Diversity is an innate characteristic of India, especially when it comes to socio-economic factors. Whether it’s the social aspects comprising food habits, languages, attire etc or the economic dimensions consisting of income distribution, wealth composition, asset balance in the investment portfolio etc, Indians have varied preferences and profiles.

Experts recommend that variety is actually good while investing for long-term wealth creation. In this article let’s understand how India invests and the variegated nature of investing.

Why a mixed-bag works best while investing

A BCG report reveals that between 2015-20, India’s financial wealth grew by 11% p.a. to $ 3.4 trillion and is slated to cross $ 5.5 trillion by 2025, clocking a healthy 10% growth.

The sure-shot way of long-term wealth creation is prudent asset allocation towards portfolio construction. Asset diversification across real assets such as gold and real estate and financial assets such as equity, bonds and fixed income securities serves as a robust risk-mitigation strategy.

The more the merrier

While saving for a financially secure future, it is important to say no to a ‘one size fits all’ investing approach. A portfolio can come in all shapes and sizes. Asset balance allocation depends entirely upon individual preferences, personal financial conditions and other circumstances. Asset classes may be categorised into the following broad segments:

- Gold- physical gold, digital gold, Gold ETFs, sovereign gold bonds

- Equity- stocks, equity MFs, equity ETFs

- Debt instruments: FDs, debt MFs, bonds, PPF

- Real estate – house property, REITs, InvITs

For example, while some investors may prefer bulk gold buying, others might prefer to utilize small change towards buying marginal quantities of digital gold.

With the current gold prices hovering at over INR 5000 for each gm, an investor would need to shell out a minimum capital of INR 5000 for physical gold.

However, in the case of digital gold, one would not feel the pinch as one can invest as low as INR 10 and buy digital gold in fractional quantities.

The benefits of a decoupled asset mix

The secret sauce is to invest across uncorrelated asset classes to overcome volatility and build a balanced investment portfolio.

Consider, for example, gold, which is mostly considered to be uncorrelated with equity shares.

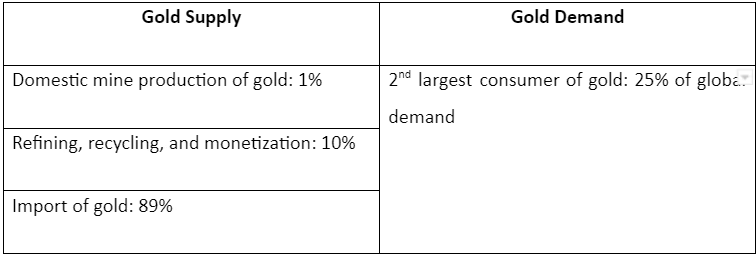

Thus, irrespective of whether stock prices move up or move down, gold prices do not move in tandem. In India, while there is a huge demand for gold, on the supply side, our indigenous production is minuscule, as depicted in the following table:

Thus, when the stock markets crash and the share prices plummet, the risk-adjusted returns of a prudent investor holding gold as part of the investment portfolio would not be in negative territory.

