Swiggy

Swiggy was founded in 2014 by Sriharsha Magti, Nandan Reddy, and Rahul Jayamini. It is an Indian online food ordering and delivery platform that connects users to restaurants and local stores.

Located in Bengaluru, Swiggy began as a food delivery app. Since then, it has evolved into a comprehensive service platform that offers grocery delivery via Instamart and pickup-drop logistics through Genie. It is considered one of the major consumer-technical startups of India.

Zomato

Zomato was founded in 2008 as FoodieBay by Deepinder Goyal and Pankaj Chaddah. It started as a digital restaurant directory focused on making menu exploration and dining choices easier.

In 2010, it changed its name to Zomato, broadening its reach into food delivery and international markets. The company gradually shifted from content to commerce.

Zomato has strategically expanded its services to compete with various platforms. It introduced Blinkit for instant deliveries, challenging competitors in the food and essential services sector.

Additionally, District by Zomato was launched to rival established ticketing platforms like BookMyShow, demonstrating Zomato's ambition to disrupt diverse markets beyond its core food delivery business.

In 2021, Zomato launched its initial public offering, enhancing its market position in India. It recently rebranded itself as Eternal Limited.

Zomato vs Swiggy: Brand Overview

| Aspect | Swiggy | Zomato |

| Year Founded | 2014 | 2008 |

| Core Services | Food delivery, grocery delivery (Instamart), pickup-drop logistics (Genie) | Food delivery, grocery delivery (Blinkit), restaurant loyalty (Zomato Gold) |

| City Coverage | 580+ cities (stronger in metros) | 800+ cities (wider national reach) |

| Market Share | 42-45% | 55-58% |

| Estimated Revenue FY25 | ₹15,227 crore | ₹20,243 crore |

| Daily Orders | Approximately 2.5 million | Approximately 2.2 million |

| Valuation (2024) | $10.7 billion (public company) | $23-26 billion (public company) |

| Competitive Strengths | Superior logistics and bundled services (Swiggy One subscription) | Wider reach, faster grocery delivery via Blinkit, strong public market presence |

| Grocery Delivery Sales | ₹2301 crore (Instamart) | ₹1100 crore (Blinkit) |

| Profitability (Grocery Segment) | Operating at loss of ₹178 crore, focusing on growth | Operating at loss of ₹840 crore, investing heavily for expansion |

| Unique Features | Pickup-drop service (Genie), Swiggy Access (cloud kitchens) | Restaurant supply chain (Hyperpure), Zomato Gold/Pro loyalty program |

| Recent Acquisitions | Dineout (dining out services), Scootsy | Blinkit, Uber Eats India, Runnr |

Summary:

- Zomato benefits from a bigger valuation and more public visibility, while Swiggy focuses heavily on enhancing delivery efficiency and diversified services.

- Zomato leads in overall market presence with wider city coverage, higher market share, and greater revenue.

- Swiggy excels in logistics, bundled service offerings, and daily order volume.

- Both platforms compete aggressively in quick commerce (groceries) with Instamart and Blinkit, though they operate at losses aiming for growth.

Grocery Delivery Battle: Blinkit vs Instamart

Both companies have jumped into quick grocery deliveries, aiming to get essentials to your door in minutes.

Blinkit (Zomato’s grocery arm) and Instamart (Swiggy’s grocery service) are racing to expand.

While Blinkit covers more ground and pulls ahead in sales, Instamart offers slightly higher average order values, meaning people tend to buy more per order on Swiggy’s platform.

Both are currently operating at a loss as they invest heavily to grow, but they are critical pieces in the food delivery puzzle going forward.

|

Parameter |

Instamart (Swiggy) |

Blinkit (Zomato) |

|

Annual Sales |

Estimated ₹1100 cr |

Estimated ₹ 2301 cr |

|

Profitability |

Operates at a loss of 840 cr; investing in growth |

Operates at a loss of 178 cr; high burn rate |

|

Avg. Order Value |

₹499 |

₹707 |

Both Instamart and Blinkit offer rapid grocery deliveries across India. Let’s see how they compete on speed, coverage, and service.

