Buying or leasing a car is one of life's most challenging decisions.

On one hand, buying has higher monthly payments, but in the end, you own an asset—your automobile.

On the other hand, a lease provides lower monthly payments and allows you to drive a more expensive vehicle than you would afford to buy, but you get stuck in a cycle where you never cease paying for the car.

With more consumers opting for a lease than a loan only a few years back, the leasing boom isn't going away anytime soon.

Simply put, leasing an automobile is comparable to renting an apartment.

This is a circumstance where you may easily avoid large down payments and obtain a new car by paying a small cost and a monthly rental fee.

This can be an excellent choice for folks who like to buy a new automobile every 2-3 years but don't want to deal with the headache of maintenance issues and fees while they own the car.

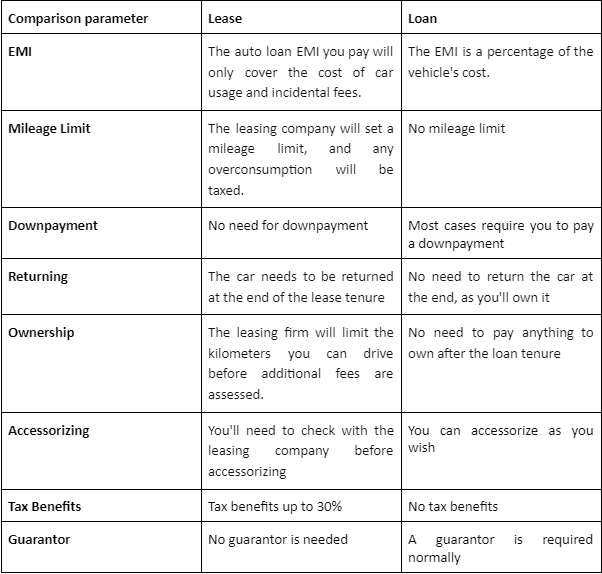

However, there are drawbacks to any new market experience. Let's compare the two-vehicle ownership experiences in India in detail!

How does car leasing work?

A car lease permits you to drive a vehicle of your choice for a set time.

A leasing business will provide you with an automobile while maintaining full ownership of the car in exchange for monthly rentals determined by them.

While some leasing businesses require you to purchase car insurance, others include the expense in the rental fee. You are not required to pay the road tax, maintenance expenditures, or other recurrent costs.

Your eligibility will be determined by factors such as your age and income, among others.

If you want to take possession of the car, you must pay a fee set by the firm. You must return the vehicle to the company at the end of the lease.

How does a car loan work?

A vehicle loan is a beneficial financial solution allowing you to pay for your dream car monthly.

The vehicle you obtain will serve as the guarantee for a car loan. If you fail to settle the car loan, the lender will seize possession of the vehicle.

The bank's interest rate determines the EMI you must pay toward the car loan.

Your eligibility for a car loan is determined by factors like your salary, credit rating, and age.

So, should you lease or loan?

Should you rent a car instead of buying one with an auto loan?

For example, let's assume you are interested in renting a Ford EcoSport in Bangalore. If you go and lease the car from a site like Revv Open, the monthly payment will be Rs. 27,300. The lease will last for one year. Therefore, the total amount you will spend over a year will be around Rs. 3.27 lakh.

The figure does not take into account the cost of your automobile insurance. On the other hand, the monthly installment payment (EMI) for a Ford EcoSport will be Rs.82,001 if you finance the vehicle for one year at a rate of interest of Rs.10.35% and if the cost of the EcoSport is Rs.9.31 lakh.

If, on the other hand, you lease the identical car for four years, the monthly installment payment (EMI) will be Rs.21,000, bringing the total cost to Rs.10.08 lakh. If the same interest rate is applied to a vehicle loan over four years, the monthly payment (EMI) amount will be Rs.23,769; the total amount payable over the loan will be Rs.11.4 lakh.

Even though the overall cost of a car loan is expensive, it is important to keep in mind that the money you pay back can be regarded as an investment because you will own the vehicle once the loan is paid off.

Nonetheless, if you choose to lease a car instead of buying one, your monthly payments will be lower; however, you will be required to hand up the vehicle after the contract's duration has expired.

Car leasing is an option worth considering if you enjoy having a variety of vehicles to pick from but are hesitant to invest in a single automobile. Car loans are the best option for people who want to buy a car but don't have the cash right now.

How to fill out an application for a car loan or a car lease online

Review the many options for auto loans and car leases currently on the market, then submit your application through the official site of the bank or lease company you decide to work with.

After applying for a loan or lease and providing the company with your basic information, the company will examine your eligibility.

You will receive a call from a representative who will explain the next few actions you need to take to obtain the auto loan or lease.

You also have the option of using a web aggregator, which allows you to compare various schemes and select the one that best meets your needs.

To conclude

You now have an understanding of the benefits and drawbacks associated with car leasing.

In a crisp, you can conclude that if you lease an automobile, you will be required to pay a monthly rental payment that is less than what you would be required to pay as an EMI if you buy the vehicle. Compared to buying a car outright, leasing a vehicle typically results in a more significant overall sum being paid over the same time.