it comes to investments, gold is a safe and secure way of making your money work for you. Hence, start your Daily Saving Journey now.

It is important to change with time. So, adopt new ways of investing digitally over a long period and reap its benefits.