| TL;DR: The 50/30/20 rule is a simple way to organise your monthly income: 50% for needs like rent, bills, groceries, and essential expenses; 30% for wants such as eating out, entertainment, travel, and hobbies; and 20% for savings to build security through emergency funds, gold, or long-term goals. For modern Indian lives with high rents, family responsibilities, and easy digital spending, this rule works best when used flexibly. With small adjustments and automation, it helps reduce money stress and build steady saving habits over time. |

Almost everyone has, at some point, wondered where their salary went by the end of the month. More often than not, the issue isn’t careless spending. It’s the absence of a simple money system that fits everyday Indian realities.

Does it feel like your money vanishes as soon as it arrives, with rent, family needs, rising prices, and little comforts eating it all up?

This is where the 50/30/20 rule of budgeting feels refreshingly practical. You don’t need to track every single rupee or give up your style of living. Instead, these budget rules offer structure, flexibility, and balance.

What is the 50/30/20 rule of money?

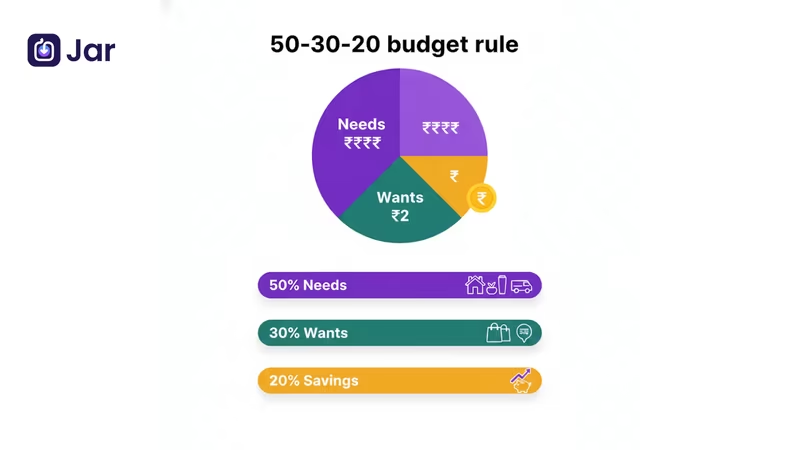

The 50/30/20 rule is a budgeting method that divides your monthly income into three broad categories:

- 50% for needs, which cover essential expenses

- 30% for wants, which include lifestyle and enjoyment

- 20% for savings, meant for future security and goals

You are not expected to follow these numbers perfectly. The purpose of the 50 30 20 budget rule is to give direction to your money so it does not drift without intention.

Having a clear structure for your money reduces decision fatigue and makes saving easier over time.

If you’re curious about why budgeting works psychologically, you can also read about 4 ways budgeting helps you save more efficiently.

Understanding the 50% for needs

You qualify something as a “need” when it costs money to maintain your life's stability and safety.

In most Indian households, needs typically include:

- Rent or home loan EMIs

- Groceries and daily essentials

- Electricity, water, gas, mobile, and internet bills

- School or college fees

- Basic commuting costs

- Insurance premiums

- Unavoidable medical expenses

A simple method to figure out if you need something is to ask yourself if life would be harder or unsafe if you stopped paying for it. If the answer is yes, it goes here.

The “family tax” factor

For many working Indians, especially in their 20s and 30s, supporting parents or contributing to household expenses is a reality. These contributions are genuine needs and should be counted within the 50%.

Why the 30% for wants matters more than you think

This portion is what makes the 50-30-20 rule sustainable in the long run.

Wants are expenses that make life enjoyable but are not essential for survival. They usually include:

- Eating out or ordering food

- OTT subscriptions and entertainment

- Shopping beyond basic needs

- Weekend trips and short travel

- Fitness classes, hobbies, or leisure activities

| Do you feel the same? Spending money has become almost effortless. One UPI scan, one tap, or a delayed payment option, and the money is gone before you’ve really paused to think. |

Spend wisely with the Jar app's smart round-off saving feature. Download the app and save money in 24K digital gold.

The role of the 20% savings bucket in a high-inflation economy

The savings portion is where long-term stability is built, even though it may not feel exciting at first.

Your savings bucket can include:

- Emergency fund contributions

- Long-term investments such as SIPs

- Gold savings

- Short-term goals like travel, education, or big purchases

In an inflation-heavy economy like India’s, relying only on low-interest savings accounts may not be enough.

| A simple example: If your monthly income is ₹30,000, the 50/30/20 savings rule broadly looks like this: ₹15,000 for needs ₹9,000 for wants ₹6,000 for savings |

You can also read our detailed guide on how to save money from salary.

How to handle EMIs within the 50/30/20 framework

EMIs often confuse budgeting.

- Home loan EMIs are usually counted as needs, as they provide shelter

- Car loan EMIs may fall under needs or wants, depending on necessity

- Personal loan EMIs often belong in the wants category, especially if taken for lifestyle spending

The key is honesty. Classifying and calculating EMIs correctly prevents your needs bucket from becoming overloaded without realising it.

What people actually do in real life

Most people don’t follow budgeting rules perfectly, and that’s normal. What works is consistency, not accuracy. Most people:

- Start by saving 5-10%

- Increase savings gradually as income grows

- Save in small daily or weekly amounts

- Prefer gold savings for emotional comfort

- Adjust spending during tight months

- Review their budget a few times a year

Over time, these small actions create stability.

Common mistakes that reduce effectiveness

Even simple systems fail when the basics are ignored.

- Treating every comfort as a “need”

- Forgetting yearly expenses like insurance or festivals

- Not revisiting the budget when income changes

- Investing aggressively without an emergency fund

- Relying on motivation instead of automation

A quick review every few months keeps the system realistic.

What really matters in the long run

The 50-30-20 rule does not require you to limit yourself but to find a balance.

It helps you spend less without feeling bad about it, enjoy life without going overboard, and save without feeling like you have too much to do.

It rewards patience, perseverance, and little habits done every day, just like investing in gold for the long run.

Start where you are, automate what you can, and let the system evolve as your life changes.

FAQs on 50/30/20 budget rule

Is the 50-30-20 rule good for low-income in India?

Yes, the rule works for low-income people in India by changing the percentages while keeping the savings the same.

How do you save 20% income using the 50-30-20 rule?

You save 20% by setting aside money first, using small daily savings methods like in digital gold on the Jar App.

Can the 50-30-20 rule be changed?

Yes, you can change the 50-30-20 guideline based on how much money you make, how much you spend, and how much you want to save.