‘Finance is not merely about making money. It's about achieving our deep goals and protecting the fruits of our labor’ - Robert J. Shiller, American economist

Money touches multiple facets of our daily lives – self, family, work, home, hobbies and beyond.

Each of these dimensions is connected with a set of financial goals which could range from retirement planning for self, planning for a vacation with family, buying a dream home to building future wealth through prudent investing.

In fact, goal-setting is the starting point of every investor’s investment journey. Let’s find out about the advantages of goals while investing.

Investing amidst shifting goal-posts

Wealth is not built in a day. Growing wealth through investing towards meeting life goals requires careful financial planning and monetary discipline.

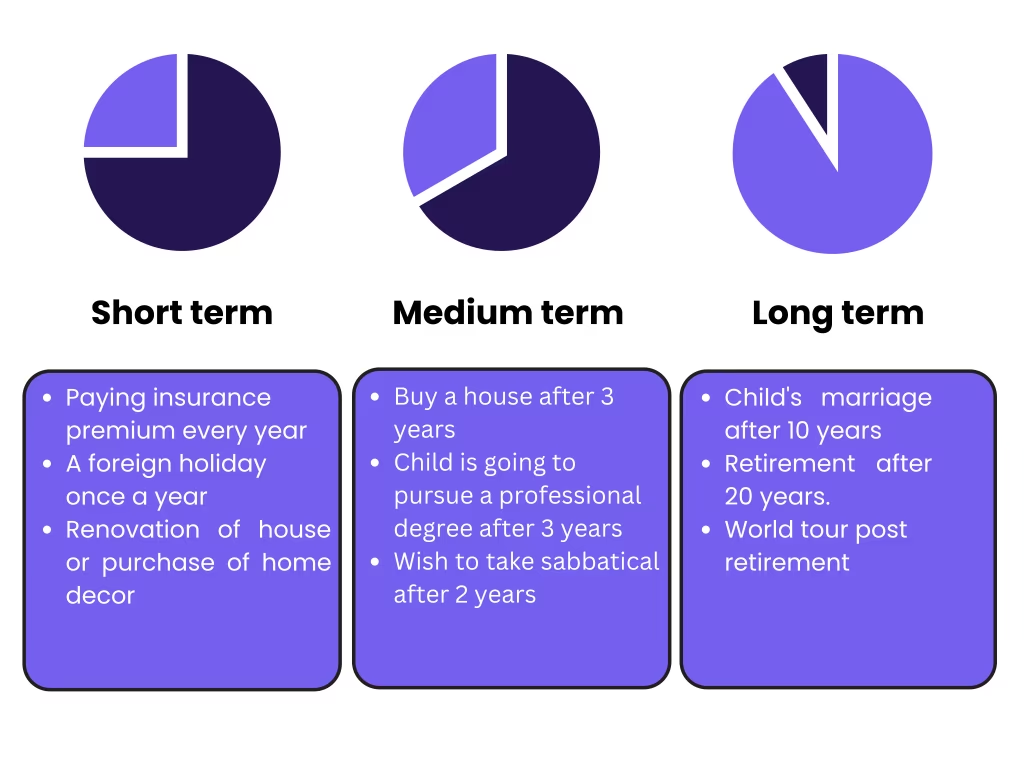

Wealth creation is a gradual process that takes time, depending upon the timeframe i.e. short-term, medium-term and long-term goals and of course, the life stage of the investor.

Some examples of timeline-based goals are as follows:

Each goal serves as a financial milestone towards which investors accumulate their savings or invest regularly, either as fixed amounts at periodic intervals i.e. Systematic Investment Plan (SIP) or alternatively in bulk amounts.

Never lose focus of your goals

Goals-based investing means investing towards specific goals.

The goals vary based on multiple criteria such as age group, income levels, family size, financial condition, health profile, investment preferences, risk appetite, and so forth.

