Saving money from your salary requires planning, discipline, and strategy. It is not about cutting back on expenses but building better money habits to take control of your finances.

However much income you earn, the fundamentals of savings would remain the same; what matters is how you manage your salary.

With simple strategies, you will be able to manage your salary smartly and create a balance between your daily needs, lifestyle goals, and long-term financial security.

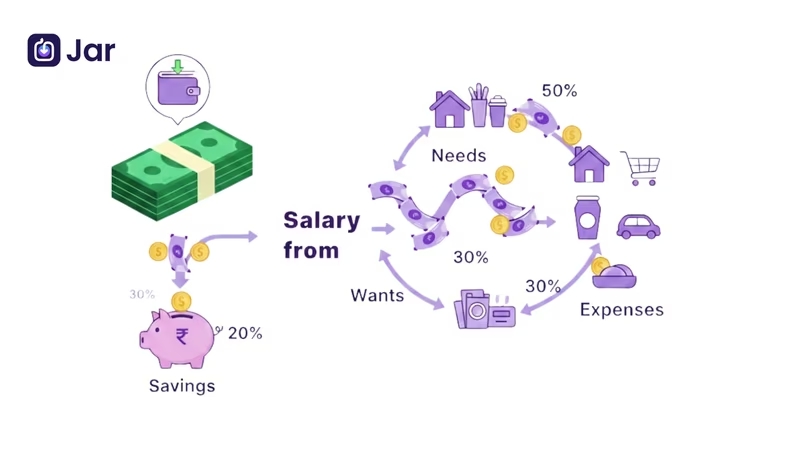

1. Use a Budgeting Framework (50-30-20 Rule)

Use a savings rule for your money-building habit. One of the most popular rules is the 50-30-20 rule.

According to this rule, 50% is for your needs, 30% for your wants, and 20% for your savings. Whatever your salary is, you should follow this rule each month, other than in any emergencies.

Let us understand what these needs, wants, and savings are-

50% for Needs

You need to keep 50% of your salary for your needs. The needs can include unavoidable expenses like

- Rent

- Groceries

- EMIs

- Utilities

- Debt payments

- Or any other fixed expenses

30% for Wants

The next 30% of your salary goes towards your wants. These can be the expenses that are there to improve your lifestyle. These wants can be

- Participating in hobbies

- Going to the movie

- Going out for shopping

- Or any other leisure activities

- Vacations

- Purchasing or upgrading electronics

20% for Savings

The other 20% of your remaining salary should go for savings or investments. According to financial experts, an individual should have at least 3 months or more of emergency funds. This will help in case of any unexpected financial needs, like job loss or other medical expenses.

These savings or investments can also help you achieve other financial or personal goals, like buying a car or house.

For eg, if your monthly salary is 25,000, you need to keep 50% which is 12,500, for your needs, 30% which is 7,500, for your wants, and 5,000, which is 20% your salary needs for your savings.

However, following this rule is not always possible, as there might be emergencies or unexpected expenses. In that case, you can make slight adjustments to this rule based on your expenses for the month.

Use the calculator below to segment your salary according to the 50-30-20 framework

Budget Breakdown Tool

Apply the 50-30-20 rule to your salary instantly.

2. Automate Your Savings

The best way to save each month is to automate it so you don’t forget to save or miss out on your savings goals each month.

You can set aside 20% of your salary and automate the savings in the Jar app as Daily savings, weekly savings, or monthly savings. In case in a month you want to save more in a month, you can save instantly in the Jar app.

Check out how saving in the jar app has helped Esha Gokhale, a Marine Scientist, in case of a Life Emergency.

Download the jar app to start your saving journey, watch your money grow, and create an emergency fund for yourself.

3. Create a Monthly Budget and Track Every Expense

Once you have saved, you need to take care of the other expenses. To manage these expenses, you should create a budget and then spend accordingly.

The first step in this will be identifying your expenses, and then categorising them to improve your savings. This will help you to analyse the costs and check where you are overspending, and to avoid or minimize it.

Identify your expenses, and you can break them into:

- Fixed expenses: Rent, Utilities, EMIs

- Variable expenses: Groceries, Shopping, and entertainment

- Discretionary expenses: Travel and hobbies

Once you have identified these expenses and made a budget, make sure to stick to it.

4. Build an Emergency Fund

An emergency fund is a separate pool of money kept aside only for unexpected situations like job loss, medical needs, or urgent home or vehicle repairs. It acts as a financial safety net so that you don’t have to depend on credit cards, loans, or friends and family during tough times.

