The difference between needs and wants is crucial for effective financial management.

Needs are the essential items or services necessary for a comfortable life, such as food, shelter, and healthcare. Wants, on the other hand, represent desires or non-essential expenses, like luxury items or unnecessary subscriptions

By learning how to differentiate between needs and wants, you can allocate your resources wisely, prioritize your financial goals and avoid the trap of impulsive and unnecessary purchases.

So, if you're ready to overcome your overspending habits, establish a budget, and start saving for a better future, this article is your comprehensive guide.

Let's dive in and learn how to distinguish between needs and wants.

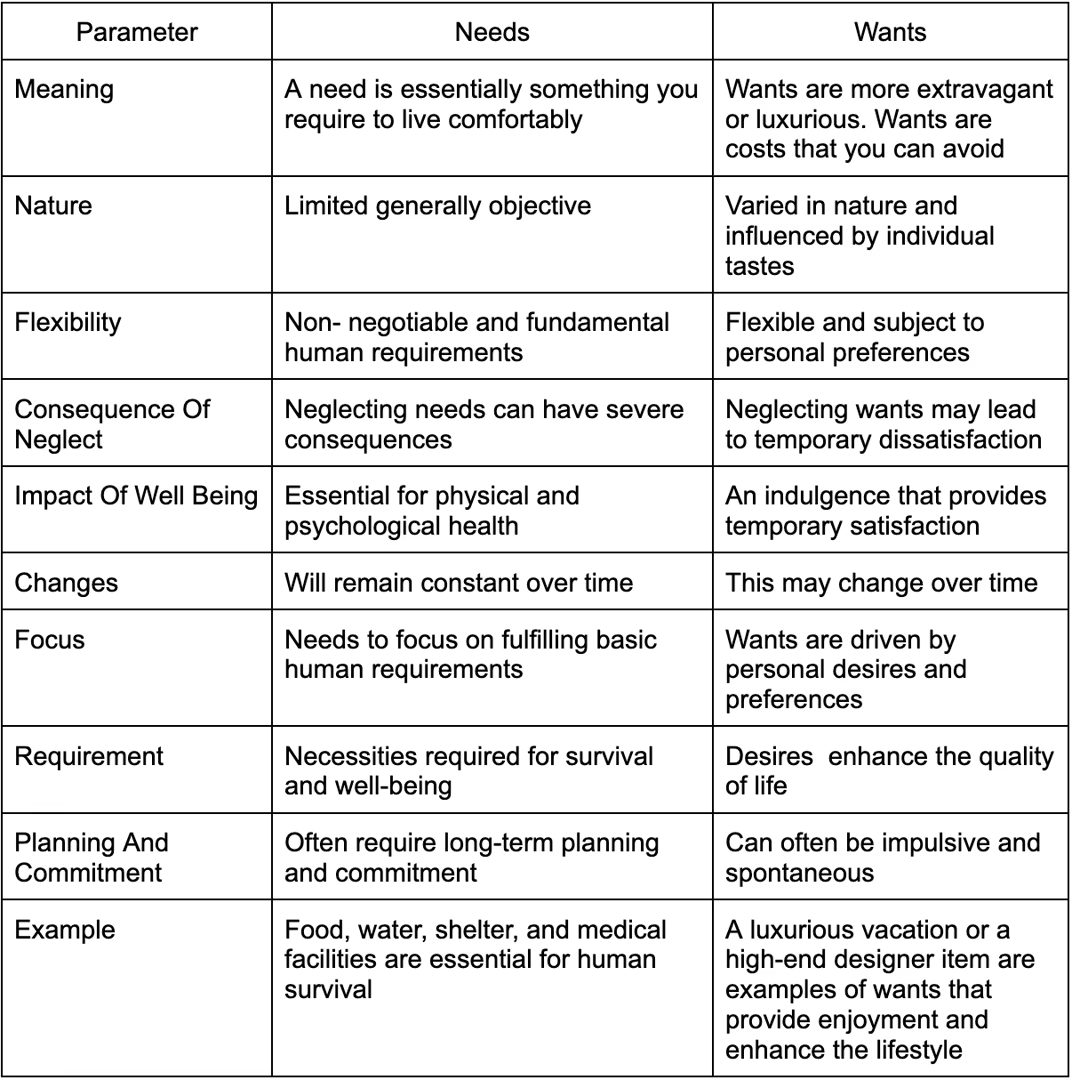

What is the Difference Between Needs and Wants

Here is a quick overview of the 10 differences between needs and wants -

Definition of needs and wants

Needs are essential requirements for a person’s survival and basic well-being.

