A bankruptcy would rarely be caused by a single factor. This kind of major financial calamity is often the mix of several factors leading to distortion of good financial management.

The inability to just manage your money can also be a reason but it solely isn’t capable enough to take down all of your finances.

As mentioned that bankruptcy is a mix of several factors, it can happen like: a sudden lay-off from job and then getting caught up in the diagnoses of a major disease.

Or say you took a loan to build a house but you suddenly became jobless. A reckless financial behaviour like accumulating too much debt is definitely what stirs this type of disaster however, it seldom is the sole reason.

Let's look at 5 reasons behind bankruptcy:

1. Jobless Situation - Lack of Source of Income

The loss of a job unexpectedly is perhaps one of the prime reasons why you can go bankrupt.

In case you are lucky enough to quickly get your hands on some other job, you may prevent bankruptcy. However, the chances of such a miracle are too low.

Especially if you haven’t set up a proper emergency fund before you lost your job or say if you have been a reckless spender, the financial trouble can be close behind.

Unfortunately, since you also didn't have any other alternative source of income, you might end up trying to get a loan- not so easy now that you cannot assure to pay it back.

2. Major Medical Emergencies

More often than less, a major medical emergency can be evil enough to eat up all of your finances.

Lucky if you have health insurance. But if it doesn't cover critical health conditions, you know there is a whole room for bankruptcy to stay and basically ruin the situation for you.

In this case, it can be all mentally, physically and financially taxing. Therefore, ensure to take proper care for your health. Do not forget to buy a good health insurance policy.

3. An Unbearable Debt - Like a Huge Mortgage

While mortgages can be payable- in case you haven’t laid hands on something disastrous- it can be a big problem if you suddenly lose your income sources.

One must never consider taking up an unbearable mortgage just to get access to something bigger. These plans often harm you in the long run.

Instead, try to look for a better investment and saving plan and follow some goal-based savings strategy.

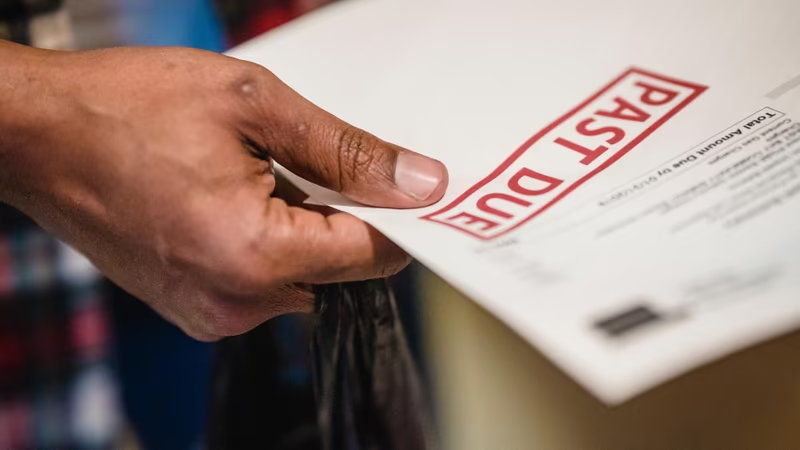

4. Financial Recklessness- the Credit Card Debt Loop

Another self-destructive thing to do is play a reckless role while managing your credit card.

That sleek rectangular piece of plastic (or metal) is a slow poison for your financial health if you don’t handle it right.

The risk that is involved with a credit card is the sole reason why many people avoid getting involved in such business altogether.

Therefore, if you have been overspending and not paying the dues on time, the bankruptcy is not far behind.

5. The External Factor

It is not essential that your own mistakes lead you to bankruptcy, sometimes, it can get transferred from someone else to you.

Consider, for example, that one of your friends was facing a major financial problem and asked you for help.

Now that you decided to assist them, you ended up ruining your own financial health.

This can be even more taxing if your own finances were not exactly in pink health before you decided to help them.

This, by putting a major strain on your budget, can eventually take down all your finances.

Therefore, the next time you help someone, ensure that you check your own financial health thoroughly.

Now that you know what can lead you to this calamity, you must be thinking about how to prevent it.

While preventing bankruptcy isn’t a smooth road, there are still some strategies that you can follow to avoid it.

Here’s how to avoid filing for bankruptcy:

1. Rethink your Budget- Cut Down on Spendings

As soon as you discover that things might be going out of hands, the least you can do to cut yourself some slack is to readjust your budget.

DO NOT spend unnecessarily! Cut down on any lame expenditure.

A little minimalism won't harm you but can save you something to sustain for the time being.

Save as much as you can and try to pay off any debt in maximum amounts.

2. Always make sure to generate more than one source of income

Just relying on one source of income is definitely destructive, especially in these times of financial instabilities.

Always make sure that you have an alternative source of income if one fails to get you anything.

It can be anything! Got a spare room? Put it for rent. Have an in-trend skill? Put it to use and make money.

Make use of the online resources that are available and develop skills that interest you.

This way, even if there is a situation of bankruptcy and you lose your job, the alternative income source can be your last resort of hope.

3. Settle those Debts

Never ever let debt accumulate. Small or huge both make your life difficult and no, you don’t want that.

If you own a credit card and find it sufficient, do not apply for another. just focus on making fruitful use of the existing one.

If you have taken a loan, do not take a bigger loan just to pay the existing one back.

Instead, try to manage your budget and look for a minimum loan if necessary.

Refrain from burdening your finances with something extraordinary. It's a debt trap more like a Financial Death Trap.

4. Seek some professional help is you need to

Lastly, if you feel that you alone cannot do this, seek some help from experienced financial professionals.

However, make sure that the company or the person is legit and not faking it. Since this would clearly not be the right time to commit such a mistake.

Bankruptcy is not just limited to a bank, you can face it too. This huge financial havoc is the worst of all financial emergencies.

In order to avoid it, you need to know why it can occur and how you can tackle it. To know this, refer to the above article.

Download the Jar App and start investing in digital gold starting at just Rs. 10! You can build a secure portfolio through Jar’s micro saving features.