Ideally, you should aim to save at least 3–6 months of your essential monthly expenses such as rent, EMIs, groceries, and utility bills. You don’t have to build it in one go; start small by consistently putting a part of your 20% savings share into this fund every month.

Keep your emergency fund in a safe and easily accessible place, like a savings account or other low-risk option, so you can withdraw it quickly when needed.

5. Control Small Spending (Invisible Costs Add Up)

Expenses like snacks, coffee, digital wallets, etc, are often not accounted for, and so these go unnoticed, but can cumulatively reduce the saving potential if taken care of.

Pausing before any impulsive purchase, limiting these costs, setting caps, and being mindful of these expenses can help.

6. Cut Unnecessary Expenses

Revisit your budget and cut down on small expenses that you can avoid. Cutting down on discretionary expenses can give you more space for savings. If you are spending more on travel, identify alternatives to travel and the same cost. Or if you are eating out frequently, consider cooking at home, or opt for affordable meal options, which will help save some money.

7. Use Technology to Your Advantage

Money-saving and budgeting apps and tools to save money and budget your expenses.

8. Set Clear Savings Goals

Saving becomes easier when they are goal-oriented. You can choose to save for any goal, like an emergency fund, a vacation, to buy a gadget, home improvements, or any other such goal.

When you have a goal to save, it will keep you motivated. You can write down your goal and review it monthly. Tracking progress makes saving more rewarding and less abstract.

9. Invest Rather than just Save

Once you have an emergency fund, instead of saving it, invest it in different types of funds to grow it over a period of time. These investments can be done for any duration feasible to you.

A short-term investment will be for less than 3 years, a Mid-term investment ranges from 3 to 7 years, and a long-term investment will be for any duration more than 7 years.

There are different media through which you can invest, like

- SIP in mutual funds

- PPF and other post office savings schemes

- Bank FD or RD

Check out the best private sector banks in India.

Depending on the type of your savings goal, you can decide the time duration and mode of investment.

10. Review and Adjust Regularly

The budgeting and saving strategy you created is not static; it can change according or various life events.

So it is essential to revisit and adjust your budget accordingly, so that savings remain a priority.

Conclusion

Saving from your salary doesn’t have to feel restrictive—it’s about being mindful of how you spend, save, and invest. By following a clear budgeting system, tracking expenses, and turning savings into a monthly habit, you can build a secure financial cushion and work toward your bigger goals.

Start small, stay consistent, and let technology like the Jar app make saving effortless. Over time, those small savings will grow into something meaningful—helping you handle emergencies, plan your future, and achieve true financial freedom.

Download the Jar app to start your money saving journey today.

FAQs

How do I save money from my salary?

Start by using a simple rule like 50-30-20 to divide your salary into needs, wants, and savings, then automate the savings part so it happens every month without effort. Tracking your expenses and cutting small unnecessary spends will further increase how much you can save.

What is the 50/30/20 rule of money?

The 50/30/20 rule suggests using 50% of your after-tax income for needs, 30% for wants, and 20% for savings and investments. It is a simple framework to balance essential expenses, lifestyle, and future goals.

How to manage a 20k salary?

Prioritise your fixed needs (rent, food, transport), then cap lifestyle spends, and aim to save at least 10–20% to start, even if you cannot hit the full 20% immediately. Make a budget and stick to it, avoid debt where possible, and use an app to track every rupee so nothing goes unnoticed.

What is the 70/20/10 rule for salary?

The 70/20/10 rule means that you set 70% of your income for living expenses, 20% for savings or investments, and 10% for debt repayment. It is an alternative to 50-30-20 that keeps spending slightly higher while still prioritizing saving and debt reduction.

How do you calculate salary savings?

Decide how much you saved in a month, divide that amount by your monthly salary, and multiply by 100 to get the savings percentage. For example, if you save ₹5,000 from a ₹25,000 salary, your savings rate is 20%.

How much of my salary should I save each month?

You should at least save 20% of your salary every month.

Should I save before or after paying my bills?

First, pay your essential bills, so that your basic needs and obligations are met, then move a fixed portion to savings before spending on wants. Treat savings like a non-negotiable monthly “bill” to yourself.

How much of my salary percentage should I save?

Aim for at least 20% as a baseline, and try to increase it toward 30% or more as your income grows or expenses reduce. You can adjust this percentage based on your responsibilities, goals, and other factors.