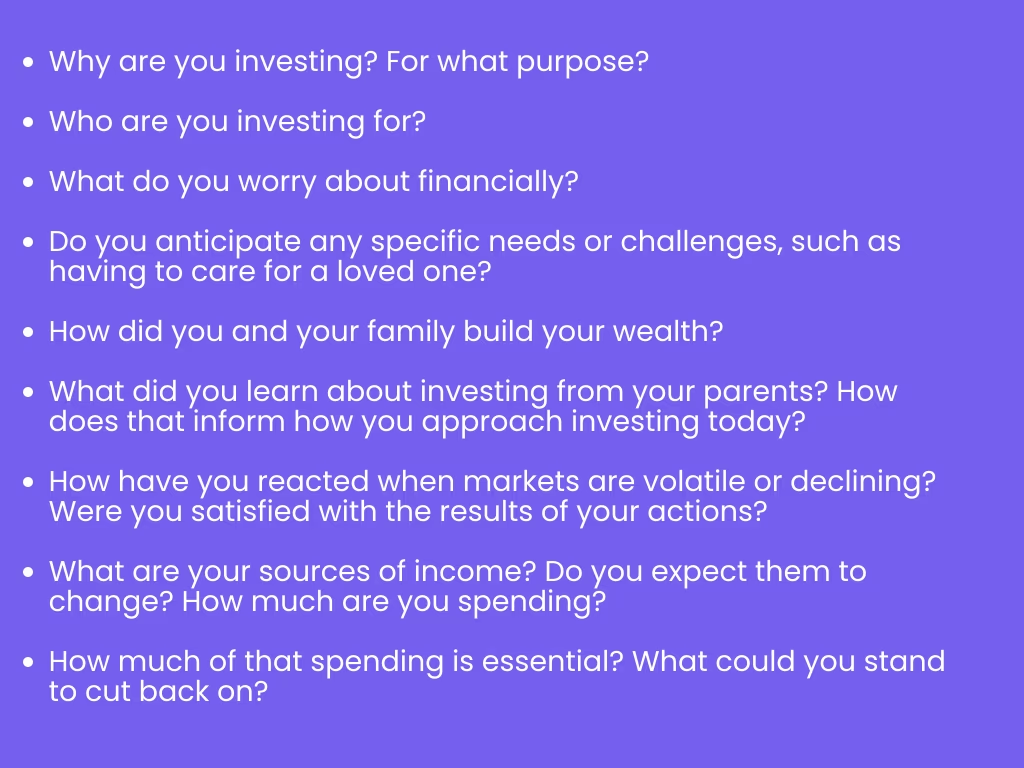

A Fidelity study provides a useful checklist of the questions to ask before kickstarting the investing journey:

Goals-based investing provides a structure to financial goals and helps decide which goals to prioritise.

You can also build a well-balanced investment portfolio with a diverse asset mix to meet goals, measure the progress rate and periodically rebalance your investing strategy to stay on track.

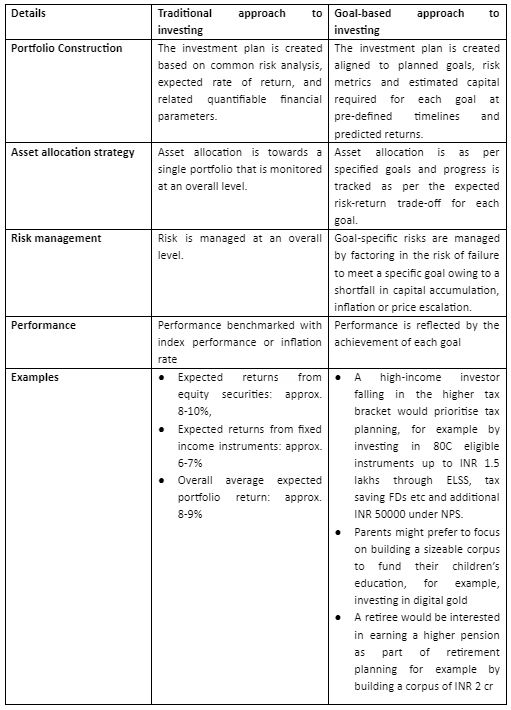

How does traditional investing stack up against goal-based investing

Goals-based investing focuses on achieving financial milestones with the aim of accumulating a pre-defined corpus value for each goal.

On the other hand, traditional investing emphasizes risk-adjusted returns and asset allocation towards realising a minimum rate of return, say, for example, returns benchmarked with the index or inflation-beating ROI.

The following are some of the key differences between traditional investing and goals-based investing:

One path, multiple goals

There is no one-size-fits-all approach when it comes to goals-based investing. This is because goals vary across investors and the investible surplus also differs greatly.

For example, the estimated corpus required for a 3BHK house property would vary widely from say INR 50 lakhs to INR 6 cr depending on the financial situation and preferences of every individual.

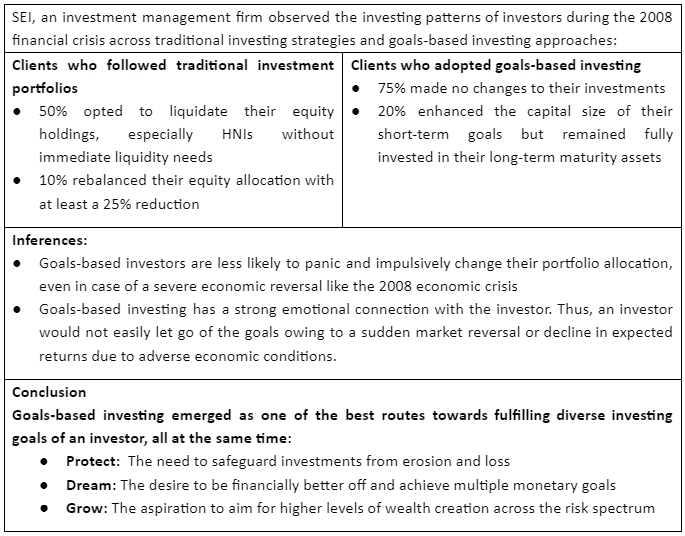

A whitepaper by Orion provides interesting insights on goal-based investing based on an SEI case study:

A world of benefits by scoring goals

Each one of us has so many unfulfilled aspirations and things we want to achieve in the future. Be it buying a car, purchasing a home, or growing a sizeable corpus for a happy retired life.