Find out if Rapido food delivery is going to be the market disruptor in 2025.

What About Daily Orders and Revenue?

Swiggy handles around 2.5 million orders daily, while Zomato is just behind with 2.2 million.

Revenue-wise, Zomato’s estimated ₹20,243 crore for FY25 beats Swiggy’s ₹15,227 crore.

This shows how fierce their competition is, with both investing heavily in expanding services and improving customer experience.

Check out our in-depth comparison of telecom giants—Jio vs. Airtel.

Zomato vs Swiggy: Who Rocks in Notifications to Win Your Attention?

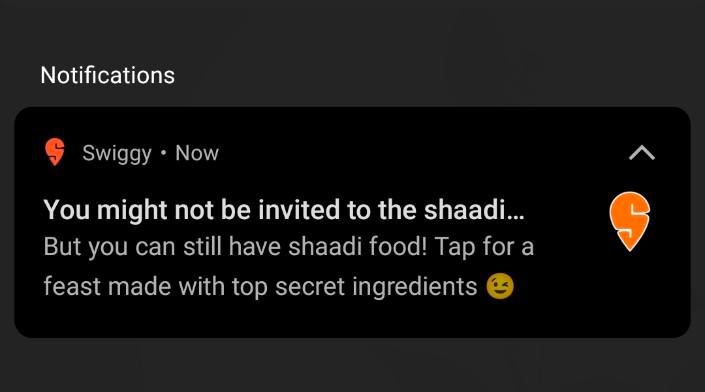

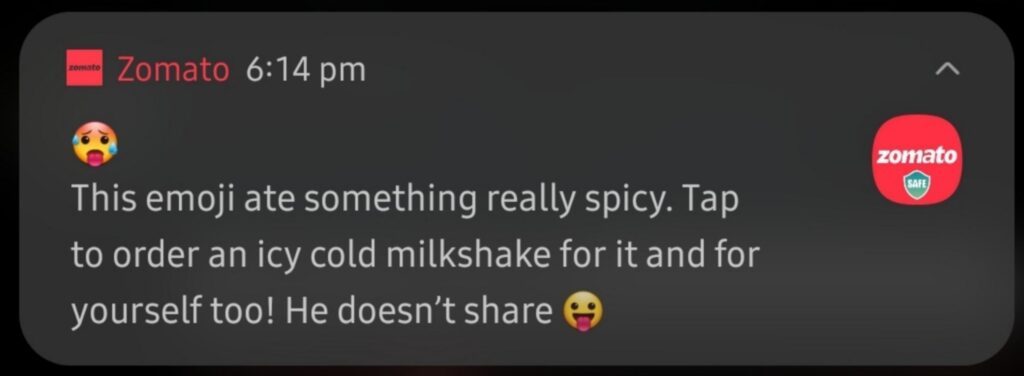

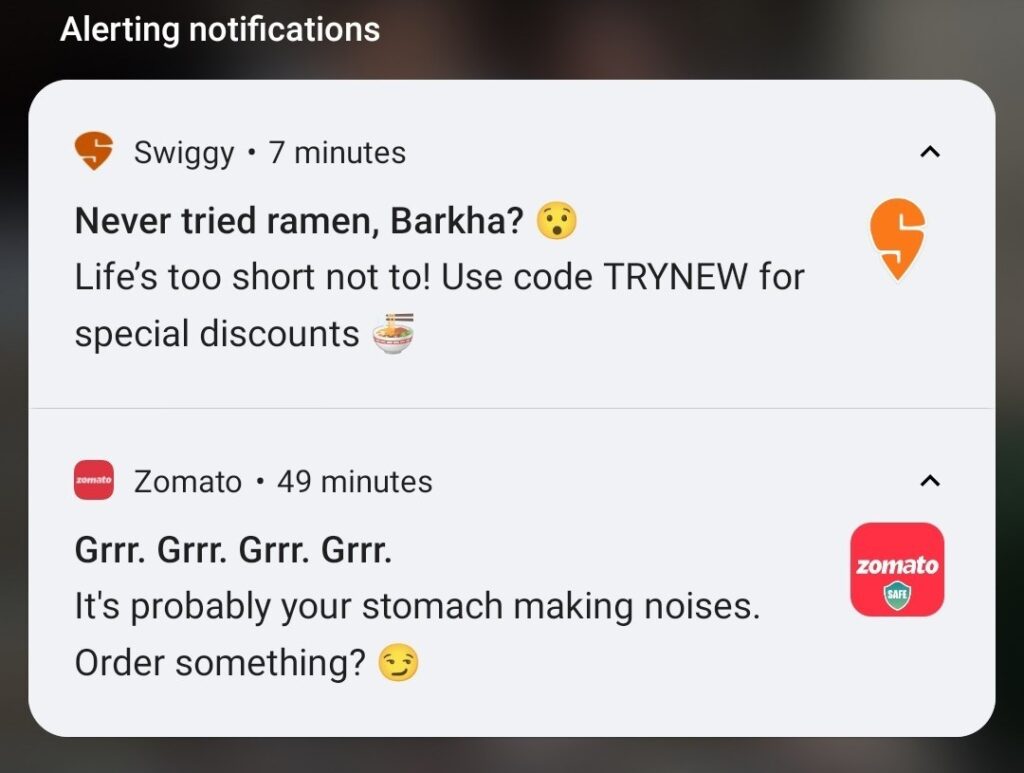

When it comes to grabbing your attention right on your phone, Zomato vs Swiggy battle heats up with their push notification strategies. Ever wonder why you suddenly get an irresistible deal popping up just when you’re thinking about ordering? That’s no accident!

Swiggy is known for its timely, personalized push notifications. They cleverly nudge you with reminders about ongoing discounts, new restaurant launches nearby, or the benefits of their Swiggy One subscription. Plus, their messages often feel friendly and engaging — like a helpful food buddy rather than an annoying salesperson. This keeps users hooked, boosting repeat orders in a subtle yet effective way.

Zomato competes fiercely, using push notifications not only for flash sales and new offers but also to highlight loyalty rewards with their Zomato Gold program. Their notifications are crafted to trigger FOMO (fear of missing out) with limited-time deals and exclusive member perks. It’s all about creating that sense of urgency mixed with excitement.

