’Failing to plan is planning to fail’’. This especially holds true when it comes to managing one’s finances towards wealth creation for self, family and the future

Financial planning is all about managing money.

The art of money management is striking a balance between one’s income and allocation of earnings towards expenditure, spending, investing for the future and saving to meet lifetime goals- be it going on a vacation, funding an MBA education, buying a dream house, living a comfortable retired life, splurging once- in- a- while on one’s favorite jewellery- the list is endless.

There is a lot more to financial planning than mere math though. One needs to be financially disciplined, live within one’s means, stick to a budget and aim for financial independence. Let’s find out what it takes to be good at financial planning.

Nurturing financial intelligence

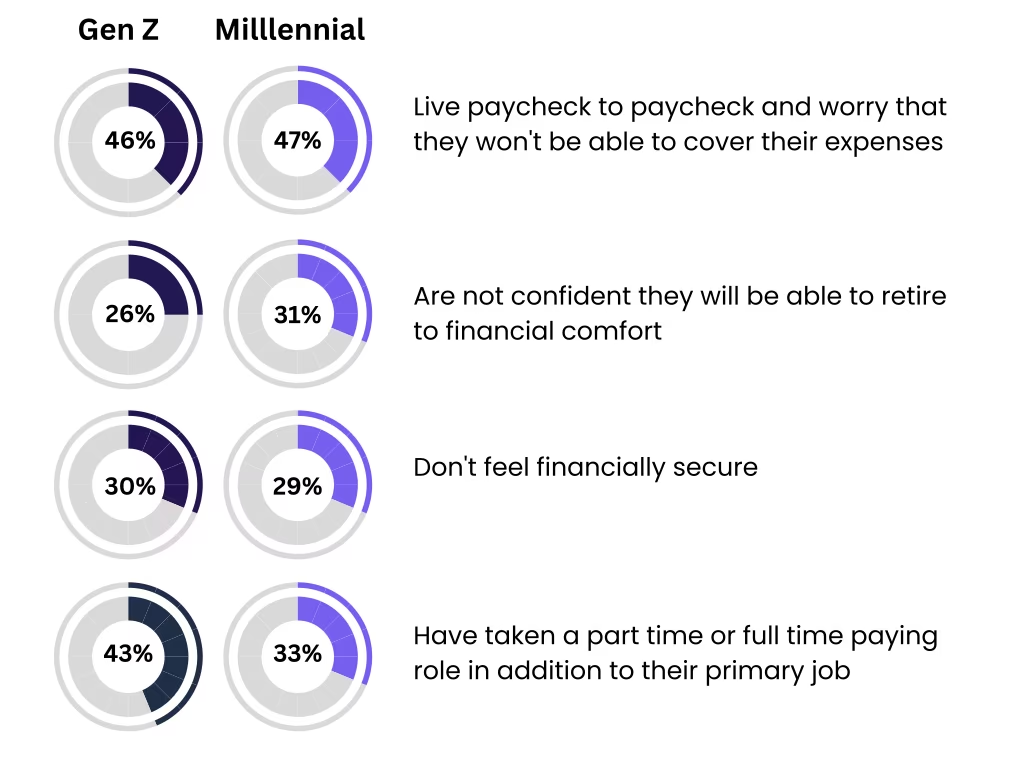

Effective financial planning involves a healthy mix of financial freedom and nurturing financial intelligence. A Deloitte survey conducted in 2022 finds that money-related worries were top of the mind for millennials and GenZs as follows:

- 47% of millennials and 46% of Gen Zs live paycheck to paycheck and feel that they may fall short of covering their expenses respectively

- Cost of living topped as a key concern for 36% of millennials and 29% of Gen Zs respectively

- 29% of millennials and 30% of Gen Zs feel financially insecure respectively

- 31% of millennials and 26% of Gen Zs are uncertain about retiring in a financially comfortable situation respectively

- 33% of millennials and 43% of Gen Zs have opted for supplementary income earning avenues in addition to their primary jobs respectively

- 43% of millennials and 47% of Gen Zs were stressed about their long-term financial future respectively

- 39% of millennials and 42% of Gen Zs were stressed about managing their daily finances respectively

The above stats reinforce the importance of having in place a sound financial plan.