India’s wealth composition

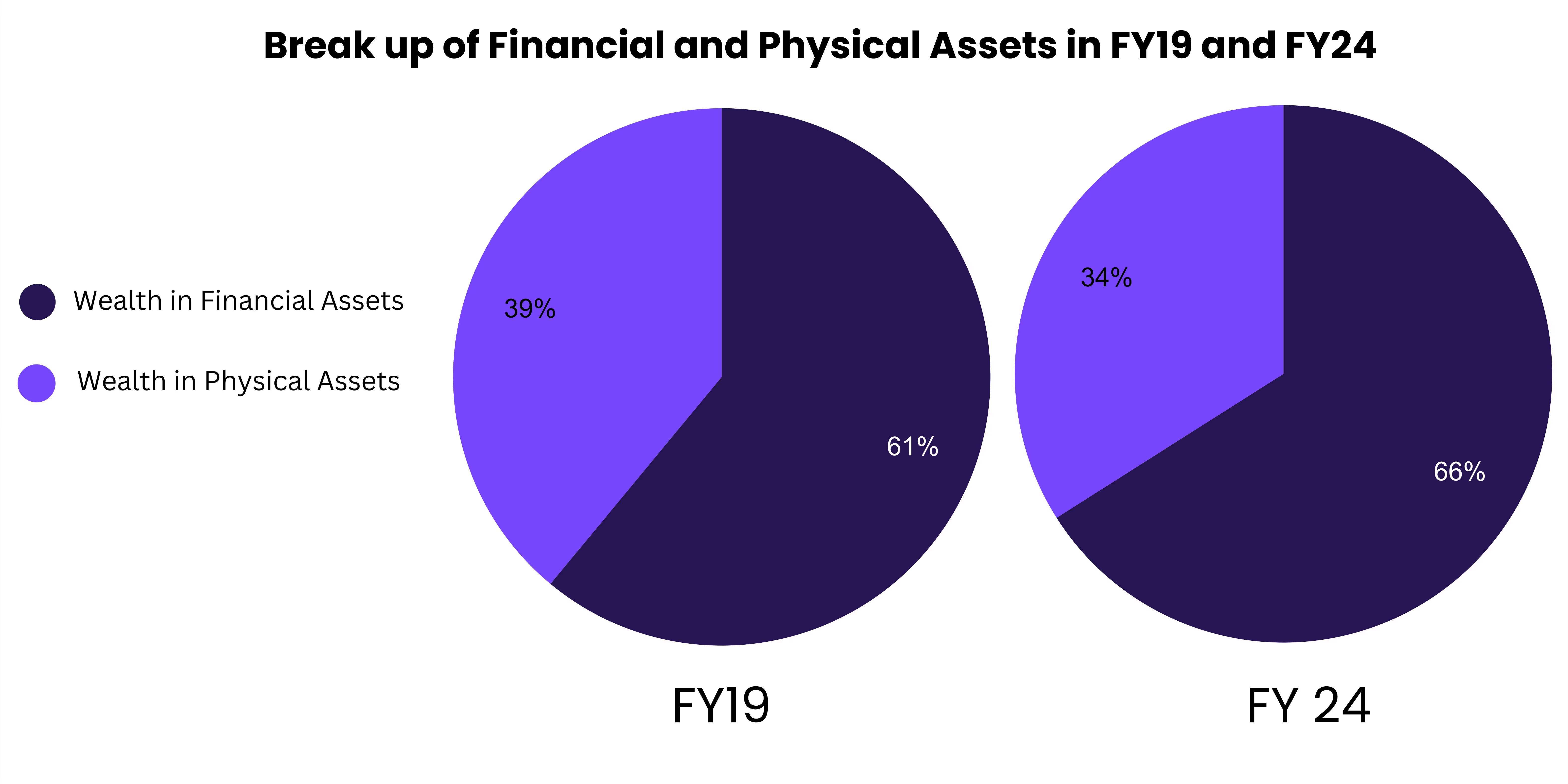

A Karvy Wealth report (2019) provides a snapshot of the asset-wise wealth composition of Indian investors, broadly divided into real assets and financial assets.

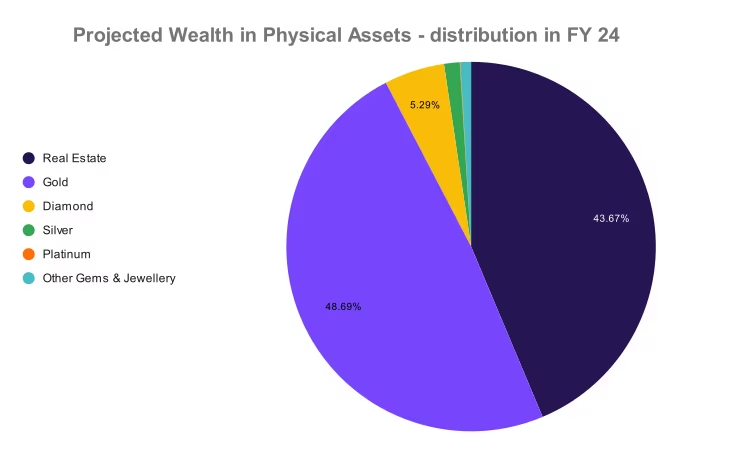

Under physical assets, gold commanded a lion’s share i.e. 48.20% in FY19 and is expected to grow to 48.69% by FY24 owing to its capital preservation benefits and availability of diverse purchase modes as follows:

