When faced with the decision to purchase travel insurance, does your cursor or finger often hover between the 'Protect your trip' and 'No, I'll risk it' buttons? If so, you're not alone. To help you make an informed decision, we are here with this guide to travel insurance.

Travel insurance is one of the areas people often get confused about whether to spend some extra bucks on it or opt out.

It is mainly because of the lack of knowledge about its efficacy and limitations.

In this article, we will demystify travel insurance so that you know exactly which option to choose the next time you book a holiday with the financial security of insurance.

What does Travel Insurance Cover?

As the name suggests, travel insurance protects you from unexpected expenses. We spend thousands and lakhs of rupees planning a trip for leisure or business.

Travel insurance also ensures you do not lose the hard-earned money that you've invested in the trip.

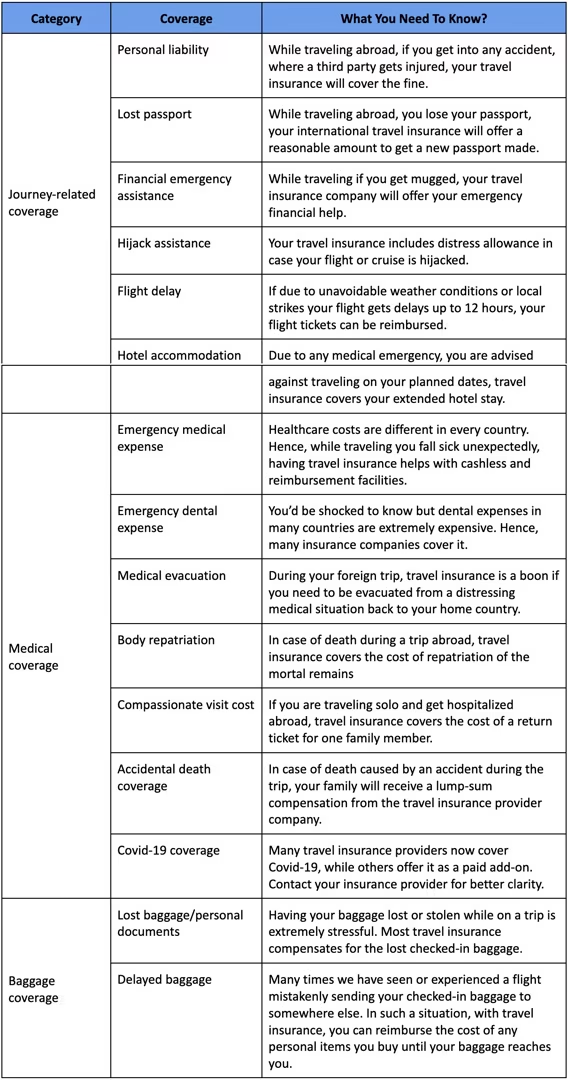

Although coverage differs from company to company, travel insurance generally covers various journey-related, medical-related, and other non-flight-related unexpected events. It includes:

Types of Travel Insurance

There are primarily two types of travel insurance:

1. Basic trip cancellation insurance

It covers lost luggage, reimbursements if you miss a connecting flight, and a refund if you cannot go due to illness or injury.

2. Comprehensive travel insurance

This type of insurance covers all of what basic insurance offers and any expenditures incurred from medical or dental problems, catastrophic evacuations, and even costs incurred due to accidents.

Essentially, this is a combination of travel and medical expenses.

If you're thinking of getting travel insurance, it is advisable that you get the most comprehensive type.

You can also get insurance with a 'cancel for any reason clause, which is perfect if you're going to places with political instability.

When Should you Opt for Travel Insurance?

You may already know that travel insurance offers many advantages if you get into trouble while traveling.

If you are traveling abroad, travel insurance is a must, despite the protection your credit card offers.

That's not all; many embassies ask for travel insurance documents for visa approval, such as the Schengen visa.

When Can you Skip Travel Insurance?

You can avoid investing additional money in travel insurance if:

You are not paying a hefty deposit for flight tickets

Many airlines charge a non-refundable trip deposit to book your visa application seats.

If your visa gets rejected, you can claim the non-refundable deposit amount. But, if you are not paying such deposits, you can skip travel insurance.

You are traveling domestically

On domestic trips, travel insurance is not mandatory. If you get sick during your trip and already have health insurance, that is enough to recover medical expenses.

You do not need separate travel insurance for domestic travel.

You have a refundable booking or on-spot payment option

Unless you have non-refundable bookings in flights and hotels, you can skip getting travel insurance.

Bottomline

Yes, travel insurance is optional. But, it is probably a smart idea if you've paid a significant amount for a non-refundable holiday.

If you travel internationally and require coverage in the event of illness or injury, you should also pay a few extra bucks to stay protected.

Trust us; you'll be thankful to be insured if you find yourself in any troubling situation in a foreign country.