The way we invest has changed a lot. From digital gold, equity, fixed income securities, alternatives to real estate, investors today are spoilt for choice when it comes to investment instruments.

Another marked ‘change’ is the emergence of Change Investing.

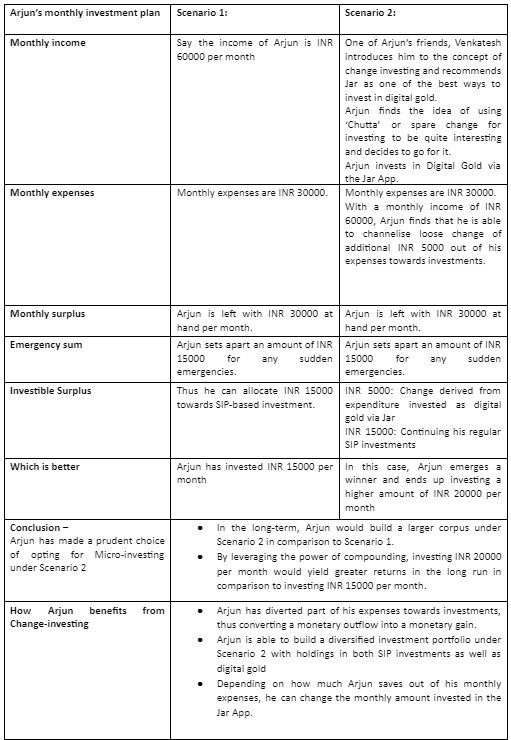

Also called Micro-investing, this is a novel idea that enables smart investors to fruitfully channelise their spare change of nominal amounts towards building a long-term corpus in equivalent terms of digital gold.

Let’s explore Change Investing and how it is forever changing the investment landscape.

Change is the only constant

Remember the good old childhood days, when we would collect and put coins into a piggybank to satisfy our small cravings- toffees, candies or a new board game?

As children, we would jiggle the box multiple times to hear the clanging sound of coins – music to the ears and of course, the more the merrier i.e. more coins means more goodies can be bought.

Through this, our parents encouraged us to develop the habit of saving at an early age.

As we grew up, our priorities changed and so did the modes of investing.

Over the years, there has been a marked evolution in the forms of investing namely bulk investing, SIP mode and the emergence of the all-new ‘Change investing’ – the adult version of piggybanks.

Every Rupee counts

Investing requires proper financial planning and greatly depends on the monthly budget of the investor.

For example, an investor holding a monthly income of INR 1 lakh would be able to allocate a higher proportion per month towards SIP as compared to an investor with a monthly earning of INR 45000.

Since the amounts invested vary, the time taken to build a sizeable corpus would also differ.

Thus, different modes of investing are suitable for diverse investors – depending upon their income level, budget, investible surplus, corpus required etc

- Bulk investing: Generally, institutional investors like banks, financial institutions, corporates etc prefer investing in big-ticket, huge amounts, say in denominations of lakhs or crores. However, even HNI investors may opt for investing in bulk amounts.

- SIP investing: Retail individual investors tend to opt for SIPs or Systematic Investment Plans i.e. regularly investing fixed sums of money in relatively smaller amounts, say in denominations of thousands.

- Change investing: On the other hand, micro-investing doesn’t require any advance planning and is a convenient way of investing, irrespective of income levels. Plus, since loose change, say in denominations of tens or hundreds, are utilized for investing, the investor would not feel the pinch.

Small is the new BIG in investing

Change investing is a powerful idea whose time has come.

With steep inflation, high cost of living and growing expenditures, it often becomes difficult to allocate a fixed amount every month towards savings.

This is where change investing can work wonders.

Let’s find out how micro-investing can be advantageous for investors with the below example.

How it works?

Investors can adopt change investing on the Jar App and cultivate the savings habit while simultaneously growing their wealth.

Jar enables users to save money in the following three ways. The accumulated amount is then invested in 24K digital gold of 99.99% purity.

- Round-up: Through this, users can use Jar’s feature that accrues small sums of money each time they make a transaction. For instance, say a user has spent INR 18 on a transaction, say towards an online purchase. The user needs to allow the Jar App access to view the SMSes. Jar App would then round up that money to the nearest 10th -- which is INR 20 in this case, and invests the differential (INR 2).

- Daily savings: Under this, a recurring payment (say via Paytm) can be set up by users who can commit to investing any amount starting from INR 10.

- One-time investment: In this mode, a one-time saving as per the user’s preferences can be made through the Jar platform.

Why Micro-investing wins hands-down over others?

Change investing is one of the most affordable ways of investing that is gaining in popularity as a viable route to build a corpus in the long-term, short-term and medium-term horizons.

- Flexibility: Under micro-investing, an investor need not mandatorily hold a certain minimum lumpsum amount in order to invest. Also, the investor need not commit any fixed regular amount prior to investing.

- Dynamic: This is a dynamic method of investing suited to investor preferences. Investors can invest at any time of the year and in varying amounts. For example, an investor may invest INR 8000 in the first month and INR 6000 in the second month and so on. Alternatively, an investor may invest INR 25 every day on a recurring basis.

- Suitable for all: Even those with irregular earnings, limited savings or uncertain income like gig workers, self-employed professionals, entry-level salaried persons etc can opt to utilise their spare change from their expenses to invest. With a minimum amount of INR 10, any investor can easily kickstart their investment journey on the Jar App.

- Digital: Change investing is a convenient, DIY, online mode of investing that can be done anytime and from anywhere. The digital mode of investing makes it a popular choice for the younger demography consisting of digital natives like millennials and Gen Zs.

- Tech-driven: New-age fintech apps deploy advanced tech tools to offer innovative investment products via the digital platform. The Jar App offers digital gold to investors at investible amounts starting at just INR 10 and a transaction completion speed of merely 45 seconds!

- Easy to understand: Change investing is channelised towards simple-to-understand investment products. For example, investing in digital gold on the Jar App is no rocket science at all. Most investors are aware that gold is a robust product with strong returns potential.

- High liquidity: Investors can exit their holdings at any point in time – either by liquidating their digital gold at the prevailing market rate or opt for home delivery of equivalent physical gold.

- Secure: The Jar app offers a secure investing experience in digital gold. The investment is 100% safe, almost as if you were directly investing in digital gold and can be redeemed whenever you wish.

Get a head-start with Jar

If you were to consider investing as a race, change investing is a marathon, not a sprint.

Like in any other race, while investing it’s vital to get an early start to stay ahead, beat inflation and realise superior returns over the investment tenure.

In other words, change investing is all about starting the investment journey early, staying invested for a long tenure and investing in small, easily manageable amounts.

These steps allow investors to take maximum advantage of compounding and accumulate a sizeable corpus as savings. When it comes to matters of investing, indeed ‘Change is good’.

About Jar App

Jar App is an automated Investment App that enables investors to securely invest in 24K Digital Gold, offering unimagined convenience, absolute safety of investments and superior gains.

Be the change. Invest your change with Jar. Be a proud owner of pure 24K gold.

Visit us at https://www.myjar.app/ to know how automated savings in digital gold can give you a head-start in the investing race. in