In the context of economics, needs typically include fundamental goods and services that address both physical and psychological aspects of life.

Physical needs refer to the basic necessities that sustain our bodies and ensure our survival. Examples of physical needs include food, water, clothing, shelter, and healthcare. These physical needs should be the focal point of budgeting, as they directly impact an individual's quality of life.

Psychological needs are crucial for our mental well-being and emotional stability. According to Maslow's Hierarchy of Needs, psychological needs include safety, love and belonging, esteem, and self-actualization.

Wants, on the other hand, are non-essential desires that a person seeks to enhance their experience, provide additional comfort, or satisfy personal inclinations.

These are things that we desire but can live without.

While fulfilling wants can contribute to overall satisfaction and happiness, it is essential to manage and balance them against essential needs in financial planning.

Comparative Example of Needs And Wants

Let's consider the case of owning a smartphone.

A need in this context would be having a basic mobile phone with essential features such as calling, texting, and a simple camera for communication purposes. This need could be fulfilled by purchasing an affordable, entry-level smartphone.

On the other hand, a want might be purchasing a high-end smartphone with advanced features like facial recognition, a high-resolution camera, and a large storage capacity.

While owning a high-end smartphone may bring enjoyment and enhance one's experience, it is not essential for fulfilling the basic need for communication.

Understanding the difference between needs and wants from an economic perspective is crucial for making informed decisions and prioritizing resources in various aspects of life.

Recognizing the distinction between physical and psychological needs can also help individuals focus on maintaining a balanced and healthy lifestyle, both physically and emotionally, while making sound financial decisions.

Needs Vs Wants: How to Identify the Difference

- Analyse Necessity: Determine if the item or expense is essential for your basic survival and well-being. Ask yourself if it is vital for you to live and function properly. If the answer is yes, it is likely a need. If it is not essential for your basic needs, it is likely a want.

- Evaluate Impact: Consider the long-term consequences of the item or expense. Will it have a significant impact on your overall quality of life, or is it more of a short-term desire? Needs generally have a long-term impact, while wants tend to provide more immediate gratification.

- Assess Alternatives: Explore alternative options that can fulfill the same purpose but at a lower cost. For needs, consider whether there are more affordable alternatives available. For wants, evaluate if there are less expensive or free alternatives that can still provide a similar level of satisfaction.

- Regularly Reassess: Periodically review your needs and wants to ensure they still align with your values and priorities. As circumstances change, so do priorities. Continuously evaluate whether certain items or expenses are still necessary or if they have become more of a want. This is crucial for keeping track of the difference between Needs and Wants.

Budgeting by Differentiating between Your Needs and Wants

Effective budgeting requires the ability to differentiate between needs and wants.

By understanding this distinction, individuals can prioritize their spending and make informed financial decisions.

Prioritizing needs allows individuals to allocate a significant portion of their budget to cover essential expenses such as rent, utilities, and groceries.

By ensuring that these fundamental requirements are met first, individuals can avoid financial stress and ensure their basic needs are taken care of.

Furthermore, differentiating between needs and wants helps individuals avoid impulse purchases. Understanding the difference allows individuals to reflect on whether a purchase is truly necessary or simply a desire at the moment.

By considering the distinction, individuals can make more informed and intentional spending decisions.

This practice helps to reduce unnecessary expenses, impulsive debt, and financial regrets.

By cultivating this awareness, individuals gain greater control over their financial choices and develop the discipline needed for successful budgeting.

Conclusion

When it comes to smart budgeting, understanding the difference between needs and wants is crucial.

While it's important to fulfil your needs, it's equally important to be mindful of your wants and prioritize them based on your financial situation. Saving and investment can save you big time.

Jar is a daily savings app to automate your digital gold investments where you can start saving & investing in Gold for just Rs.10.

This can be super helpful when it comes to budgeting according to your wants and needs.