Between Swiggy’s personalized charm and Zomato’s deal-driven urgency, users benefit from smarter, more relevant notifications that keep the hunger cravings satisfied and wallets happy!

Zomato vs Swiggy Meme Marketing: Who Serves Laughs & Engagement Best?

In today’s social media-savvy world, Zomato vs Swiggy meme marketing has become the secret sauce for winning hearts and shares! Both brands have jumped headfirst into meme culture because nothing connects better with millennials and Gen Z than humor that hits close to home.

Swiggy’s meme game often plays on delivery quirks and the excitement of tracking your order when the delivery guy is faster than your WiFi or celebrating food moments like late-night cravings. Their memes are playful, often self-deprecating, making the brand feel approachable and fun.

Zomato’s meme marketing leans heavily on the rivalry itself, creating funny comparisons with Swiggy or poking fun at foodies trying to decide between the two apps. They also tap into trending meme formats to keep their content fresh and shareable, ensuring they stay top-of-mind among digital chatter.

Both brands know that meme marketing isn’t just about laughs; it’s a clever way to boost engagement, spark conversations, and build a loyal fanbase that’s eager to share the fun. In the meme showdown of Zomato vs Swiggy, the real winner? The foodies who get entertained along with their orders.

Bottom Line

Swiggy and Zomato dominate India's food delivery market, each with distinct advantages. Zomato surpasses Swiggy in urban reach and market presence, whereas Swiggy excels with superior logistics and offerings.

Their continuous innovation maintains robust competition, offering consumers additional choices and quicker deliveries.