Multiple targets can often leave one feeling overwhelmed and disheartened. This is where goals-based investing can provide financial clarity.

It can help create a timeline-based roadmap towards transforming these dreams into reality in a phased, gradual and milestone-driven manner.

Goals-based investing may be summarised in 4 distinct steps:

- Identify the financial goals i.e estimated amount of money required towards meeting each goal

- Set a timeline for each goal i.e. short-term, medium-term or long-term time horizon

- Invest regularly to grow wealth

- Track progress and review the asset allocation and portfolio structure based on evolving scenarios

A Morningstar study finds that adopting a goals-based framework for financial planning resulted in a 15% jump in utility-adjusted client wealth.

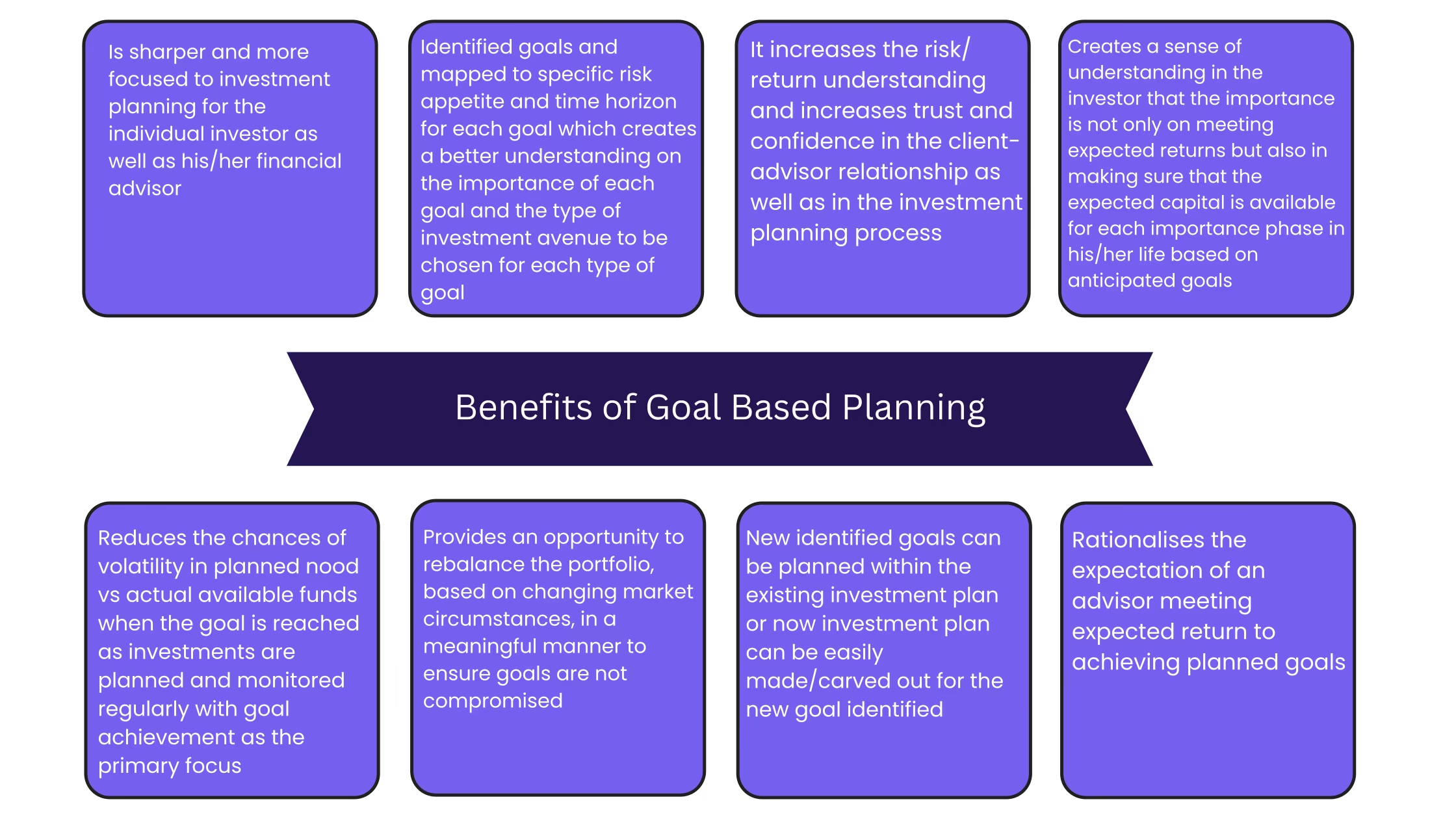

Along with superior returns, goals-based investing has several other benefits as below:

Invest with purpose

Just like life needs to have a purpose, investing too should have a purpose.

Goals define the purpose behind investing by answering all the basic questions of the investor- why to invest, how much to invest, where to invest, what to achieve by investing and when to invest.