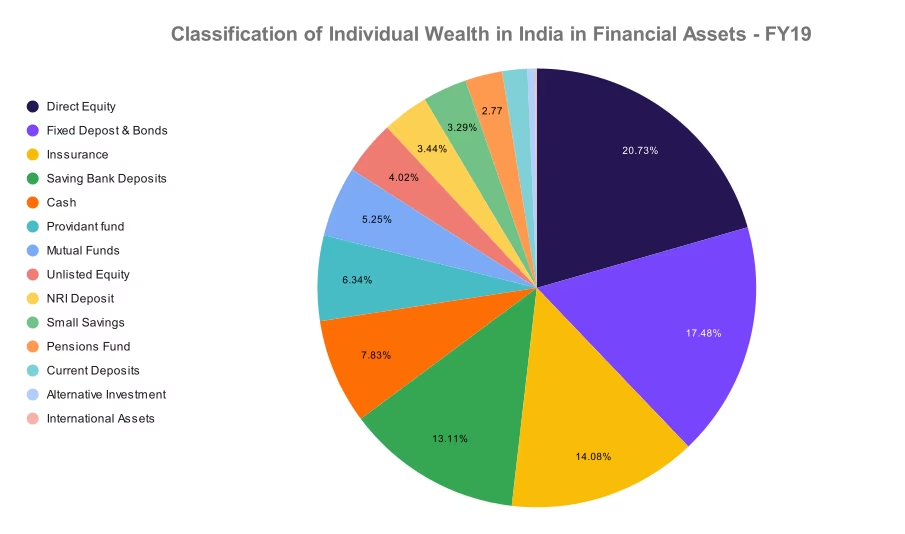

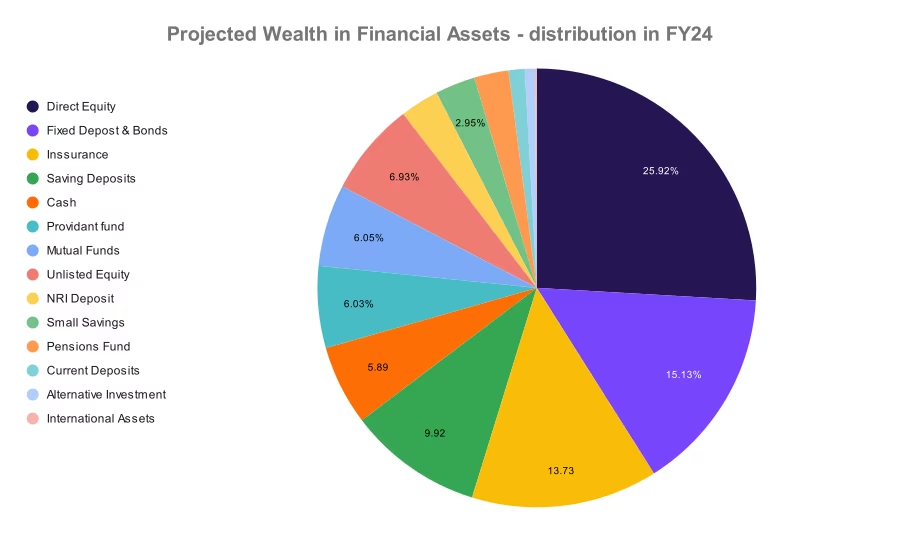

Financial assets:

Source: Karvy Wealth report 2019

To risk or not to risk that is the question

The growth in asset value in terms of capital appreciation or risk-adjusted returns by way of income generation from interest or dividends contributes to wealth creation in the long-run.

Risk appetite is an important criterion that greatly influences the asset mix. As per Hurun India Wealth report 2021, 30% of India’s millionaires preferred a low-risk investment philosophy with 35% being inclined towards investments in public equity.

Advantages of holding gold

It is evident that gold brings multiple benefits as an investment option, especially for risk averse investors. We shall look at some of its advantages over other asset classes:

- Effective tool in portfolio diversification

Portfolio diversification balances out the risk-return trade off across asset classes, protecting against market volatility and excessive price movements.

- Low correlation with most other asset classes

Being a precious commodity, gold prices are largely dependent on the demand and supply dynamics, economic scenario, FX rates, interest rates and global price movement. By holding gold, the portfolio can be safeguarded against volatility.

- Hedge against inflation

It is well-known that inflation erodes the intrinsic value of money and reduces real purchasing power.

Owing to gold’s high potential for capital appreciation, as an asset class, gold is able to enhance its value in the long run, in step with the escalating cost of living.

Generally, it has been observed that gold prices peak during periods of high inflation. Being highly liquid owing to its steep demand, at times of emergency or financial crisis, gold may be liquidated for cash.

- Robust returns

Historically, it has been witnessed that gold has delivered robust returns for investors. Being a precious natural resource, the limited availability of the metal results in demand exceeding supply.

This causes a rise in gold prices, which makes it an excellent way to build long-term wealth. With gold, investors can realise inflation-beating returns.

- Easy to buy

Gold may be bought as physical gold, paper gold or digital gold, either in grams or in fractional units.

With a wide choice of gold purchase options, there is considerable flexibility available for investors looking to own gold.

Going long on gold

A core rule in investing is ‘high risk, high return’. In other words, equity, where the risk of investible capital erosion is higher in case of downward stock market correction, is deemed to be high risk in comparison to fixed income instruments, which are considered low-risk with low-return.

Gold, however, seems to be an anomaly that provides a best-of-both-worlds scenario: low to moderate risk with high returns. Gold is considered a relatively safe-haven investment avenue and also delivers superior returns in the long-term investing horizon.

About Jar App

Jar App is an automated Investment App that empowers investors to fruitfully channelise and securely invest spare change from online transactions into 24K Digital Gold in any denomination including fractional units, at any time and from anywhere.