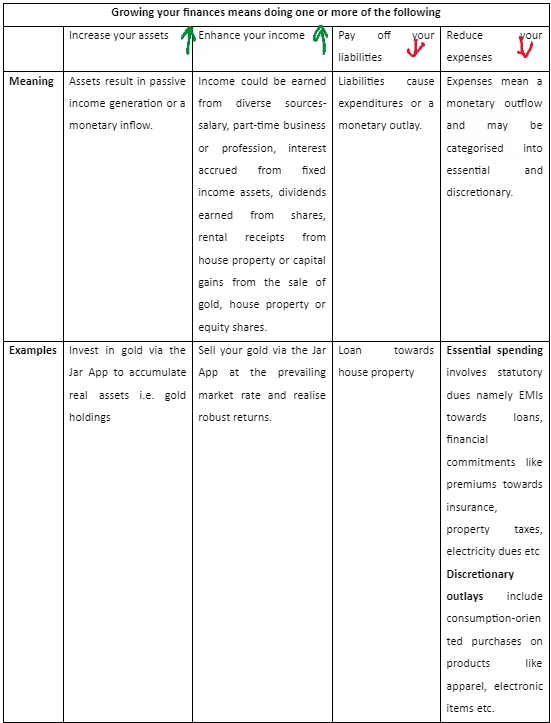

While financial independence revolves around reducing debt and borrowings towards controlling monetary outflows, financial intelligence is related to growing one’s monetary inflows and building a corpus by investing in the right assets.

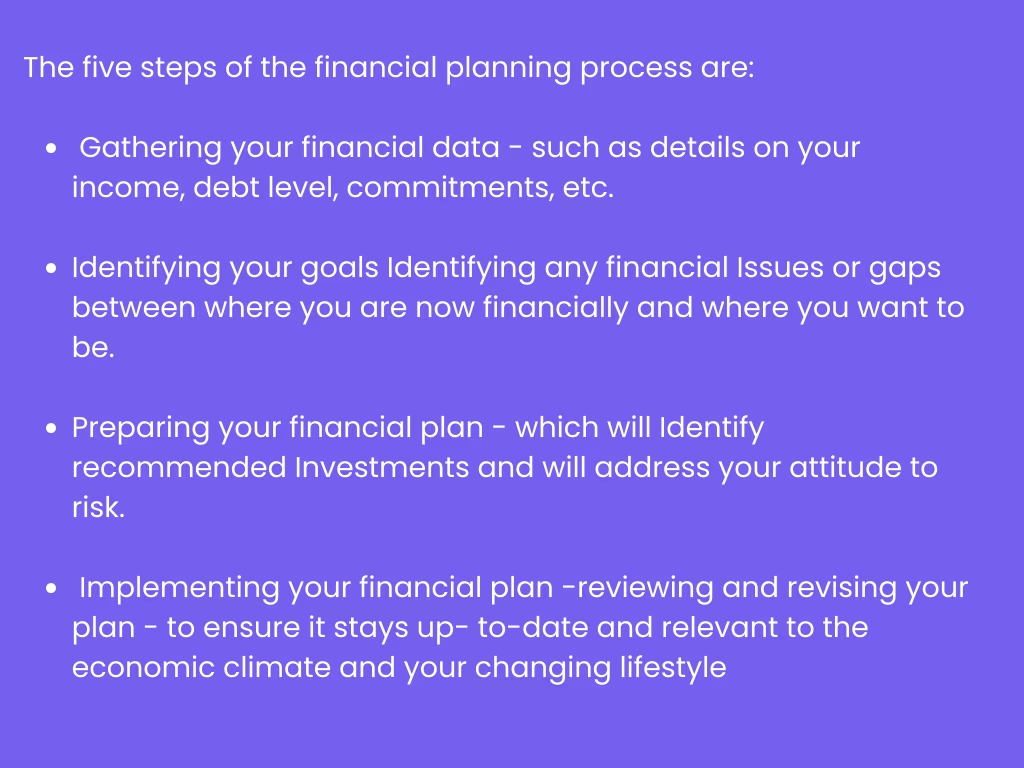

A SEBI report highlights the following key steps in financial planning:

In reality, financial planning is no rocket science at all.

By following basic thumb rules and adopting the correct attitude towards money, aligned to one’s risk appetite, lifestyle preferences and financial condition, you can make your money work for you.

1. Assess your finances to understand the cashflow position

Financial assessment involves measuring and gathering details of one’s assets, liabilities and cash flows.

Ideally, one needs to ensure that at any point in time, the assets exceed liabilities along with positive cashflows. The below table summarizes what each of them indicates and why:

While one can’t do away with essential expenses, one should try and cut down (to the extent possible) on discretionary spending to save money.

By identifying the major expenses in the present and future, one can manage their finances better and make investments to help build a corpus to achieve lifetime goals.

