Gold Leasing is a lesser-known, yet highly beneficial investment opportunity with the potential to yield high returns and mitigate risks.

It has become increasingly popular amongst investors seeking alternative investments. This also allows them to take advantage of potential price fluctuations and benefit from the stability of gold as an asset.

Whether you're a seasoned investor or new to the game, this beginner's guide will provide insight on improving your investment potential with gold leasing.

So grab a cup of coffee and get ready to learn how you can turn gold into an exciting and profitable part of your portfolio. Let's go!

What is Digital Gold?

Before we dwell into Gold leasing it is important to first understand Digital Gold, as that forms the basis of the lease.

Digital Gold is a new and innovative way to purchase gold that allows investors to buy gold anytime and anywhere in India without having to physically own it - because it’s all digital!

For every gram of Gold, you buy, there is an actual 24k Pure Gold stored in a locker in your name by one of the three authorized gold banks in India - Augmont, MMTC PAMP, and SafeGold.

This type of investment is becoming increasingly popular as it allows investors to diversify their portfolios without having to worry about storage costs or security risks associated with physical gold ownership.

What is Gold Leasing? How can you lease your Gold in India?

The basic process involves leasing your Digital Gold to jewellers. The jewellers hold on to it for a certain time period and use it as part of their daily business. Throughout the leasing process, you remain the owner of the gold. The jewellers are liable to pay you interest for the gold they have borrowed from you.

Digital Gold lease investments are fairly straightforward, unlike physical Gold leases, which require actual Gold coins or bars and dealers.

All you need is to be at least 18 years old, have a valid PAN Card number, and have an active bank account. You can lease anywhere from 0.5 grams to 20 grams of digital gold.

Every month you get paid in grams of Gold that are credited to your account and at the end of the lease period, both principal and profit earnings will be part of the final amount.

You can also choose whether you want to renew your lease, sell off the Gold or have it delivered to your home as coins or bars.

If you are looking for Gold leasing companies in India like Jar app. Jar has launched Jar GoldX, which promises to provide secure leasing and better returns for Gold investments.

In collaboration with SafeGold, Jar GoldX provides a secure leasing platform for Gold, yielding a gold leasing rate of 3% per year. This means that instead of settling for the conventional 11% return, you can now expect a return of 14% on your Gold investments.

As the leasing program is facilitated through the Jar app, it makes it accessible and convenient for users to participate.

How does Gold Leasing benefit you as an investor?

Gold leasing is a great way for investors to gain exposure to gold without having to take on the full price of the asset. Here's how Gold Leasing benefits you as an investor:

- Generate income: Gold leasing allows investors to generate income from their holdings while still retaining ownership of the asset. This can be especially attractive to those who hold a large amount of gold that isn't being used to generate income or sitting idle in a safe. By leasing their gold, investors can earn interest on their deposits without the need to sell their assets. This can be especially valuable as gold generally increases in value over time, so investors can earn both lease payments and capital appreciation on their gold holdings.

- Diversification: By investing in gold leasing, investors can diversify their portfolios beyond stocks and bonds, which can help mitigate risks during market downturns. Gold leasing allows investors to capitalize on the surge in demand for gold, which can increase during times of economic or political uncertainty.

- Lower upfront cost: Since you are not buying the gold outright, the upfront cost of leasing is lower than if you were to purchase it outright. This makes it an attractive option for investors who want to invest in gold but don't have a lot of capital to put forth initially.

- Flexibility: With a gold lease, you can choose how long you want to lease the gold. This allows you to better tailor your investment to your specific goals and timeline.

- Potential for profits: If gold prices go up during the period of your lease, you could profit from the appreciation in value. This is different from owning physical gold, which does not offer any potential for price appreciation (beyond any collector's value).

- Hedging against inflation: Gold is often seen as a safe haven asset that can protect against inflation. By leasing gold, you can hedge your portfolio against inflationary pressures.

Guidelines to Maximize Your Investment Potential With Gold Leasing

Here are some guidelines to help you maximize your investment potential when leasing gold:

- Consider the current market price of gold and where it is likely to go in the future. You don't want to lease gold at a price that is significantly lower than the current market value, as you could miss out on potential profits.

- Decide how much gold you want to lease. This will depend on your investment goals and how much money you have available to invest.

- Shop around for the best deals on gold leases. There can be significant variations in price, so it's important to compare offers from a few different sources.

- Be aware of the risks involved. Gold prices can be volatile, so there is always the potential for losses as well as gains. Make sure you are comfortable with this before entering into a lease agreement.

Conclusion

Gold leasing has been used by investors to maximize investment potential for centuries. By paying a certain interest rate and using leverage to increase the return on their investments, gold leasing can be an effective way of increasing our returns without having to risk too much capital.

Furthermore, gold is known as a safe-haven asset in times of economic uncertainty and so provides some extra security in turbulent markets.

If you’re looking for an efficient way to invest your money with minimal risks, then gold leasing may be just what you need.

FAQs about Gold Leasing

1) Is Gold Leasing safe?

Answer - Gold leasing is 100% safe. The whole process takes place digitally, hence, there is no risk of theft or loss, unlike in the case of physical Gold. Gold is kept in secure lockers and vaults with bank-level security with reputable and well-established jewellery merchants.

2) What is the difference between Gold SGB and Gold Leasing?

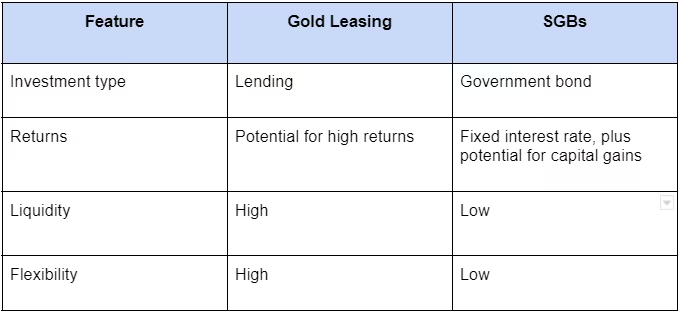

Answer - Gold leasing and Sovereign Gold Bonds (SGB) are both popular investment options for those who want to invest in gold. However, there are some key differences between the two.

Gold leasing is a process where you lend your gold to a jeweller in exchange for a fee. You will earn a return on your investment, which is typically higher than the interest rate you would earn on a savings account.

SGBs are government-backed bonds that are denominated in gold. When you buy an SGB, you are essentially buying a small piece of gold. SGBs offer a fixed interest rate, which is currently 2.5%. They also come with a lock-in period of 8 years.