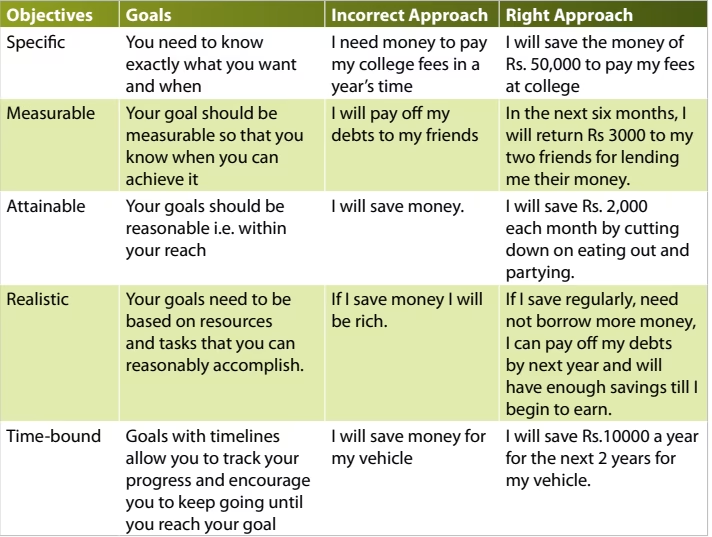

2. Goal-setting is key

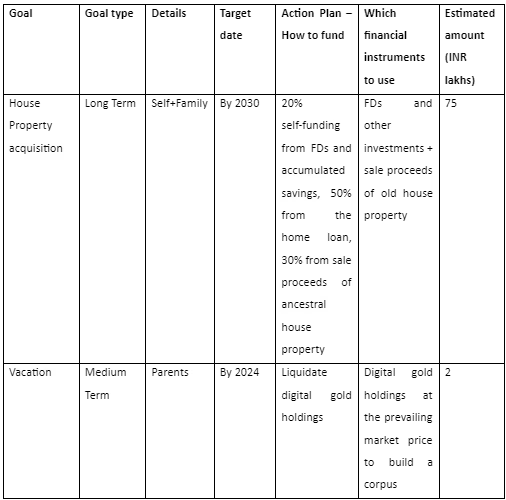

A goal without a plan is just a dream. Financial goals can be timeline based i.e. short-term, medium-term or long-term or even milestone based i.e. education, vacation, retirement or home acquisition.

Generally, short-term goals range from 1-3 years, medium-term consists of a 3-5 years horizon and long-term is referred to as 5 years and beyond. SEBI categorises goals as per the SMART acronym namely goals that are specific, measurable, attainable, realistic and timely, as follows:

To add to this, financial goals are those that can be measured in monetary terms.

3. Resolve the bottlenecks

At this stage, after determining the monetary goals, it’s vital to prepare a list of loans and payables and preferably pay off high-interest-bearing debts.

This would help limit one’s outflows and prevent any adverse scenario of default or delay in EMI (equated monthly instalments) repayment. Besides a wholistic understanding of income and expenses would aid in building a comprehensive plan, for example, as follows:

A big-ticket acquisition like a house property requires a greater degree of planning and a larger corpus than a relatively lower-value monetary goal like a two-wheeler purchase.

Along similar lines, a long-term goal, say funding for retirement planning needs a meticulous financial strategy rather than an outlay for a short-term vacation. With a financial plan in hand, one can suitably allocate funds towards priority or emergency goals based on the timeline and the financial outlay required.

4. Prepare a financial plan

A plethora of factors namely income level, risk appetite, asset class preferences, age group, lifestyle choices, investment goals, timeline etc influence the financial plan. Risk and returns vary across asset classes.

Risk appetite is also referred to as risk tolerance.

Generally, equity as an asset class carries high risk along with the potential to deliver high returns. Based on the risk category, investments may be categorised into:

- Conservative: These involve minimal risk. For example, fixed income instruments like FDs, PPF, post office time deposits or RBI bonds where the capital amount is considered secure and returns by way of interest are assured.

- Moderate: This involves a small degree of risk. For example, mutual fund investments in debt or hybrid MFs where there is the risk of capital erosion.

- Aggressive: Here the level of risk is high. For example, equity shares, ETFs and commodities may be subject to higher price speculation and market volatility.

Further, risk tolerance varies as per age group.

Risk-taking capacity is believed to be higher amongst investors belonging to a younger demographic profile i.e. GenZs and Millennials.

One needs to prepare a financial plan after factoring in the above aspects. Further, it’s critical to periodically review and proactively recalibrate the plan as per changing circumstances.

5. Monitor performance

Tracking the progress towards each milestone regularly is important for building a well-balanced investment portfolio that would help meet financial goals at different timelines and various life stages.

For example, if a particular equity mutual fund is not performing as per expectations due to poor market conditions, it might be prudent to move the funds to a debt MF till the markets recover.

The journey matters as much as the destination

Once a particular goal is achieved, one could review the investment strategy based on the existing income-expense scenario and lifestyle preferences to redraw the plan for accomplishing other monetary goals.

Ultimately, prudent financial planning is all about balancing ‘needs vs wants’ and building long-term wealth to meet one’s monetary needs.